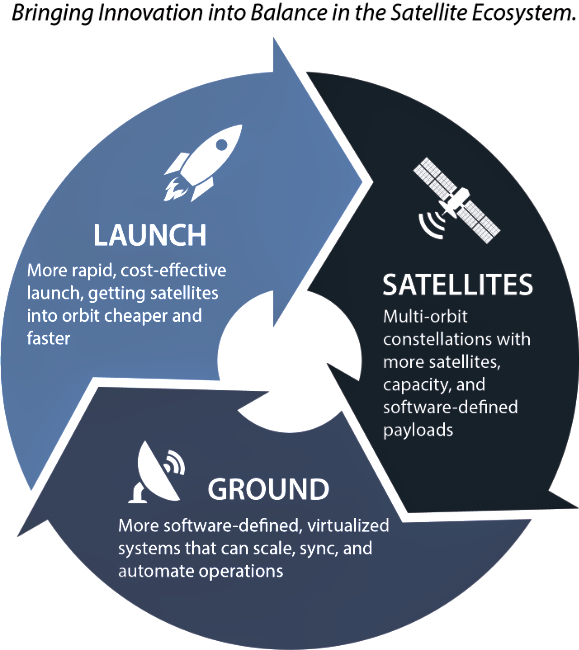

The satellite industry has experienced tremendous innovation over the past several years, with many hailing it as a renaissance, a reboot or a Space 2.0. However, not all this innovation has occurred equally across the industry’s three sectors of Launch, Satellite, and Ground. Each of these plays a distinct role, yet their fortunes are tied to together. If innovation in one doesn’t keep up with the others, it can hold back the industry’s full potential.

Innovation in Launch by notable players such as SpaceX, Blue Origin, and Rocket Labs has reduced costs and increased access to space, helping to get satellites into orbit far more quickly and affordably. Similarly, massive innovation in the Satellite sector has resulted in high throughput satellites, software-defined payloads and high-volume production of LEO and MEO constellations, creating exponentially more capacity and capability in orbit. However, when we look at the Ground, this has been the laggard of the three and the most in need of “catching up.” If all that innovation in space is to be unlocked, it depends on innovation with newer, more adaptable and scalable architectures on the Ground.

For decades, the Ground has remained largely unchanged, making do with analog infrastructure and purpose-built hardware systems that were designed for more static and limited missions, not today’s newer generation of software-defined payloads, and larger fleet/constellation operations.

The Coming Revolution

However, there is a paradigm shift occurring on the Ground, with a host of innovations that are signaling the start of this long-awaited change. In fact, this transformation mirrors the revolution that occured in the wireless industry years ago when the jump was made from 2G to 3G, moving from more static networks to more dynamic and interoperable ones and making possible the seamless wireless services and instant connectivity we enjoy today.

With 5G, the wireless industry has moved even further ahead, enabling not only faster speeds but networks that are even more dynamic, open and adaptable for a new breed of applications such as the connected car, smart home and the Internet of Things (IoT). For the satellite industry to play in this world, it will have to embrace similar change on the ground, replacing hardware with software, adopting standards, using Software Defined Networking (SDN) and cloud-based systems. This digital changeover can unlock the full value of the newer, more advanced satellite technologies in orbit, enabling low-cost, scalable, and highly automated and orchestrated services like we see in the terrestrial world.

The satellite ground segment is still in the early phase of evolving from a 2G-like architecture with stove-piped, vendor-specific hardware and software, to a standards-based 5G-like virtualized, cloud-based one. Change is underway as these systems are starting to leverage the same digital technologies we see elsewhere in the industry.

The Early Adopters of the New Ground

The move toward a digital ground started in the ‘New Space’ market. With the launch of thousands of smallsats delivering exponentially more data, these operators required lower cost and more scalable ground systems. They turned to virtualization instead of legacy infrastructure and hardware, using software-based front-end processors, modems, and recorders that run in the cloud supporting tens of thousands of smallsat passes around the globe. This also led to the ground system-as-a-service business models that you see widely adopted in the LEO Earth Observation (EO) market.

The deployment of these virtual systems has enabled the commercial and government smallsat and EO markets to cost-effectively scale their ground system operations to meet the growing and variable demand for TT&C and mission downlink services at a speed, scale and price point that would not be possible if they had to rely on purpose-built hardware.

Moving Beyond Virtualization

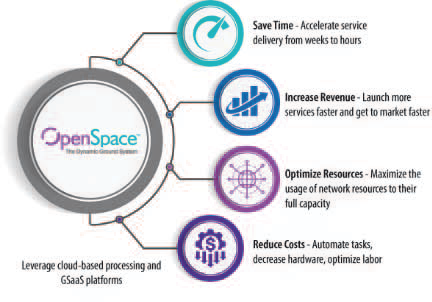

While virtualization is a crucial first step, the entire ground segment must still become more automated and dynamic. When Kratos introduced OpenSpace™ this year, it was the industry’s first, fully software-defined, ground platform to go far beyond virtualization. Built on industry-standards and an open architecture, OpenSpace uses SDN to dynamically orchestrate software based Virtualized Network Functions (VNFs) that replace hardware, thus managing complete end-to-end service chains to support different payloads, satellites, and orbits on-demand.

Service provisioning that typically took weeks with traditional hardware installation, cabling, and configuration can be accelerated to mere minutes by deploying and orchestrating everything in VNF service chains running on commodity x86 hardware.

Azure Orbital: An example of Dynamic Ground

Taking advantage of these ground innovations, Microsoft entered the market by introducing Azure Orbital, a groundbreaking platform for offering ‘Ground Station-as-a-Service’ (GSaaS) for the satellite industry. Microsoft incorporated components from OpenSpace into its Azure cloud architecture to create a more dynamic, software-based, ground service for satellites to connect directly to the cloud. With GSaaS, satellite operators no longer need to build their own infrastructure. They can quickly downlink their satellite data and immediately process and analyze it in the cloud along with their other applications.

A View Into the Future of Space & Ground

OpenSpace Benefits

OpenSpace Benefits

Enabling the Ground to Keep Pace with Space

OpenSpace from Kratos is the industry’s first and only fully virtualized, software-defined and orchestrated satellite ground system platform. The platform was built to enable the ground system to become much more dynamic to synchronize with the innovations and needs of the space layer. OpenSpace uses software-defined networking (SDN) to dynamically orchestrate the software based Virtualized Network Functions (NFVs) that replace hardware, thus managing complete end-to-end service chains automatically to support different payloads, satellites, and orbits on-demand.

While these examples are major breakthroughs and mark a departure from the traditional ground, the satellite industry is only at the early stages of this ground revolution. As satellite demand continues to grow exponentially, forecasted to grow four-fold over the next ten years, these innovations on the ground will need to continue to keep pace.

Considering the new spacecraft planned over the next five years, the ground segment as we know it will need to evolve from the 2G-like stovepipe systems of the past to 5G-like, highly automated, virtualized, cloud-based platforms in order to support the requirements of the evolving space segment. The ground segment and the space layer will need to integrate seamlessly with each other and become part of a broader software-defined network, which can be dynamically configured, managed, and deployed in sync with mission or end-user needs. The adoption of standards and orchestration frameworks will enable greater interoperability and tighter integration with terrestrial/cloud/and 5G networks for more seamless end-to-end services.

The telecom industry, which has embraced software-defined, cloud-based architectures, is a $6 trillion global communications market. Unfortunately, the satellite industry represents less than 1 percent of the telecoms market; however, as it transforms and similarly modernizes with these highly scalable, service-aware networks, there is huge potential to grow its share and better integrate into the global communications grid, providing additional value, especially where terrestrial networks reach their limit.

As the wider satellite industry moves toward digital infrastructure and more dynamic, software-defined, ground architectures, there is the promise of a revolution on the ground that will enable the monetization and optimization of all of the innovation that has been created with newer satellite payloads, including the LEO, MEO, and GEO constellations.

kratosdefense.com

Stuart Daughtridge is the Vice President of Advanced Technology at Kratos Space, Training and Cybersecurity. With more than 30 years of experience in the satellite and aerospace industry, he leads Kratos initiatives including the planning for the next generation of ground segment technology.