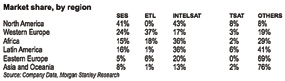

There seems to be some confusion as to whether the overall satellite FSS industry, which includes the ‘big six’ satellite operators (Intelsat, SES, Eutelsat, Telesat, SkyPerfect-JSat and Optus), are likely to flat-line over the next few years, or whether there remains prospects for growth.

The concerns regarding growth started in October—initiated by a detailed report from the media team at investment bankers Morgan Stanley. The report did little to bolster investor confidence in the industry’s leading FSS players SES, Eutelsat and Intelsat. Morgan Stanley had held a dialog with “three highly experienced professionals in the FSS industry,” and said, “We focused on High Throughput Satellites (HTS) supply and demand dynamics and the expected industry returns for the next three to five years. Our contacts believe the industry has entered a no-growth cycle and that returns should edge down over the next three years, as oversupply translates into sub-optimal utilization rates.”

The Worry List’s Number One Item—HTS

Morgan Stanley continued, “HTS will struggle to find a market of their own: Our contacts believe that most HTS were launched before their operators had secured enough backlog to allow them to beat their cost of capital. This will likely lead HTS operators to start commercializing existing applications (Trunking, GSM, VSAT) and compete against traditional Ku-band satellites. It may also lead HTS operators to try and differentiate themselves from Ku-band through lower prices. This usage of HTS would be sub-optimal, however, it would seem like a plausible response from management teams looking to drive HTS returns as close as possible to their cost of capital.”

Number Two on the worry list was consumer broadband, where the picture appeared somewhat brighter. “Our contacts are most bearish on HTS-powered consumer broadband. Competition coming from terrestrial networks and the rollout of optic fiber is a major issue, as these networks are seen as more user-friendly than satellites.”

However, Number Three on the bank’s list discussed a “cycle of over-supply” and this topic, while not new, is of growing concern to market watchers and the satellite industry in general. The bank said, “Our contacts identify three main threats to the growth of the satellites industry. By order of importance, (i) competition from terrestrial networks, (ii) the rollout of HTS that has not been fully thought through and will compete against the incumbents’ core business, and (iii) oversupply of Ku-band capacity in some markets. Our experts forecast flat growth in video and flat growth in data. In data applications, they expect a decline in Government applications, VSAT in Europe and in the U.S., and a strong decline in trunking, offset by solid growth in Maritime, Aero (broadband on airplanes) and Oil & Gas.”

Which leads to Item Four and the inevitable consequence that “Returns will edge down.” The report said, “Our experts are adamant the FSS industry has entered a no-growth cycle. This will likely translate into Utilization rates below long-term averages, which could then hurt returns. Our contacts estimate that a satellite whose utilization rate is below 80 percent in its third year of existence will likely never hit its cost of capital. Another interesting rule of thumb is that, per our experts, an HTS generating less than $150m of revenue in year three will probably never hit its cost of capital. This is usually when it starts offering applications beyond what it was originally designed for.”

Concern five suggested that Ka-band could compete on the video segment in some emerging markets. “Our contacts do not believe Ka-band on HTS can compete against Ku-band in video in the developed world. This is essentially because payTV platforms usually have a large and well-established subscriber base that would be hard to shift into a new technology and new orbital slots.

However, they believe the HTS technology is good enough that it can be used for video applications. This means that, in those emerging markets where payTV platforms have smaller customer bases, the broadcasters could decide to adopt Ka-band instead of Ku-band. This has not happened yet, however, it may possibly happen in Africa and parts of Asia in the future.”

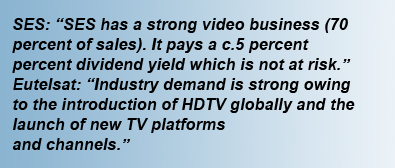

The bank then distilled these elements for SES and Eutelsat.

“SES has been launching a lot of capacity recently (available capacity +22 percent between 2011 and 2016). We estimate 45 percent of the capacity launched between 2012 and 2016 targets applications and/or markets that may be negatively impacted by oversupply (VSAT, GSM, Broadband, Africa, Europe, and so on). We think this could lead the group’s utilization rates to remain at, or below, 80 percent in the medium term and put the returns of some of the most recently launched, or yet to be launched, satellites under pressure. SES generates c.30 percent of revenue from data and voice.”

As far as Eutelsat is concerned, the bank said, “Our contacts are not optimistic on the possibility that military budgets can pick up in the near-term. They also think KA-SAT will likely never generate the level of profits it was originally expected to deliver before it was launched.

Changing the business model of KA-SAT will, per our experts, not make a material difference. Competition from terrestrial networks is fierce and the design of the satellite means it will struggle to service other applications besides consumer and professional broadband. ETL derives c.12 percent of revenue from military and c.30 percent coming from data, overall.”

Despite this doom and gloom, there were signs of optimism. For example, the bank sees new markets emerging, especially for HTS services. “Our contacts are pretty positive about HTS unlocking some growth potential in mobile broadband (broadband on large cruise ships and airplanes) and Oil & Gas applications (broadband connectivity for businesses located in remote and hostile locations, such as the middle of an ocean). However, they estimate these markets will remain pretty small in revenue terms and will only partly offset the cannibalization created in trunking, VSAT, GSM, consumer broadband.”

This directly affects so many aspects of the industry. There’s SES’ O3b, and Eutelsat’s KA-SAT, which both represent investments in these areas. However, Telenor’s new Thor 7 satellite, which is very much an HTS craft and has a target of maritime-type services, will launch next year. Intelsat also has enormous investments in its new EPIC series offering HTS services.

The bank said, “The cost of launching an HTS is high and there is nothing like a half-sold satellite to drag down the returns of a company’s fleet. Therefore, our contacts believe that, in order to fill up these satellites, there is a genuine risk these HTS may increasingly target the more traditional FSS applications such as VSAT, enterprise and Government solutions, mobile backhaul, and such. To sell some of the unused capacity, our contacts suspect some operators will also be tempted to offer lower prices as the marginal cost of an HTS is very low once it is up and running, and management teams are under pressure to produce some form of return on investment.”

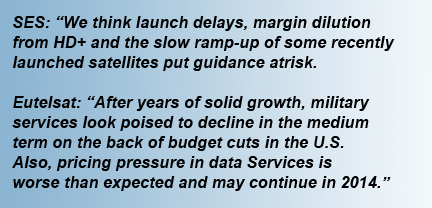

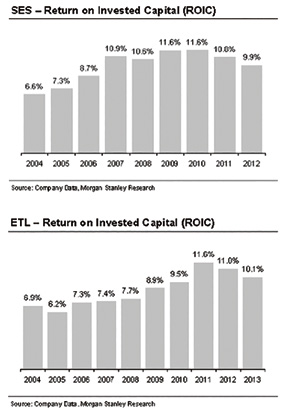

The bank’s returns analysis illustrates how ROIC and ROCE have generally risen between 2004 and 2010 before declining in calendar 2011 and 2012. “Our experts believe that the satellite industry goes through cycles,” continued Morgan Stanley. “At times, demand will grow much faster than supply and push returns up. This cycle then reverses and returns come down closer to their long-term average levels. Our contacts believe that the combination of (i) the rollout of terrestrial infrastructure (ii) the expansion of HTS, which often struggles to find a market of their own and (iii) unfavorable supply/demand dynamics in Ku-Band will most likely lead industry returns to come down over the next few years. The emergence of this new cycle is expected to be most visible in the shape of relatively low utilization rates and falling ROCE and ROIC. Meanwhile, it is conceivable that revenue and EBITDA continue to grow though, as a lot of new capacity is commercialized.”

The bank insists their report is not all ‘doom and gloom.’ “Some regions and some applications continue to grow. Specifically, our contacts are unanimously bullish on Latin America, where both data and video are expected to grow fast over the next few years. The same applies to large portions of Asia. With SES-6 (49 transponders), SES-8 (21 transponders) and SES-9 (53 transponders, 2Q15), SES will benefit from this.

These three satellites represent 45 percent of the capacity SES will have launched between 2012 and 2015. With GE-23 (acquired in 2012), Satmex (acquired in 2013) and ETL 65WA (to be launched in 2016), ETL will also benefit from fast-growing demand in those regions. However, GE-23 and Satmex were purchased at a relatively high price, and ETK 65WA will only be launched in three years. Therefore, it seems fair to say that SES has anticipated the shift toward LATAM and APAC earlier and in a much more organic way than Eutelsat has.”

“Our contacts’ feedback suggests two things in our view,” says the report: “(i) it will be very difficult for the incumbents to put through net price increases across the entire fleet as long as oversupply negatively impacts a number of their key markets and (ii) oversupply may lead utilization rates to remain below the levels seen in 2008-10 even if case demand in LatAm and Asia proves stronger than expected. We now believe some of the assumptions previously factored in our bull case seem overly optimistic, and cut our bull case valuations for both ETL and SES. Our new bull case valuation for SES is 25 euros per share versus 27 euros per share, previously, and 28.5 euros per share for ETL vs. 32.5 euros per share, previously. We cut our bull case valuation on the back of lower pricing and utilization assumptions. We now forecast bull case terminal utilization rates of 85 percent for SES and 83 percent for ETL (negatively impacted by KA-SAT) vs. 90 percent previously. We also forecast flat prices at best over the next three years vs. 3.5 percent inflation previously.

“Our new bull case assumptions suggest bull case upside of 15 percent for SES and 22 percent for ETL. We leave our price targets in line with our base case, which suggests no upside to the SES share price and just +6 percent to the ETL share price. Eutelsat and SES have undeniable virtues. They have solid balance sheets, a reasonable dividend policy and falling CAPEX might, in the medium-term, lead them to consider special cash returns. However, we believe their lack of cyclical bias, falling returns and the presence of important structural question marks will likely limit their stock performance in the medium-term. We remain ‘Equal Weight’ on Eutelsat, whose valuation we think already reflects some of the structural challenges we have been focusing on for a few months now. We remain ‘Underweight’ SES, whose multiples look more full.”

Counter Argument

In other words, elements are not exactly looking up if the Morgan Stanley report is to be wholly taken as is, especially for the likes of Intelsat and Eutelsat in particular, which are both investing heavily in HTS. However, within days of the release of the Morgan Stanley report, a counter-argument appeared from the experts at Northern Sky Research (NSR). One strong phrase used by Morgan Stanley was that ‘High Throughput Satellites’ would struggle to find a market. NSR, in an October 16th report, firmly states that the bank has misread the current trends in the market.

“Overall, NSR feels that the Morgan Stanley report authors have, to a large degree, misread the current trends in the FSS sector and that they have treated some specific, real issues with too broad a brush stroke in how they impact the entirety of the FSS sector. In the narrowest of terms, the Morgan Stanley report was nominally meant to assess the revenue growth outlook for SES and Eutelsat over the next three to five years. Within this very specific context, the report did correctly highlight a number of real issues that will likely have an impact, both positive and negative, on SES’ and Eutelsat’s revenue performance through to 2018,” said the NSR rebuttal.

However, NSR goes on to say, “Where the Morgan Stanley report falls down, and in quite a dramatic fashion, is how it parlayed these specific issues related to SES and Eutelsat into a relatively scathing assessment of the overall FSS sector and, in particular, for emerging HTS services. NSR could engage in a long, point-by-point critique of the Morgan Stanley report on where we have agreements and disagreements; however, the most fundamental issue that seems to have been missed by the report’s authors is what NSR sees as the true necessity of the satellite industry to move down the path towards HTS. And, interestingly, the Morgan Stanley report raises many of the issues of why this needs to happen but fails to make, or incorrectly makes, the connections.”

“In particular,” says NSR, “the Morgan Stanley report notes that, to their “surprise,” the main threat to growth in the FSS industry comes from terrestrial networks and fiber. Specifically in terms of data-type applications, NSR would actually agree that terrestrial networks and fiber are the greatest long-term threat to revenue growth. However, Morgan Stanley more or less interprets the FSS sector’s response to the fiber and terrestrial network threat, which is the launch of new HTS, as a failure to date and endlessly laments about the negative impact that HTS’ capacity is having on FSS revenues by driving down pricing on classic C/Ku-Band capacity.”

NSR’s simple answer to this assessment is that if the satellite industry did not change, it was already on the path of losing this business anyway, regardless of the short-term impact on C/Ku pricing. “A specific case in point is the trunking segment. Even Morgan Stanley’s researcher noted that C-/Ku- leasing revenues for trunking only represent 2 to 3 percent of Eutelsat’s and SES’ revenues base. The connection that Morgan Stanley has fundamentally missed is that the new HTS architectures—here NSR includes any spot-beam, high frequency reuse payload as well as the medium Earth orbit networks (MEO-HTS) like O3b—will be able to recapture some of this market demand and even likely grow the revenue base for data services and applications that were fading from the classic C-/Ku- capacity repertoire. This includes not only services such as trunking but also consumer broadband access, VSAT networking and other related data markets.”

NSR’s clear view is that the satellite industry today must make the investment in the new HTS architectures in order to remain relevant in the mid- to long-term to clients for data-type services. “Does that mean there won’t be negative impacts short-term? Of course there will. In any industry in transition, competition among players will be high, mistakes will be made, and markets misread. Part of the process of learning what can be done with the new HTS architectures and what will emerge in terms of business that could not even be initially imagined is part of the process.

When Thaicom first undertook development of its IPSTAR project, did it ever imagine that a core service would become cell backhaul services for SoftBank in Japan? Yet, this has turned out to be the case and has caused a revelation in the industry about the types of services and applications that can be successfully addressed with HTS capacity. A related example would be the strong uptake of Thaicom-4/IPSTAR capacity in Malaysia for government-backed rural connectivity/social inclusion projects.

“Another interesting emerging niche application that few expected is for SNG services with Eutelsat’s NewsSpotter service apparently being the “hot thing” for the SNG crowd at the 2013 IBC Conference.”

NSR labels the transition that is occurring in the FSS sector—a transition that will admittedly take many years and not without some stumbles on the way—as the “bifurcation” within the FSS segment. In this model, all of the different satellite services and applications that in the past were only served by the same architecture of widebeam C-/Ku-Band capacity will gradually segment into different types of satellite architectures with each architecture best designed to serve, and grow, specific satellite applications and segments,” said NSR.

“There will always be some overlap between the architectures, especially during the period of transition; however, in overarching terms, NSR continues to fundamentally believe that classic FSS C-/Ku-Band capacity, with its unbeatable point-to-multipoint strength, will continue to successfully serve the classic sectors like video/media distribution to consumers as well as applications that require a professional grade of point-to-multipoint services. HTS capacity will see much of its capacity used for consumer-class point-to-point services like broadband access, but also overlap significantly into the point-to-point and point-to-multipoint areas for professional services where the cost per bit is the dominant decision point for the end client. Finally, MEO-HTS architectures (i.e. O3b) will play best in the point-to-point professional category of services like trunking and backhaul.”

NSR asks “Will every HTS that is launched be successful? No, just as in any technology driven industry there are always leaders and followers, those who successfully interpret the market and those who significantly misread the market trends. Will the industry be able to completely avoid oversupply and internal price competition between operators? Again, the answer is “no,” as every operator has to develop their own strategy and, if one of them stumbles along the way, their missteps will have unavoidable consequences on those around them.

“But should the emerging HTS services already be judged largely as a failure or a threat to the existing services? In NSR’s view, absolutely not. The satellite sector must find ways to better serve its clients, and one absolutely key criteria of success in the future will be to drive fundamentally down, and keep driving down, the cost per bit delivered across a whole spectrum of services and applications. The trend towards HTS is creating what NSR has labeled the “bifurcation” of the market. But to already wholesale condemn the bifurcation of the market as done by Morgan Stanley shows a major lack of insight as to where the sectors needs to go in the coming years. Only by truly understanding the long-term trends can industry experts, including our banker and financial advisor colleagues, be able to judge the real prospects of each player in the sector.”

About the author

Senior Contributor Chris Forrester is a well-known broadcasting journalist and industry consultant. He reports on all aspects of broadcasting with special emphasis on content, the business of television and emerging applications. He founded Rapid TV News and has edited Interspace and its successor Inside Satellite TV since 1996. He also files for Advanced-Television.com. In November 1998 he was appointed an Associate (professor) of the prestigious Adham Center for Television Journalism, part of the American University in Cairo (AUC), in recognition of his extensive coverage of the Arab media market.