Chris investigates the prospects for what is turning out to be a major story for the commercial satellite industry. Can satellite-to-cellular make any serious inroads? Northern Sky Research believes the Direct-to-Device market could be extremely valuable.

SpaceX suffered an extremely rare problem on the night of Friday July 12th (at 02.25 UTC) when the company lost a key second stage on its Falcon 9 rocket — that resulted in its cargo of 20 Starlink satellites being placed in orbits that were too low to be effective. More than half that cargo (13) were Starlink ‘direct to cellular’ (D2C) satellites. The Federal Aviation Administration (FAA) ordered SpaceX to suspend their Falcon 9 flights.

The FAA said the problem must be identified and fixed before Falcon rockets can fly again. This could mean many weeks depending on the complexity of the failure and SpaceX’s plan to fix it. SpaceX’s engineers said the second stage’s failure occurred after engineers detected a leak of liquid oxygen. “A return to flight is based on the FAA determining that any system, process, or procedure related to the mishap does not affect public safety,” said the FAA.

SpaceX watcher Gav Cornwall of Space Offshore, prior to the failure, had said that SpaceX would have launched sufficient D2C satellites by the end of September for an autumn D2C service initiation. Cornwall said all indications showed satellite launches of 22-23 orbital planes (at about 13 payloads per orbital plane) was the target. “They need 15 additional launches of D2C to reach that target by end of September,” he said.

Those 13 D2C satellites were lost on July 12th and the early introduction of any D2C scheme had to be scuppered. Technicians said that at just 84 miles in altitude (135 kms), the Earth’s gravity was bringing most of them 3 miles (5 kms) closer with every orbit.

“At this level of drag, our maximum available thrust is unlikely to be enough to successfully raise the satellites. As such, the satellites will re-enter Earth’s atmosphere and fully demise,” said SpaceX.

One of the 20 satellites was reportedly at just 115 kms altitude. The first re-entries happened within a few days.

However, the FAA ruling means that there will be an inevitable delay to some customers’ missions by months as SpaceX reshuffles its manifest, as well as its own Starlink launch schedule. SpaceX stated, “With a robust satellite and rocket production capability, and a high launch cadence, we’re positioned to rapidly recover and continue our pace as the world’s most active launch services provider.”

The failure has put a halt — at least for the time being — of SpaceX’s launches of its D2C satellites. Prior to the July 12th problem, SpaceX had placed over 100 D2C satellites into orbit. Indeed, experts had forecast that, given the company’s then production/launch rates, SpaceX would require only 115 days to reach the projected (about) 300 satellites for initial, continuous D2C coverage, or around October 30th to complete the basic global fleet.

Those dates and forecasts are now impossible to meet.

The best that can be hoped for that SpaceX can satisfy the FCC that it has analyzed the July 12th problem and has undertaken actions to remedy the problem. If this could take place by — say — the end of August, then SpaceX will have only lost around 50 days of launch activity.

Meanwhile, the company will have continued to produce D2C satellites and could thus reinstate a rapid return to flight for the firm’s fleet of Falcon 9 rockets.

In other words, the 100+ existing D2C satellites could expand to reach the SpaceX target of around 300 suitable craft on-orbit and that could be achieved well before year’s end.

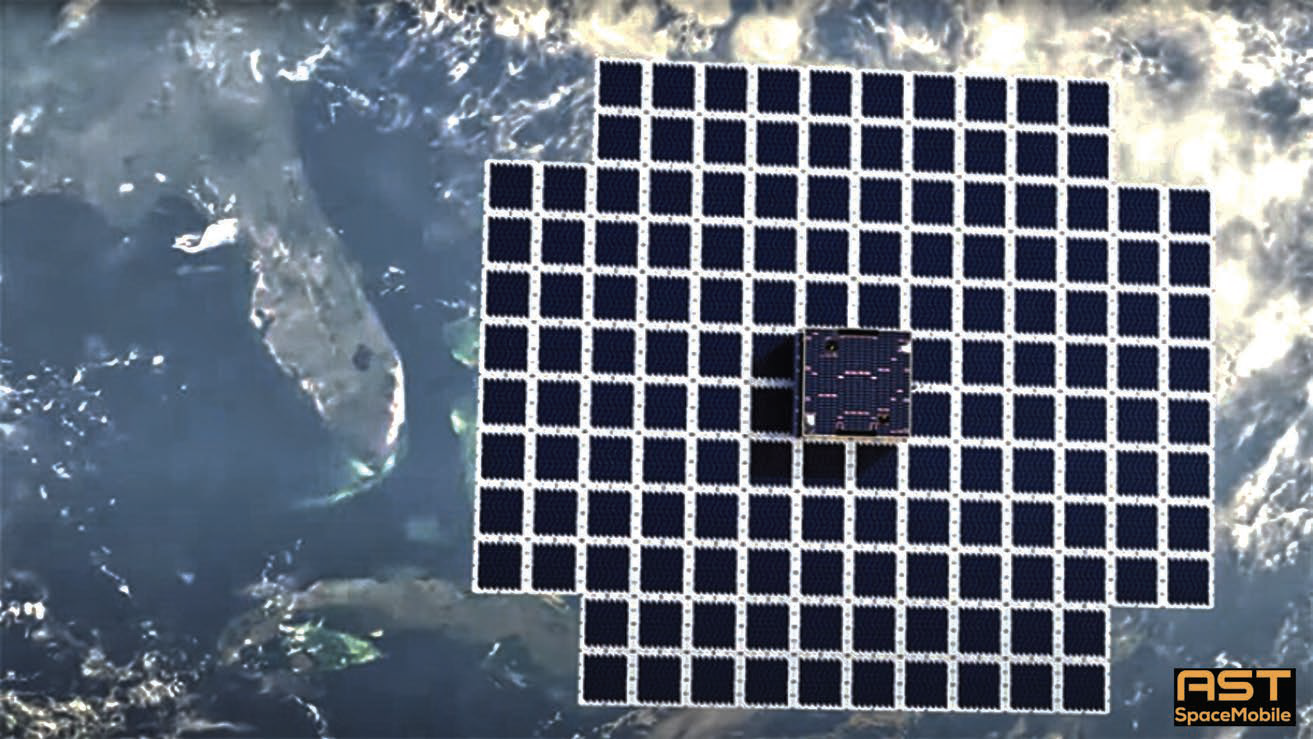

However, SpaceX is not alone in this potentially lucrative space race. By year’s end, arch-rival AST SpaceMobile should witness SpaceX using a — corrected and approved for flight — Falcon 9 rocket to launch AST’s five BlueBird Block 1 5G D2C satellites into their transfer orbits.

AST has stated that during Q1 next year, the company will start launching its Block 2 BlueBirds into orbit which AST says will be “ten times more powerful” and downloading at least 14 Mb/s to ordinary smartphones around the world. As this is written, AST has yet to announce what launch provider they will use to post those satellites to orbit.

AST SpaceMobile’s plans to place five of their ‘Block 1’ BlueBird satellites into orbit are at an “advanced stage,” stated a Prospectus that was issued on July 3rd. The Prospectus was issued to the Security and Exchange Commission (SEC) in conjunction with a share transfer of 10.4 million shares that are related to Antares Technologies LLC (a Cisneros-related business).

AST already has a test craft on-orbit (BlueWalker 3) launched in September of 2022. The firm’s follow-on satellites are its Block 1 craft which were confirmed in the Prospectus that “We now have all the parts, including the subsystems from the two suppliers who were previously delayed in meeting their delivery contractual timelines, to complete the assembly, integration, and testing of the five Block 1 satellites.”

“We are currently in the advanced stages of assembling and testing the Block 1 BlueBird satellites and estimate to transport the five Block 1 BB satellites from our assembly facilities to the launch site between July and August 2024 with an orbital launch scheduled shortly thereafter,” the Prospectus added.

However, AST gave no further details on the specific launch dates for these 5 satellites. “The exact timing of the launch is contingent on a number of factors, including satisfactory and timely completion of assembly, integrating and testing of the satellites, regulatory approvals, confirmation of the launch slot timing by the launch provider, logistics, weather conditions, and other factors, many of which are beyond our control,” stated AST.

The operator’s five Block 1 craft are interim satellites and will be quickly followed by significantly larger and much more powerful Block 2 satellites. AST says they are in discussions with a launch provider — probably not SpaceX — for the first Block 2 BB satellite.

“The agreement has a launch window of December 15, 2024 to March 31, 2025. The exact timing of this launch is contingent on a number of factors, including satisfactory and timely completion of the design, assembly and testing of the Block 2 BB satellite,” stated the Prospectus.

“We plan to achieve service in the selected, targeted geographical areas with the launch and operation of 25 BB satellites and achieve substantial service in all targeted geographical areas to meet our long-term business goals with the launch and operation of approximately 95 BB satellites. We anticipate launching and deploying additional satellites beyond the initial 95 satellites in order to enhance coverage and system capacity in response to incremental market demand,” said AST.

The question now is which of these two will actually start D2C services to users in out-of-reach regions or cellular ‘not-spots.’

AST has already stated they will provide a limited, although non-continuous, service in targeted geographical areas during 2025, “including in the US and seek to generate revenue from such service.”

AST has two heavyweight U.S. terrestrial partners: AT&T and Verizon. SpaceX has the USA’s third national cellular player, T-Mobile, signed up. Both satellite operators have additional telco partnerships around the world.

Next year AST has said it will launch 25 of the larger Block 2 BlueBirds and start serving its 40-plus global partners, including Vodafone (265 million customers), Rakuten (1.6 billion clients), Bell Canada, Google and dozens of others, totaling a claimed 5.3 billion cellular subscribers who “move in and out of coverage as they live, work and travel,” said AST.

AST has told analysts that terrestrial users will receive a message along the lines of “You are out of network coverage. Would you like to turn on your SpaceMobile Day Pass? (Yes/No).” If they answer ‘Yes,’ the user will be welcomed to SpaceMobile and told “You will now be connected everywhere.” AT&T has suggested there will be a monthly additional fee for users of about $2-$4, depending on their selected cellular plan.

Key to profitability for both AST and Starlink are those cellular partnerships. They will handle marketing, promotion and billing to customers and simply remit the monthly revenues to the operators. While AST is promising service introduction for some U.S. customers during 2025, there has been no commitment from Starlink. However, with more than 300 satellites perhaps on- orbit by year’s end it is perfectly likely that SpaceX’s orbital assets and terrestrial partnerships will be brought into play by year’s end.

While the FAA has suspended SpaceX flights, its fellow agency, the Federal Communications Commission (FCC), has not been idle. The FCC wanted to know how satellite services would handle true emergency calls and how they would be directed.

AST, in a filing to the FCC, has explained how 911 calls will be handled, and which will almost certainly be incorporated in the FCC’s upcoming Rules covering satellite operators obligations under the FCC’s ‘Supplemental Coverage from Space’ (SCS) rules for basic telephony.

The current SCS rules accept that responsibility for routing 911 calls should remain with the terrestrial provider but asks for at least a year in which to monitor and examine actual usage.

“The Commission has now adopted reasonable baseline 911 rules applicable to terrestrial providers in the context of SCS and issued the ‘Further Notice of Proposed Rulemaking’ (FNPRM) seeking further comment on 911

issues. In the intervening year, however, the reality on the ground has not changed: SCS technology is in its infancy and no SCS provider is yet offering commercial services. Therefore, the industry needs time to learn about the best ways to implement 911 in the SCS context, fuelled by real-world demonstrations and coordination between mobile carriers, satellite operators, and public safety entities.”

Indeed, AST suggests to the FCC that it accepts the existing rules and no further legislation is needed.

AST also accepts that it must respect the needs of the Radio Astronomy Service (RAS) and astronomy community and the threat from interference.

AST said, “In fact, AST SpaceMobile is uniquely well situated to operate harmoniously with the RAS given the relatively small size of AST SpaceMobile’s planned constellation and its use of phased-array antennas that can form and steer precise, narrow downlink beams dynamically to avoid interference with RAS receivers.”

Nevertheless, the record of some 330 successful Falcon 9 launches will stand the test of time, and perhaps for quite a long time! The Falcon 9 has proven to be the most reliable rocket in history.

Meanwhile, and wholly unrelated to the July 12th problem, SpaceX has formally asked the FAA permission to increase the launch frequency of the company’s giant Starship rocket flights to 25 per annum from the Boca Chica, South Texas, Starbase.

Pacôme Révillon, CEO of Novaspace (the name of the merged Euroconsult and SpaceTec) said that SpaceX’s Starlink broadband by satellite system has been transformative in terms of their maritime customers.

Speaking to Kratos’ Constellations podcast, Révillon said that shipping is a highly complex environment, not least because of the variety of rules and obligations and just like everywhere else there’s a growing demand for reliable data connectivity. There’s also a distinct trend leading to distant monitoring of a vessel and fewer on-board staff.

“In the maritime domain, Starlink has already been transformative,” he said, and at a lower cost when compared to traditional antennas.

However, Révillon cautions that Starlink will soon have competition. “If we look middle term, there are other constellation projects out there that will certainly look at competing with what Starlink is offering today,” and that Starlink is not licenced to operate everywhere.

Meanwhile, maritime demands themselves are evolving speedily but there are thousands of vessels still to be equipped and this will take many years to complete, he added. But once a vessel is equipped, the prospects are that owners and managers will demand more data — plus, if the vessel is integrated into Internet of Things (IoT), such will require more bandwidth.

While Révillon was focused on maritime’s commercial fleets, and not the world’s cruise liners, there was also a comment from the CEO of Carnival Cruise Lines, Christine Duffy, who said that Starlink had proved to be a “game changer” for Carnival.

“We completed the rollout of Starlink this quarter, another revenue uplift opportunity and a real game-changer for our onboard connectivity experience; We’re spending more on bandwidth than we ever have, and it’s generating outsized returns because people love the service. It’s land like and it’s something people are willing to pay for,” said Duffy.

Chris Forrester

Author Chris Forrester is the Senior Columnist and Contributor for SatNews Publishers and is a well-known broadcasting journalist and industry consultant. He reports on all aspects of broadcasting with special emphasis on content, the business of television and emerging applications.