The satellite ground terminal industry is complex. Attributing cause and effect to changes in the market is a confusing and often fruitless exercise.

The changes in Solid State Technology and product design that have influenced the growth in the market for high performance mobile and transportable terminals will be explored in this article. Market surveys predict a high single-digit growth rate for solid-state power amplifiers and BUCs through 2025 but provide little clarity on the drivers of this demand.

In spite of the constant push to lower prices in the satellite market, there is a sizeable and growing segment that demands premium performance over price. A second observation is that new applications require higher levels of performance and compact designs for high power RF components and these new applications require new products. Hence, there is an additional aspect to market growth that is attributable to performance rather than price.

Mission Microwave Technologies is a relatively new (five years as a company) entrant into the SATCOM business. The company builds Solid State Power Amplifiers (SSPAs) and Block Upconverters (BUCs) for X-, Ku- and Ka-band SATCOM terminals — a focused business selling what is effectively an industrial component to manufacturers of satellite terminals for ground, sea, and airborne applications.

A good representation for the business is to compare it to a company selling bearings to an automobile manufacturer. If the component supplier can deliver a product that makes the automobile manufacturers’ cars twice as energy efficient, more reliable, and more powerful, the supplier will probably find an audience that will want what it has to sell — because it helps to make their customer’s product better. It may even allow them to create new products that were not previously feasible.

Not a Low Price Market

When a customer looks to extend or back up their network, a satellite solution only wins when there are no other alternatives. Terrestrial solutions (when they exist in a given location) are usually less expensive and faster. Therefore, when a customer has determined that they need a satellite solution, they have already resolved that a cheaper solution is not available. As these are critical networks, the customer has acknowledged that reliability/availability is a key metric — more critical than price.

Customer priorities for satellite networks have traditionally started with basic connectivity. Networks such as Iridium established that connectivity is possible literally anywhere on the planet. Customers initially welcomed basic connectivity, and their requirements quickly grew from basic connections to outpace the ability of the satellite networks and terminals to provide the required throughput.

The satellite industry’s focus from about 2010 to today has been increased mobility. Remote work locations — whether forward military operating bases, oil rigs, airplanes, fishing vessels or construction sites — all needed to be connected to enterprise networks. While not all of the applications were mobile, hardly any of them were “fixed”. Soon customer expectations increased to include connection of mobile platforms (airplanes, ships, trains) with the same level of service that was expected for fixed sites.

Customers are generally willing to pay a premium for high throughput connectivity to mobile platforms and at a given price point they expect the industry to continue to deliver higher throughputs and better quality of service. This is not necessarily a lower spend but is certainly more value per dollar. One can see that performance does matter and technologies are evolving to be able to deliver better performance within the constraints demanded by mobile platforms — efficiency, size, and weight.

New Mobile Terminals

The ability of the industry to provide small terminals that can work on the move or on the quick halt has opened up new markets for both products and services. One can now routinely see applications using small antennas to provide symmetric high throughput services to mobile platforms.

These remote terminals are effectively high speed VSATs. They require more power in a small package to be able to uplink a larger carrier. The math is straightforward and, until companies such as Mission Microwave made compact, efficient, and reliable power amplifiers available, it was impractical to have a high throughput Ka-band return link on a ship, vehicle, UAV or flyaway SATCOM terminal.

Now that the capability is available to provide twice the output power in the same size, weight, and power (SWaP) footprint, new applications become available. This increase in RF power performance actually creates new demand for terminals and for bandwidth sales.

A simple example is this: in 2015, a typical Ka-band, 20 Watt BUC would weigh ~30 lbs and require 540 Watts to generate a 12 Watt carrier at linear power. The available market for such a BUC is limited — one probably would not put that unit on a flyaway antenna, certainly not on a UAV and as it was the size of a small suitcase, one could not easily put it in a small, on-the-move radome. Therefore, in 2015, the available market for 20 Watt Ka-band BUCs appeared to be limited to fixed or large platforms.

In 2016, Mission Microwave introduced its 25 Watt STINGER Ka-band BUC, which weighs 3.25 lbs and uses only 125 Watts of prime power to product 16 watts of linear power and is practically the size of a water bottle. The STINGER product line in Ka-, X- and Ku-band has been widely accepted as a new standard for compact and efficient terminal designs for mobile, portable and fixed applications.

Left: Figure 1. Ka-band Solid State BUCs 200 to 25 Watts.

Left: Figure 1. Ka-band Solid State BUCs 200 to 25 Watts.

Right: Figure 2. Ku-band Solid State BUCs 200 to 55 Watts.

This is an example of an increase in performance that affects the demand for a product. The company has been able to grow their business by capturing market share from competitors and most substantially by enabling new high throughput applications based on lightweight and efficient designs.

New applications include dramatically higher performance on maritime platforms and increased utility of unmanned platforms as their SWaP budget for SATCOM links is cut by a factor of two or three. Mission Microwave’s customers have introduced next generation products that improve throughput by more than two times while keeping within the same size, weight and power footprint.

One example is the company’s GX-XL BUC for Inmarsat terminals. The GX-XL replaces a 5 watt, single band, Ka-band BUC with a 10 watt, dual band, Ka-Band BUC in the same size, weight and power footprint. This, essentially, allows end users to double their throughput with a simple plug and play equipment swap.

Demand for Tube Replacement

Previous high power SATCOM terminals were obliged to use TWT (Traveling Wave Tube) amplifiers in their designs because there simply were few viable alternatives. Tubes are proficient at generating high levels of RF power. They are not, however, necessarily compact. TWT’s also tend to be less reliable than solid-state amplifiers in that their predicted life spans are substantially shorter and can be difficult to keep spares on hand because TWTs effectively have a “shelf-life.” A simple analogy is the difference between LED light bulbs and incandescent light bulbs. One has an upfront cost substantially higher than the other, but the overall cost of LEDs (solid state) can be much lower based on efficiency, reliability, and performance.

Customers have been inquiring about the benefits of solid state in reliability, operating efficiency and performance for years. Only recently, through advances made in the application of GaN (Gallium Nitride) semiconductors and the development of proprietary and patented methods of using these advanced compound semiconductors, has this become feasible.

This is another example of a market segment where increases in performance have driven demand, even at a higher price point. The ability to replace TWT amplifiers with compact and reliable Solid State amplifiers has created a new class of “large” transportable stations using antennas over 3 meters with very high power (200 Watt or more) Ka-band SSPAs or BUCs. There are some obvious improvements in antenna manufacturing and feed technology that accompany this, and the complex relationship between multiple enabling technologies make it difficult to attribute the market growth to any one factor.

A New Growth Market

As manufacturers like Mission Microwave continue to invest in advancing the state-of-the-art for SSPAs and BUCs, additional opportunities for demand growth are occurring.

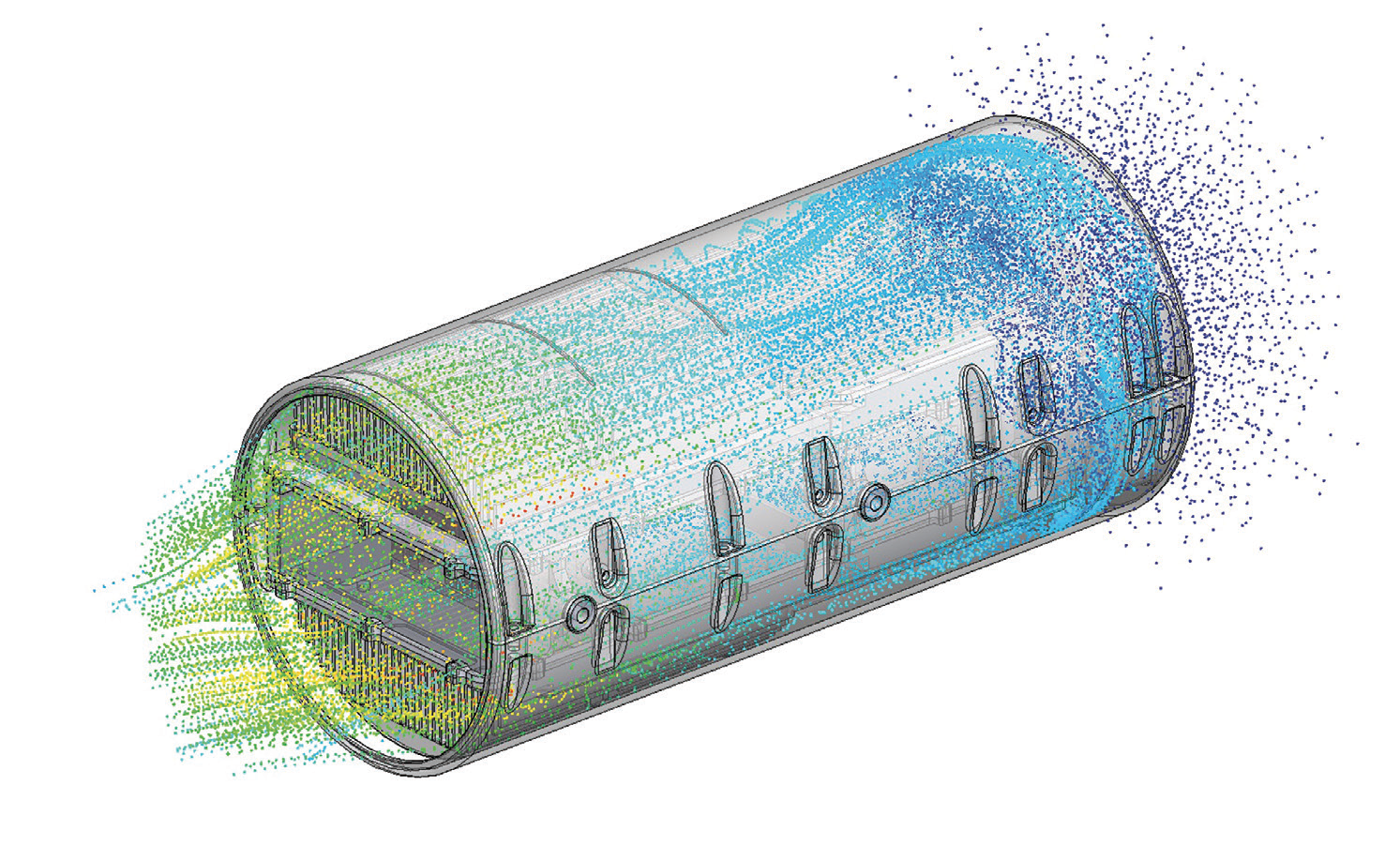

Figure 3. Thermal Design Analysis showing heat Dissipation via directed airflow.

Figure 3. Thermal Design Analysis showing heat Dissipation via directed airflow.

As customers demand high throughput terminals for their networks, they realize that these are significant capital investments so they need to be able to be in use over a long period of time. This means that they need to have the flexibility to support the mission regardless of changes in the environment. In this case, customers are often faced with the uncertainly as to which satellite network or architecture (GEO, MEO or LEO) will support their needs. Simply put, no one wants to invest in a six-figure terminal that will lock them into a certain satellite operator or network architecture. This is why wideband Ka- is emerging as a new high growth market sector.

Wideband Ka-band in a practical sense is 27.5 to 30.0 GHz. In limited cases, this may even extend to 31.0 GHz. Within that range, one can cover traditional GEO satellite, current and planned MEO networks, and the planned LEO constellations.

Within the wide band of coverage, several sub-bands are generally required and these can be switched easily between bands while accommodating the particular requirements of different satellite operators. This is complex, yet a “future proof” terminal is very much a practical reality — and to the point of this article — it is not inexpensive. Despite being a more expensive solution — the value proposition is obvious. Reliability, long service life, and the aforementioned benefits in efficiency, size, weight, power and performance all come into play to create a new and attractive market segment for RF and terminal manufactures and substantial benefit to end users.

Innovation in RF Power

The mobility market has stressed the need for low SWaP along with increased energy efficiency and reliability. At Mission Microwave, there are two core design philosophies that exemplify all of these needs and drive the firm’s innovation in the offered Block Up Converters (BUC) and Solid State Amplifier (SSPA) designs. Figures 1 and 2 show a portion of the product range produced by the company using innovative design and technology.

Principle I

RF Power efficiency is how much of the prime power gets translated into RF energy. Typical Ku-band BUCs at 100 Watts of saturated power operate in the range of 11-17 percent efficiency — most are below 15 percent. Mission Microwave’s 100 Watt, Ku-band Javelin BUC has 25 percent wall plug efficiency. RF engineers realize that the difference between 15 and 25 percent isn’t 10 percent — it’s 66 percent, which is a big deal.

Efficiency equates directly to reliability as well. That 66 percent more energy that the older style BUCs requires can only go to one place — waste heat. Prime power draw gets turned into RF power plus the remainder is turned into waste heat. Heat is the enemy of reliability. Electronics that run cooler generally run longer and provide a greater “thermal margin” for operation in harsh environments where ambient temperatures can rapidly reach 60 degrees C.

How does one make RF power more efficiently? The GaN devices used in SSPA’s have limited output power per device. Multiple devices need to be combined to reach the higher output power levels. The company’s team leads the industry in the efficient combining of RF devices to achieve the desired output powers.

The secret sauce here is in the ability to get signals from the semiconductor devices combined and into the waveguide structure with minimal loss. In addition to the designs ability to accomplish this, it is largely a manufacturing problem — to design a system such that it can routinely (and affordably) be produced. The solutions to this are proprietary or patented.

Efficient RF designs generate a lot less heat than typical SSPA designs, yet still generate a considerable amount of it. The way the design manages this heat is the key to the second design principle.

Principle II

Mission Microwave’s efficient RF designs generate less waste heat per watt of RF power than any other Solid State BUCs on the market. In doing so, there is less heat to remove, but that doesn’t mean they use traditional techniques to manage it. Mission Microwave has innovated on that front, as well. Figure 3 shows an example thermal analysis that demonstrated the optimal use of airflow in the firm’s patented cylindrical design.

Mission Microwave has developed and patented intellectual property on the thermal management of its RF amplifiers. The unique design of the company’s BUCs derives from an efficiency of thermal design. They create designs of thermal conduction and airflow to minimize the size and weight of their products — and the result is the signature cylindrical shaped BUCs and SSPAs with remarkable SWaP characteristics.

One example is the firm’s 200 Watt Ka-Band BUC weighs only 22 lbs., which is 20 lbs. lighter and 15 percent more efficient than the closest competing product.

Terminal Designs Continue to Evolve

Mission Microwave BUCs have enabled terminal designers to bring significant savings in SWaP to their platform designs.

The company has supported customers in designing new, lightweight terminals with integrated BUCs, where previously the BUC was a separate device that weighed more than the rest of the terminal. These low SWaP products have enabled new mission profiles, as the reduction in SWaP required for the BUC can be used for other parts of the system.

Mission Microwave and their customers have shown that there is still plenty of room for innovation in a mature market such as satellite terminals, especially in regard to BUCs and SSPAs.

This innovation has been driven by the desire for mobility in satellite terminals and the continual need for improved efficiency and elegance in design.

The company is proud to carry the banner of innovation in the satellite terminal market as “The New Shape of Solid State.”

www.missionmicrowave.com

Steve Richeson joined Mission Microwave in 2017 and is responsible for sales and marketing. He has over 30 years of Satellite and Radio Frequency (RF) experience in engineering and sales leadership roles at Harris Corporation, EchoStar, Scientific-Atlanta, GTE Spacenet International, RSi SATCOM Technologies and Schlumberger. Steve is a Senior Member of the IEEE and a Registered Professional Engineer. He earned his engineering degree at Georgia Tech and an MBA at Georgia State University.