We live and work in an era of very fast expansion of satellite applications, with a new constellation being announced almost every week.

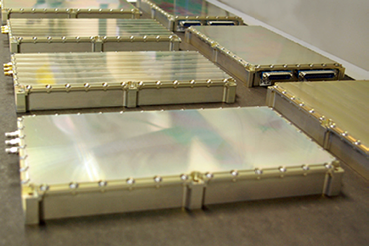

CYGNSS SGR ReSI flight models. Image credit Surrey Satellites.

At the last count, my colleague Alex da Silva listed 68 small satellite (smallsat) constellations being proposed around the world. Most already have some funding and in many cases attract amounts of cash that are the envy of more established operators.

The numbers can very quickly become mind boggling: if the more optimistic predictions are correct, we will end up with a few thousand additional Earth satellites in the near future. Some estimates point to a total value of these constellations in the order of $22 billion.

Currently, the investment figure is more likely to be around the $3 to $4 billion mark, still a rather impressive number for those of us more accustomed to think of the smallsat industry as a (very) few million dollar industry.

For a satellite manufacturer, this is great news. Having seen the highs and lows of the industry over the years, and the slow growth of smallsats in the early years, the prospect of thousands of smallsats being needed in the coming years is exciting. However, the question I am frequently asked these days is how real this ‘boom’ is, and if after the “boom” comes a ‘bust.’

I am a firm believer in a ‘boom’—the technology now delivers a performance that is financially attractive and the investment capital is available to make systems based on that technology. But as for the size of the ‘boom’ and the possibility of a ‘bust,’ that will depend on successfully navigating a few challenges and hurdles.

Some of these are industry wide and we need to address them together to ensure we create an environment that allows for the success of the current new space revolution.

The first hurdle is possibly the less exciting of them all: regulatory. The long discussions about debris mitigation and its impact on smallsat constellations are well known and several solutions have been proposed. The jury is still out on how effective these solutions are, but I wouldn’t expect this to stop the boom.

There is another regulatory aspect that might have a bigger impact for communications constellations: spectrum allocation and frequency licensing. In private (and sometimes in public), spectrum regulators are voicing concerns at what they see as possible misuses of spectrum.

Interference, or potential interference between LEO communication constellations and GEO satellites, as well as other LEO constellations, is likely to generate substantial uncertainty for some of the proposed communications constellations.

This is unlikely to stop the boom but does have the potential to limit the rate of expansion. Building and launching precursor satellites for frequency allocation will rapidly become a necessity for constellation business plans to secure further funding.

The ITU is also being very proactive in shaping and supporting the licensing of future smallsat constellations and space systems and the industry needs to support those efforts.

The second hurdle is possibly the biggest obstacle for a rapid expansion of satellite numbers and the only real ‘boom’ killer: launch capacity. Despite the promise of the last few years, rather than an increase in the smallsat capacity, we have actually seen a reduction in the overall launcher availability.

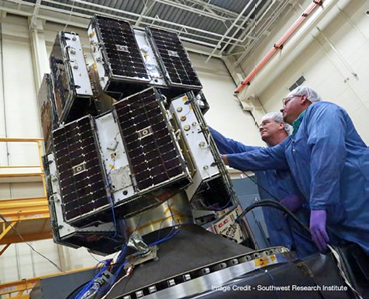

CYGNSS satellite. Image credit Southwest Research Institute.

Surrey Satellite Technology’s Space GNSS Receiver Remote Sensing Instrument (SGR-ReSI) is the primary payload onboard NASA’s CYGNSS constellation that was launched on December 15. The Cyclone Global Navigation Satellite System (CYGNSS) mission is part of the NASA Earth System Science Pathfinder Program that aims to improve extreme weather prediction by studying how tropical cyclones form. The CYGNSS space segment consists of a constellation of eight microsatellites, each carrying the Surrey SGR-ReSI as the observatory payload in the form of a delay Doppler mapping instrument (DDMI). Making use of reflected global positioning signals, the DDMI collects ocean surface roughness data using a technique called GNSS reflectometry, providing CYGNSS with a new method for looking inside hurricanes. Wind speed will be estimated from this reflectometry data.

With the effective mothballing of Dnepr over the past few years, the world is increasingly dependent on the ISRO’s PSLV to launch smallsats at cost effective prices. There are alternatives, but these rarely materialize in the required time frames and at a cost that closes the business plan.

By now, we expected to have several new small launchers up and running, increasing capacity and driving down prices. Unfortunately, this has not materialized and, of the 25 or so serious small launcher ventures, not one has yet completed a commercial test launch.

In recent years, the promise of low cost, frequent launches with small manifests seems to be stuck or going in the wrong direction: prices per kg launched in some of these new launchers are approaching that of conventional launchers and minimum mass launch is growing, thereby making it far harder to launch one or two small spacecraft into dedicated orbital planes.

Communication and RF sensing (AIS, ADS-B, etc.) constellations, in particular, require multiple operational planes to be effective and need frequent launch opportunities. There is an urgent need to address the constraint on launch capacity and ensure the success of new launcher initiatives. Only in this way can the space industry fulfill the promise of a ‘boom’ in satellite numbers.

One likely outcome of this situation is that in the next few years, Chinese built constellations will have a significant commercial advantage in relation to their foreign counterparts, as they will have access to locally built low cost launchers, that the majority of western companies are barred from using due to export restrictions. This could create a situation where Chinese companies become dominant in the new space business because of their easy access to launchers.

The third hurdle is financing. Many of these constellations require substantial initial investment to design, build and launch. Although capital markets have been generous with the satellite sector in the past few years, further funding is increasingly linked to demonstrating a degree of success.

The ability to demonstrate on orbit results is a necessary (but sometimes not sufficient) step in securing further funding. Precursor satellites, pathfinders, demonstrators are becoming common as a first step in convincing the investor community that owners of the business and its staff are able to manage the technology.

For ventures that do not have their own in-house technology capability, selecting the correct technology partner is a crucial step in assuring their investors that they can deliver on their promises. This is not about the space segment: as or more important is the overall system design, including command and control systems and the tools for downstream use of the system. These are many times forgotten and are an essential part of the success of a constellation.

The future success of the systems being proposed will depend largely on the success of their business models. As obvious as this statement might sound, it is not always clear how value will be generated and what is the likelihood of success. In some cases the challenge is more the technical solution and in others is more the business model itself.

Good, reliable technical solutions are a very important first step to achieve success. These have to be balanced with ambitious cutting edge designs that extract the maximum performance out of the technology and give a business advantage to the final user. In my experience, the key for technical success is having teams of people with good solid knowledge, mixed in with highly creative and innovative types. The environment built around that team needs to allow both types to flourish and deliver, what can be a rather challenging task for the leaders of the team (and also for their investors).

Likewise, good, solid business propositions are important to show investors that they will get a return in the future. Of course, such a proposition also needs to be innovative and show why this investment is better than others. There can be a temptation to sometimes present a better business proposition based on a more “adventurous” technical solution. Although this can improve the chances of getting in early investment tranches, it runs the risk of being based on a physical impossibility that might limit future investments.

It is important to ensure that a dose of realism is used when assessing the business plans of new ventures, but accepting that risk is part of the investment process.

There are excellent business propositions among the many commercial ventures being put forward, most of which are truly innovative and game changers. Ensuring the success of such ventures it is critical to ensure that there is only a boom and no bust. The sustainability of the industry depends on the success of the current projects.

Addressing the main potential hurdles in regulation, launch and finance are the key objectives for the near future. The strength of the business propositions needs good, solid and innovative technical solutions that can deliver the vision of the entrepreneurs that created them.

Ensuring good system design is fundamental so the systems being deployed deliver the performance required of them. That will generate the return that investors expect, and in this way the industry will remain buoyant with the continued support of the investor community.

Should we succeed, there should be no bust phase at all, just a continuous strong growth in the years to come.

sstl.co.uk/

Professor Sir Martin Sweeting is the Founder and Executive Chairman of Surrey Satellite Technology Ltd. He pioneered rapid-response, low-cost and highly capable small satellites using modern consumer (COTS) electronics devices to change the economics of space.

In 1985, he founded a spin-off University company (SSTL), which has now designed, built, launched and operated in orbit 49 nano-, micro- and mini-satellites. These smallsats include the international Disaster Monitoring Constellation (DMC). SSTL also built all of the 22 navigation payloads for the European Galileo operational constellation and a low-cost, medium-resolution SAR minisatellite (NovaSAR).

SSTL has grown to 500 staff in number, with annual revenues of $150 million—total export sales to 24 countries have approached $1 billion.

As Chairman of the Surrey Space Centre as well as being a distinguished professor at the University of Surrey, Sir Martin heads a team of 90 faculty and doctoral researchers investigating advanced smallsat concepts and techniques, acting as the research laboratory for SSTL — a true example of real academic-commercial synergy.

Sir Martin has been appointed OBE and knighted by HM The Queen, elected a Fellow of the Royal Society and a Fellow of the Royal Academy of Engineering, and he has received the prestigious von Karman Wings Award from CalTech/JPL.

In 2016, Sir Martin was identified by The Sunday Times as one of the UK’s 20 most influential engineers, confirmed again in Debrett’s 2017 list of the 500 most influential people in the UK.