Investment analysts regularly compose varied opinions in regard to their favorite company picks within the satellite industry. Now Sami Kassab, from investment bank Exane/ BNPP, in an 85-page report takes a deep examination into Europe’s two leading satellite operators. He concludes by favoring SES.

* Data: Exane/BNPP Estimates April 8 2021

His study also extends to one of today’s hottest business prospects — SpaceX and their Starlink broadband-by-satellite service. There’s much market commentary as to whether Elon Musk will go to the market and mount an IPO to further fund Starlink’s costs. Kassab believes Starlink will eventually be a success, both technically and financially.

For his report, Kassab spoke to privately held competitors, suppliers, customers, regulators, consultants, SATCOM engineers and updated his firm’s proprietary satellite demand tracker. He says he explored three key topics:

First, Kassab argues that the age of Mega-Constellations has arrived. This will change industry economics forever and will create many losers among the incumbents as well as a handful of global winners. With the launch of O3b mPower, SES’s next generation system, that company will be one of the winners, in his estimation.

Secondly, Kassab argues that the newly created U.S. Space Force (USSF) is about to announce changes in the organization’s SATCOM procurement strategy for replacing their aging fleet. Kassab expects the Pentagon to purchase more commercial capacity from non-geostationary satellite systems and Exane/BNPP notes SES as a winner and Eutelsat at risk because of the upcoming changes from the single largest customer of the industry.

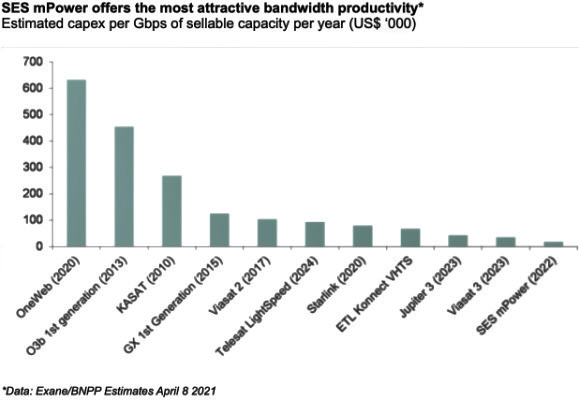

Thirdly, Exane/BNPP completed a deep dive into Space X and observed strong, commercial momentum for Starlink and, assuming they move to lower terminal production costs and complete the roll out the SpaceX Starship, Kassab believes Musk’s business could reach a double digit Internal Rate of Return (IRR). However, the bank’s analysis of Starlink system architecture suggests a focus on rural residential consumers and not the enterprise market. Starlink’s competitive threat to SES mPower is limited as the service currently lacks bandwidth density, intersatellite links and distribution, while SES mPower offers industry leading bandwidth economics.

Kassab admits that SES’s share price has "found a floor" on current levels. Investors can only hope he is correct. “Our medium-term EBITDA forecasts are11 percent above consensus for SES and 6 percent below for Eutelsat underpinning our preference for SES (+) over ETL (downgrade to -).”

The bank’s report is most fascinating in terms of their study of Starlink, and the prospects for OneWeb as well as Telesat’s Lightspeed and compares them with SES’s upcoming mPower MEO fleet expansion.

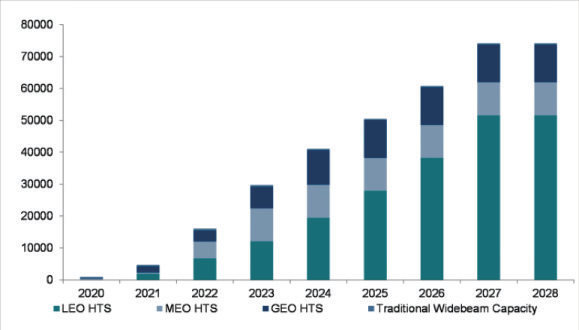

Sami Kassab’s comments make good reading. He said, “The supply of cheap network connectivity from space will unlock a surge in demand as broadband internet becomes available in places where terrestrial networks cannot go. Our bottom- up modeling captures the number of passengers in the air concurrently, the number of cruise ships, merchant vessels, ferries, yachts at sea as well as the number of military drones, satellite backhauled cellular base stations, unserved and underserved households in the digital divide and many other key drivers of demand. Based on this model we forecast that capacity volume demand (in Gbps) will grow by c15x in the medium term to over 6Tb/s.”

However, Kassab also issues a caution, noting, “While our forecast points to a strong increase in demand, we still believe that oversupply is endemic and assume further decline in pricing in our modeling. However, we also expect OneWeb and Starlink to price their commercial capacity at a premium to GEO HTS. This could put a floor on capacity pricing trends. For investors, picking the companies that will be able to offset potential pricing pressure with volume growth is hence critical.” will be able to offset potential pricing pressure with volume growth is hence critical.”

Kassab says he expects Musk to have deployed more than 11,000 satellites by the close of 2024 at a cost of $10.6 billion and supplying 23 Tb/s of salable capacity. “We forecast it will grow residential subscribers from c30,000 now to 2.4m by 2024.” These will generate an estimated $4 billion in 2024 revenues. “Assuming it can reduce user terminal production costs from cUSD2,500 now to USD500 and assuming it can move from launching 60 satellites per Falcon 9 flight to 400 on Starship from 2023 onwards, we believe Starlink can generate close to 15 percent IRR and prove to be a technological, commercial and financial success.”

As part of his study, Kassab said he has doubts concerning OneWeb’s prospects and the same outlook as far as with Amazon’s Project Kuiper. He did note that Telesat’s Lightspeed, however, “looks attractive.”

Artistic rendition of SES’s O3b mPOWER constellation on-orbit.

Image is courtesy of SES.

Exane/BNPP stated there are doubts arising over the Jeff Bezos company’s ability to meet the regulatory obligations for Project Kuiper. “In order not to lose its spectrum rights, we estimate that Amazon has regulatory obligations to launch 324 satellites by July 2023 and half its fleet by July 2026,” added Kassab.

Meanwhile, SES’s mPower fleet initiates their launch cadence later this year. Kassab said, “We believe that mPower is likely to be a major winner in the new space age as the new capacity volumes it captures more than offset price erosion, resulting in SES Networks more than offsetting declines in SES Video and overall group revenue growth from 2023. SES has a sustainable competitive advantage against new LEO constellations thanks to its attractive bandwidth economics, competitive technical capabilities (in particular GEO/MEO combination, high bandwidth density and high uplink capabilities) and established distribution network.

“In particular, we expect SES to earn leading market share in Maritime (with Aero gradually becoming less of a focus) and Government (with a positive effect from US Space Force procurement changes) and to be a key player in cellular backhaul. We believe SES’s share price does not yet capture the commercial success we believe mPower is likely to achieve nor does it capture the return to group revenue growth from 2023 onwards.”

If there is a ‘winner,’ then there has to be the potential for losses elsewhere. Kassab said that some 30 percent of Eutelsat’s revenues are, therefore, at risk.

“We are concerned that Eutelsat could suffer in Government, Mobility and Fixed Data as it lacks the technological capabilities to compete against the mega constellations. Revenue pressure on Eutelsat could be severe and not fully offset by its growing commercial success in residential broadband (i.e. Fixed Broadband division) where we forecasts subscriber count to grow from c50,000 now to c950,000 by FY2030e. We believe this is not in consensus forecasts yet and leads us to downgrade the stock to Underperform,” he said.

As to SpaceX’s latest efforts, the company has said the marketing of the service will start in June for Portugal. Starlink is also now available, albeit in limited supply, in Australia. Initial beta service is available in parts of central Victoria and southern New South Wales. According to a SpaceX press release, “Service will expand across the country in the coming months.”

As for Musk’s plans for India — where OneWeb is expected to be widely promoted — is yet to make much public progress. A report in trade publication EETelecom quotes Anil Prakash, Director-General, SiA-India (Satcom Industry Assoc - India) stating that it is premature to say Starlink will not gain access to the Indian market.

Starlink is accepting pre-booking orders from potential subscribers in India. However, there are heavyweight objections from the likes of Amazon, Facebook, Google and Microsoft as well as India Space Research Organisation (ISRO).

Prakash noted that as and when Starlink would wish to offer commercial services in India, the company would be required to make their formal application in line with the existing rules.

“The responsible government authority will carry out its due diligence on the application submitted before Starlink can offer its commercial services. Any organisation looking to offer services in the country must follow the law of the land, and adhere to the country’s licensing and regulatory framework,” Prakash added.

Author Chris Forrester is a well-known broadcasting journalist, industry consultant and the Senior Columnist for SatNews Publishers. He reports on all aspects of broadcasting with special emphasis on content, the business of television and emerging applications. He founded Rapid TV News and has edited Interspace and its successor Inside Satellite TV since 1996. He also files for Advanced-Television.com. In November of 1998, Chris was appointed an Associate (professor) of the prestigious Adham Center for Television Journalism, part of the American University in Cairo (AUC), in recognition of his extensive coverage of the Arab media market.