Jeff Ransdell is a venture capitalist building a portfolio of exponential technology companies at Miami-based venture capital firm Fuel Venture Capital, which he co-founded in 2017 following a departure from the world of private wealth management. Jeff approaches venture capital with a signature “founder focused, investor driven” mindset, shaped by two decades as a top executive of Bank of America Merrill Lynch.

His transition to venture capital was motivated by what he saw as mounting evidence that opportunities to shape the economy and capitalize on innovation were steadily shifting from the public markets to the private markets. In the face of much skepticism, Jeff chose Miami, Florida, as the home base for Fuel Venture Capital, armed with an unparalleled Rolodex and emboldened to leverage the city’s untapped resources and advantages.

Today, Fuel Venture Capital manages more than $200 million in funds and has a portfolio of 25 companies, such as Bolt and Taxfyle.

Good day, Mr. Ransdell. Would you please tell our readers about your background and what prompted you to devote your career to the space funding environments?

Jeff Ransdell

I started out as an entrepreneur. I owned a chain of fitness clubs, a textile manufacturing business, and a sound and light production company that served live-music venues and nightclubs. A funky combination of businesses, which I ultimately sold to a family office.

Merrill Lynch was involved in that acquisition and that allowed allowed me to get to know some of their team members really well. I enjoyed associating with them, plus the work they were doing was intriguing. I decided I’d try my hand at being a financial advisor with Merrill.

I spent more than two decades with Merrill Lynch, eventually becoming one of six managing directors of the wealth management division, where I managed more than $130 billion of global private client investment assets, a P&L of $2 billion, and over 2,000 employees.

Then I transitioned to VC. I launched Fuel Venture Capital in 2017 as I was seeing this shift in the markets, where opportunities to shape the economy and make money on those economic trends were going from the public markets to the private markets. The real value in businesses these days can be best extracted in the early days, when companies are still privately held.

Space always interested me, but it wasn’t until I became friendly with Marc Bell, co-founder and executive chairman of PredaSAR, that it intrigued me in a material sense. Marc opened my eyes to the great beyond, shall we say.

What was the impetus behind founding Fuel Venture Capital?

Jeff Ransdell

Fuel Venture Capital was founded to provide savvy, forward-thinking investors access to high-value, high- impact investments through private technology companies.

After nearly two decades of working with Merrill Lynch, I noticed that most advisors were dismissing major economic trends, namely the surge in billion-dollar technology companies, pre-IPO. They were playing it safe to deliver returns each year to their clients, returns that those clients would be satisfied with. However, they were essentially cheating their clients from earning much larger returns; they were far too risk-averse, and perhaps a little unmotivated, as well.

Historically, the assumption has been that investing in the stock market successfully is a one-way ticket to wealth. Once upon a time that was true, but not so anymore. Today, once a company is on the public market, the real value has already been extracted by the people and institutions that got in early and invested their money when the risk was big and returns uncertain.

It was not easy to get a seat at the table in those early days. Those were extremely exclusive deals. My team and I give ultra-high net worth individuals and the institutions that serve them a seat at that table.

What was the driving motivation for investing in PredaSAR?

Jeff Ransdell

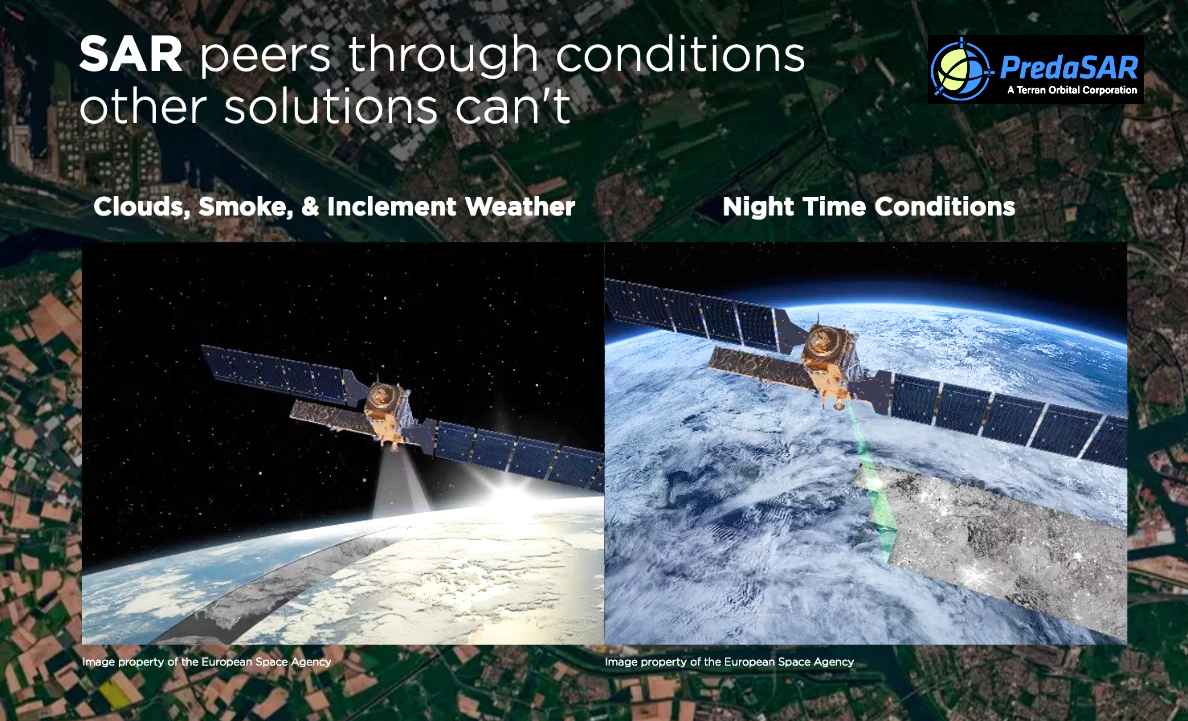

Imagine never losing a ship... never losing a plane. Imagine being able to see through the lush canopy of the Amazon rainforest in Brazil to locate illegal logging. Imagine looking at wheat fields and being able to track the crop yield. Is a ship carrying coal, or is it carrying missiles?

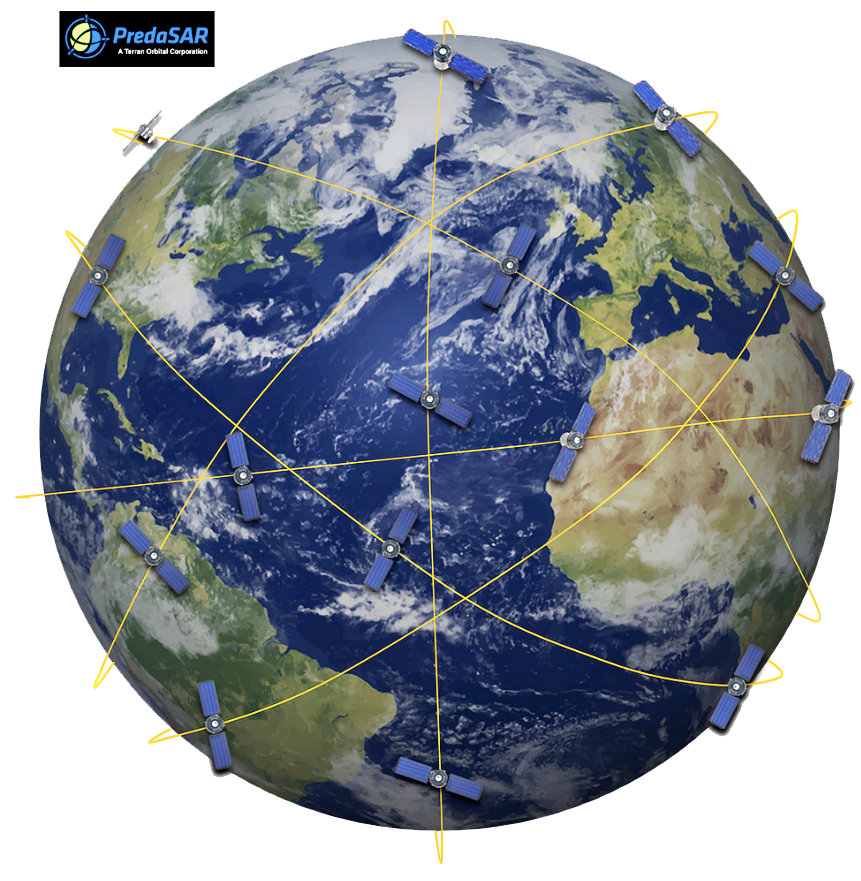

That is the power of Synthetic Aperture Radar (SAR) technology. No company is deploying SAR satellites and gathering and transmitting data at the scale and precision of PredaSAR. (For a look at how SAR operates, see addendum at the close of the interview.) How could I not invest?

How does the New Space category fit into Fuel Venture Capital’s investment thesis?

Jeff Ransdell

Fuel Venture Capital investment thesis, from a broad- strokes standpoint, revolves around investing in companies that meet a set number of criteria and can be deemed, according to that criteria, as “exponential.” PredaSAR certainly is, given the company’s size, unit economics, projected trajectory, and more.

New Space is capital intensive — asset heavy, highly technical. PredaSAR has unlocked how to make it make sense from a numbers standpoint, let’s say, through its savvy leadership that possess business finance prowess and technical know-how. Any institutional investor worth their salt knows that New Space is the next frontier. Interest around commercial space and space exploration, in general, seems to have significantly increased over the past, few years.

Why do you think that is the case?

Jeff Ransdell

Sir Richard Branson (Virgin Galactic) and Elon Musk (SpaceX) made space hot. Because of them, institutional investors started to finally pay attention to this segment. It’s now a legitimate investment opportunity that even the more risk-averse LPs are inquiring about, especially since SpaceX was valued at $100 billion. The unit economics of the business have improved due to technological advancements and specialization, and as more companies approach profitability, consolidation will occur and cap tables will be open for VCs who can move fast and offer smart capital.

What attributes were you looking for when you were reviewing the PredaSAR investment opportunity?

Jeff Ransdell

PredaSAR is led by a highly respected CEO, Major General Roger Teague, USAF (Ret), and a seasoned executive team with extensive national security space expertise. PredaSAR is supported by a Board of Directors who bring more than 100 years of national security experience. They know what PredaSAR’s end consumer wants and needs and how to address those needs. That was a key factor in whether to invest in such a technical company.

I also liked that PredaSAR was committed to not processing the data its SAR satellites capture. Their customers can do their own data processing, allowing PredaSAR to focus on what they do best, providing the highest resolution data possible today, as well as the most frequent revisit rates.

A number of New Space companies have announced SPACs in the last year – just one segment of the market latching on to this new financial vehicle. As a former financier, what are your thoughts on the SPAC trend?

Jeff Ransdell

VCs are creative and disruptive beings, by nature. VCs are also impatient, in certain regards, as we’re efficiency- minded, if I have permission to paint with a broad brush. This industry has continuously searched for alternative exit routes to achieve liquidity for investors. Given some of the challenges inherent in executing an IPO, SPACs are, in the correct scenario, a silver bullet.

Where do you believe the New Space market is headed?

2021 is the year of New Space exits. I think we’re going to see a lot of consolidation, now that business models have solidified and the competition is heating up.

When you look back upon your career, what initiatives or programs that you have been involved in truly bring a sense of satisfaction to you and a smile to your face?

Jeff Ransdell

PredaSAR is certainly up there. Think about it like this: There are about 36 conflict zones around the world, give or take a few. The government needs data on those zones. However, the government can’t be everywhere at all times. That’s where PredaSAR comes in. The company will be the largest and one of the first commercially owned SAR constellations ever created and will bring governments invaluable actionable intelligence. It’s exciting to be along for the ride.

fuelventurecapital.com

ADDENDUM: How does SAR work?

(courtesy of Fuel Venture Capital)

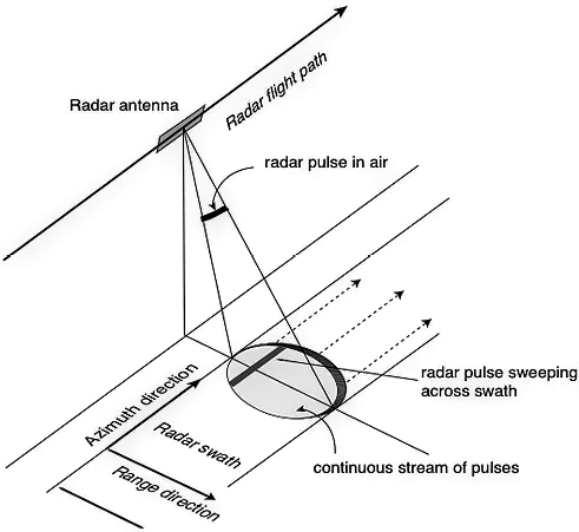

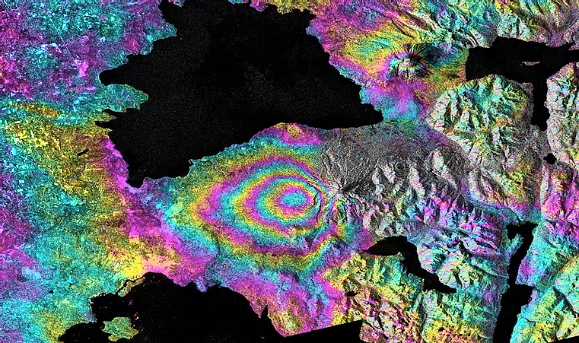

To create a SAR image, successive pulses of radio waves are transmitted to “illuminate” a target scene, and the echo of each pulse is received and recorded.

The pulses are transmitted and the echoes received using a single beam-forming antenna, with wavelengths of a meter down to several millimeters.

This process forms the synthetic antenna aperture and allows the creation of higher-resolution images than would otherwise be possible with a given physical antenna.

The antenna illuminates an area on the ground determined by its wavelength and antenna dimension.

Pulses are sent and received continuously such that any point on the ground is sampled numerous times to generate images.

Images are courtesy of NASA.