February 16th witnessed Paris-based Eutelsat reveal its half-year numbers (for trading to Dec 31st, 2003) and now incorporating the first few months of the company’s ownership of the OneWeb constellation.

CEO Eva Berneke told analysts that Eutelsat was now “returning to top line growth.” She didn’t say ‘at long last,’ but one could sense the relief in her words as she (and CFO Christophe Caudrelier) delivered an upbeat set of numbers.

Eva Berneke

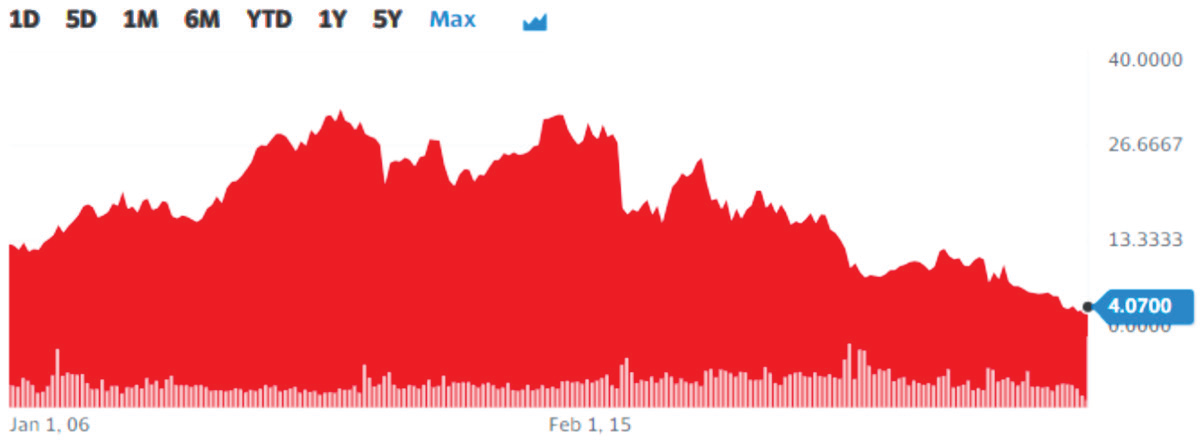

However, behind the scenes, the optimism isn’t quite as strong as might seem. A number of investment banks over the previous couple of weeks had downgraded Eutelsat’s prospects. For example, Deutsche Bank’s (DB) advice to clients was to ‘Sell’ their Eutelsat stocks. In its advice, DB points to “increasingly limited near term visibility in the OneWeb business following rollout delays alongside capex drags from the new [OneWeb] constellation.”

The bank said that these operational concerns coincide with near term refinancing needs (60% of debt over four years) which will see its average Cost of Debt double from about three percent. DB cut Eutelsat’s share target price from €4 to €3.

A few days later, Fitch Ratings further downgrade Eutelsat’s debt with an “Outlook Negative” view due to the company’s “OneWeb challenges,” its higher execution risks and competition for OneWeb from other LEO constellations.

Fitch expects Eutelsat to have to borrow more cash to fund the OneWeb expansion plan and, of that, there’s little doubt.

Fitch’s full statement stated, “The downgrade reflects Eutelsat’s significantly higher leverage and slower progress with monetising OneWeb infrastructure following the company’s downward revision of its FY24 (financial year ending June 2024) revenue and EBITDA guidance. The Negative Outlook reflects high execution risks and continuing challenges around meeting the medium- term financial targets at OneWeb with low revenue visibility, along with some refinancing risks by October 2025.”

Fitch’s specific anxieties talk about the late availability of OneWeb’s services (either delays in obtaining landing rights) or availability of ground antenna, as well as the inevitable competition from Starlink and the future entry of Amazon’s Project Kuiper (and not even mentioning Telesat’s Lightspeed, or Iridium, or Viasat/Inmarsat’s Orchestra or the dozen-and-one smaller entrants into the LEO space).

These negative elements did little to favor the market’s confidence in Eutelsat’s prospects and further hurt the firm’s share price. Eutelsat’s own decision a year ago to cease paying a shareholder dividend for a three-year period also did not help the company’scause.

Christophe

Caudrelier

In fairness to Eutelsat, CFO Caudrelier told analysts that the firm’s replacement debt plans were well in hand, and were not going to cost it double the 3% typical current obligation. Moreover, Eutelsat stresses that its absorption of OneWeb is on track. By mid-2024, the constellation will be covering 90% of the planet with only a few markets likely to remain without connectivity. OneWeb was delivering latency of just 70 milliseconds and download speeds of up to 195 Mb/s. There would be 11 various user terminals available by mid-2024.

There was also good news in terms of the cost of design and build for OneWeb’s 2nd Generation craft. These costs will be lower than initially anticipated, said Berneke. Synergies were also being achieved and would likely result in greater benefits than estimated, she said.

Eutelsat is a business that’s very much in transition and is moving away from a steadily declining Video DTH business and is not helped through the lossof a major DTH contract from DigiTurk, as well as being forced to take down Russian and Iranian channels. European Video revenues were also being squeezed. Today, Video is about 58% of Eutelsat’s revenue mix, but that is steadily falling as broadcasters switch to OTT and broadband. Video revenues for the half-year were down by 8.0% (like-for-like) to €331.1 million.

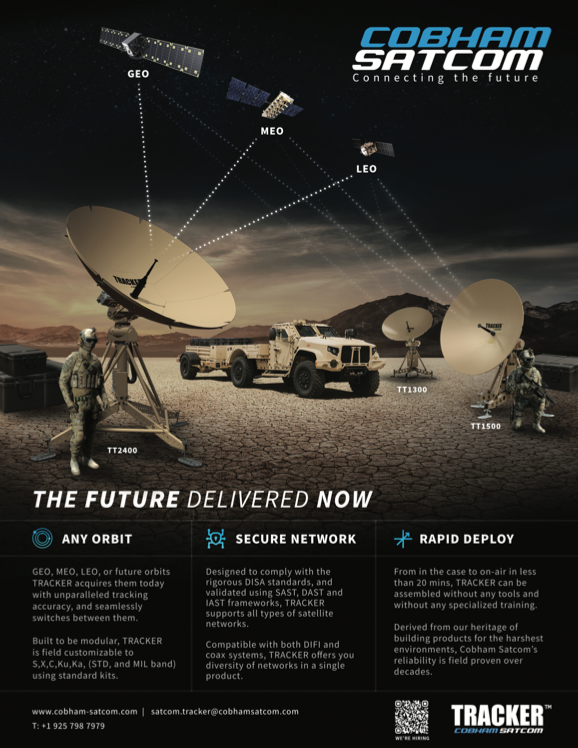

The company’s Government Services (13%) division revenues for the half- year stood at €74.2 million, up by 10.5% y-o-y, reflecting the slightly better renewal rate of the Fall U.S. Department of Defense (DoD) campaign (above 80% renewed), as well as the contribution of the EGNOS GEO-4 contract on HOTBIRD 13G. Revenues also included a contribution from OneWeb and those benefits will start to flow into the company’s coffers as 2024 unfolds. OneWeb’s backlog is more than €700 million (excluding inter-company bookings).

_____________________________________________

Delays with rolling-out new infrastructure may weaken Eutelsat’s longer-term competitive positions as other operators are active in the market. LEO infrastructure competition will be stiff as a few LEO constellations are being rolled out, supported by multi-billion dollar capex commitments. On top of this, SES, in partnership with Starlink, has started offering integrated Medium Earth Orbit(MEO)/LEO maritime services in direct competition with Eutelsat’s LEO/ GEO solutions,” said Fitch Ratings.

Mobile Connectivity (12%) revenues stood at €71.2 million for the half year, up 35.6 percent y-o-y, underpinned by the entry into service of the high- throughput satellite, EUTELSAT 10B, with significant pre-commitments and the commercialization of the final beam on EUTELSAT QUANTUM for a Maritime mobility client, said Eutelsat.

Fixed Connectivity (17%) revenues stood at €94.6 million, up 9.2% y-o-y, mainly reflecting the entry into service of KONNECT VHTS, as well as a contribution from LEO connectivity. When Q2 of the year (the three months to December 31st, 2023) was reviewed, the results showed revenues of €54.3 million, up 17.6% y-o-y and by 23.7% on a sequential basis, mainly reflecting contracts that started from mid-October following the entry into service of KONNECT VHTS. “This positive dynamic is expected to translate into double digit-growth for the Full Year on the back of KONNECT VHTS as well as the contribution from the LEO connectivity offer,” said Eutelsat.

Eutelsat’s all-important backlog stood at €3.9 billion on December 31st, 2023, versus €3.7 billion a year earlier. This increase reflects the contribution of OneWeb’s backlog, now standing at €700 million, up 23 percent over the last quarter, partly offset by natural erosion of the backlog, especially in the Video segment, in the absence of major renewals. Q2 overall revenues stood at €298.7million, up 3.7%, like-for-like. Revenues of the four key Operating Verticals stood at €298.6 million, up 3.9% y-o-y on a like-for-like basis, and up 5.4% q-o-q.

On December 31st, 2023, net debt stood at €2,619.1 million, down €146.6 million, versus the end of June, 2023, reflecting...

i) receipt of phase II FCC C-Band proceeds net of tax of €330.4 million;

ii) a negative impact from the firm’sfinancing activities, mostly related to structured debt combined with

iii) a decrease in cash flow from operating activities due to the consolidation with OneWeb.

As to OneWeb, the company said, “OneWeb’s order backlog continues to grow, now standing at €700m, up by 23% over one quarter, while we are seeing strong commercial traction with several deals activated with major customers. We are making progress on the ground roll-out following recently reported delays and we are on track for 90% network coverage by mid-2024.”

_____________________________________________

Eutelsat Fleet update:

• EUTELSAT 10B entered service in July 2023

• EUTELSAT 33F, formerly HOTBIRD 13Bc started operation at 33°E in September 2023 replacing EUTELSAT 33E, which is being relocated to the American arc.

• KONNECT VHTS entered operational service in October 2023.

• HOTBIRD 13F entered service at 13°E in September 2023

• EUTELSAT 12WE was deorbited in July 2023

• EUTELSAT 10A was deorbited in November 2023 • EUTELSAT 113 West A ceased operation in January 2024

Eva Berneke, addressing the results, said, “The Eutelsat GEO business is performing in line with expectations, confirming the return to top line growth for Eutelsat historic scope for FY 2023-24, driven by the availability of EUTELSAT 10B and KONNECT VHTS. The LEO activities of OneWeb are progressing well, with 100% of the constellation in place and a secured and growing backlog. Delays in the availability of the ground network have impacted revenues, with a mix more oriented towards the sale of user terminals affecting margins, leading us to adjust our expectations for FY 2023-24. We nevertheless remain confident in the prospects of OneWeb, and the potential of Eutelsat’s unique combined GEO- LEO offer and anticipate an acceleration in revenues in the coming months as the constellation achieves full global operational coverage of the ground network. We are progressing well on the design of the next generation of the OneWeb constellation, based on a stepwise increase in capacity and functionality with a progressive extension which also fully utilizes the current in-orbit assets. This will result in a reduction in expected capital expenditure for the period 2025-30.”

As to full-year guidance, such has all been adjusted downward as a result of OneWeb’s slowness in rolling out services, Eutelsat now states...

• Revenues are now expected in a range of €1.25 to €1.3 billion (versus €1.32 to €1.42 billion, previously).

• Adjusted EBITDA is expected in a range of €650 to €680 million (versus €725 to €825 million, previously).

• Cash capex for FY 2024 remains expected in a range between €600 and €650 million after synergies; for the period FY 2025 to FY 2030, the integration of the revised capex budget for OneWeb NextGen means cash capex7 is now expected between €600 to €700 million, on average, per annum (versus €725 to €875 million per annum, previously).

Outlook

Eutelsat’s prospects clearly depend on its own efforts, but perhaps the greater influences will be what the competitors accomplish with their own LEO activity. If there were no Starlink, or Project Kuiper or Lightspeed, or any of the other LEO threats, then Eutelsat’s future would be assured, despite the steady erosion of the company’s Video DTH business.

Chris Forrester

Author Chris Forrester is a well-known broadcasting journalist, industry consultant and Senior Columnist for SatNews Publishers. He reports on all aspects of broadcasting with special emphasis on content, the business of television and emerging applications. He founded Rapid TV News and has edited Interspace and its successor Inside Satellite TV since 1996. He also filesbfor Advanced-Television.com. In November of 1998, Chris was appointed an Associate (professor) of the prestigious Adham Center for Television Journalism, part of the American University in Cairo (AUC), in recognition of his extensive coverage of the Arab media market.