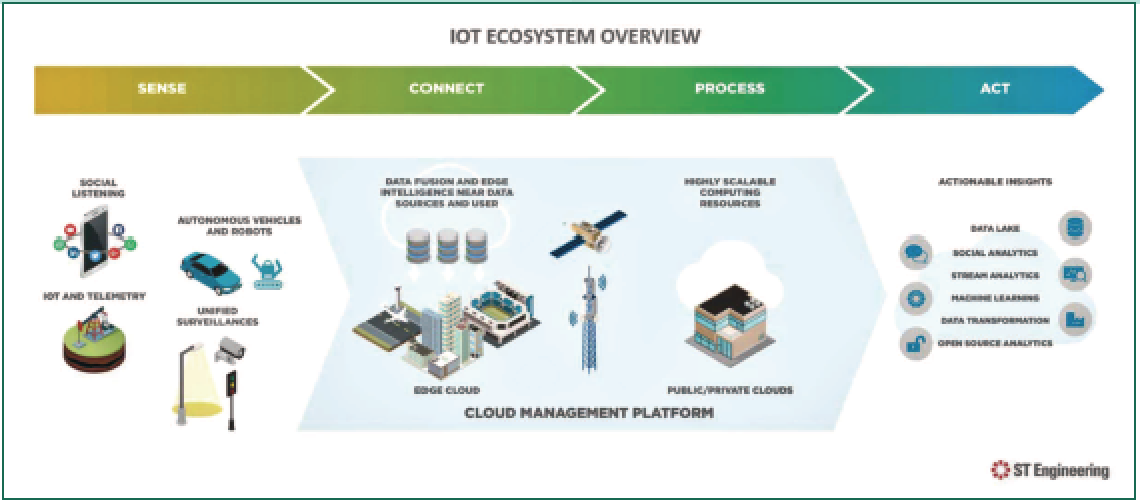

The Internet of Things (IoT) — an ever-expanding ecosystem of smart appliances, industrial sensors, and intelligence sharing assets — is being driven by vertical market applications for companies undergoing digitization for greater efficiency and transparency. Emerging applications such as connected manufacturing and smart communication are pushing the conversation on how to connect the IoT up the agenda all in support of the Fourth Industrial Revolution (Industry 4.0).

As a steadily growing billion-dollar market — according to GSMA (Global System for Mobile Communications), there will be more than 30 billion IoT devices connected to the information grid by 2025 — the size of the IoT is doubling that of the PC, smartphone, and connected cars and wearables markets. So where does satellite fit in?

(Internet of) Things Are Looking Up

The IoT ecosystem requires different systems, data types, volumes, latency, and speeds. While most M2M and IoT services currently require only low bandwidth over the next decade some verticals will demand additional bandwidth to support big data analysis, engine telematics, and live data streaming.

For example, satellite’s ‘anywhere, anytime’ capability enables real-time asset management through tracking of fleets (vehicle) or means that fleet operators can monitor the condition of their assets. At industry sites, IoT sensors collect data in the field, measure air and water quality and track weather and environmental circumstances.

With respect to smart energy, IoT gives insight into the generation and transmission of electricity. It enables asset management for mining and construction companies. Agriculture raises several different use cases, whether it’s tracking of cattle or proactive monitoring of environmental conditions. In maritime, there are a great deal of use cases for buoy monitoring and monitoring fishing vessels given the number of small-scale fisheries that exist. There is a significant use case for satellite in terms of monitoring catch and reporting fish, for example. The biggest benefit that these different applications have in common is the process and productivity improvements that come with the implementation of an IoT strategy.

Challenges To Overcome

Satellite’s reach widens the use cases for IoT and can help overcome a number of different challenges that we're facing with global IoT connectivity at the moment. Terrestrial connectivity can be unreliable and/or unavailable – it’s not necessarily accessible where and when you need it.

Cost is another factor — traditionally, satellite connectivity has always come at a premium compared to the terrestrial options. That limits the adoption for many use cases deployments. In many cases, power needs to be monitored and users must react quickly when there is no power available.

Then, there's interoperability. How do you ensure that any connectivity option that you deploy is able to retrieve that information and your application at the collection point and is able to analyze and process it?

The final challenge is deployment. This encompasses a number of different factors, like ease of installation and ease of management, especially when these assets are being deployed in remote locations. Satellite’s inherent capabilities, such as its ability to reach remote areas, scale easily and to extend coverage for other providers, are driving down cost and introducing innovations that allow interoperability with other technologies. In short, satellite IoT is rapidly knocking these hurdles down.

Commercial Appetite

The Satellite IoT (satIoT) market is at the forefront of innovation. The industry at large is looking to make use of innovations such as 5G, virtualization, automation, and orchestration to combine developments in both space and ground segment. A major application driving that change is IoT and the need to use satellite to connect everything and provide ubiquitous coverage.

The global commercial satIoT market is expected to grow with a CAGR of about 14 percent for in-service units and 6.6 percent for total retail revenues. By the end of 2028, the market is expected to grow to about $1.407 billion.

How do satellite service providers get their market share of the IoT? This is a high efficiency model and allows for a higher density of terminals on the network.

Trajectory To Success

In connectivity cases, emphasis is placed on affordable, ultra-reliable, low latency connectivity systems with greater transparency and ease of operations. The success of today’s organizations and service providers lies with networks that are easy to plan, install and operate, yet provide affordable connections. This is made possible by highly efficient, small, and very inexpensive satellite terminals with quick deployment for fast revenue generation and OPEX reduction.

At ST Engineering iDirect, we believe success in the IoT market at large lies in a robust ecosystem of partners and the ability to deliver specific applications for targeted use cases. It’s about technology alliances and working together to best address the challenges. It’s about offering cost-effective connectivity solutions that take advantage of the advances in the satellite industry when it comes to new capacities, smaller, more cost-effective satellite terminals and very efficient transmission technologies.

ST Engineering iDirect has launched flexible IoT solutions built on these advances to supplement our highly successful platforms. We ease the entry of service providers into the IoT market by reducing the upfront capital investments and operational complexity usually required to launch an IoT platform and service. Our IoT offering provides customers with a complete connectivity solution for fixed and mobile IoT environments.

Ultimately, it’s about impacting the end user’s bottom line — and that’s what we help our customers achieve.

www.stengg.com