Traditional satellites used to be the size of a bus. Over the last decade they have become the size of a shoebox and even smaller to the size of a drinks can. This miniaturization of platforms, components and sub-systems has also significantly reduced the cost of satellites, creating the foundation for the success of nanosatellites and the emergence of the billion-dollar New Space industry.

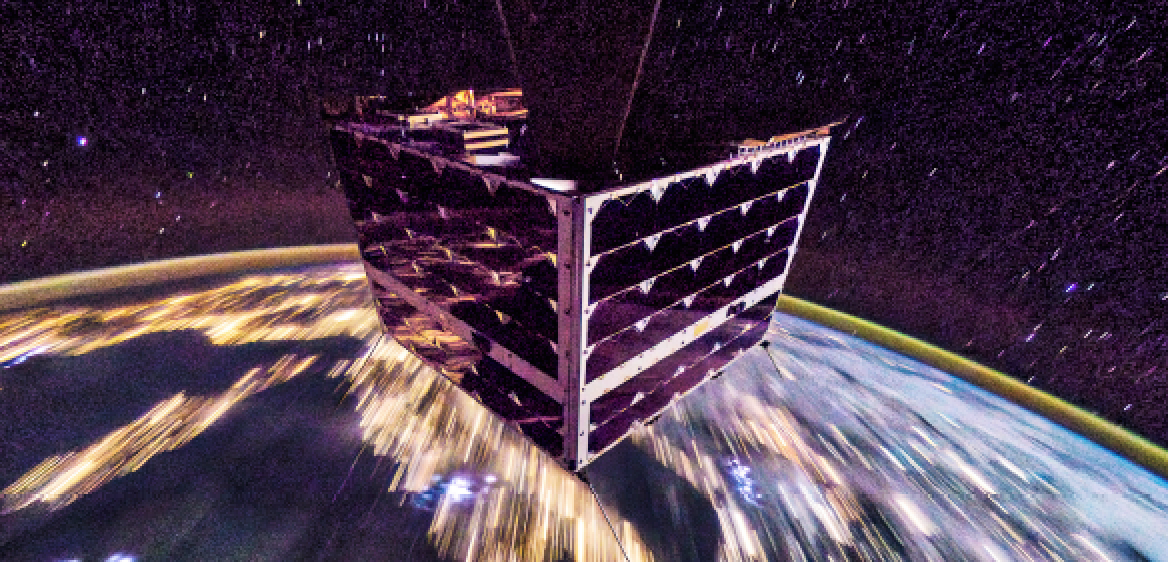

NanoAvionics MP42 satellite on-orbit.

The change this has meant for the space industry has been revolutionary. It has redefined the uses of space. Via relatively inexpensive smallsats, New Space companies can provide services almost equivalent to those of companies that traditionally serve government agencies or public sector industries. Even defence institutions are starting to witness that smallsats are reliable and cost-efficient solutions for applications. Their lower costs mean they can be replaced more frequently. This allows for the integration of each replica with updated technology, enabling smallsats to provide better services with the assistance of the latest technologies that are available in the market. They can also develop entirely new services.

Huge investments, the growing demand for low-cost smallsats, and an increasing demand for Earth Observation (EO) and remote sensing applications and their data, have been some of the major driving factors propelling the growth of the smallsat market.

However, like mobile phones that graduated from chunky boxes to tiny devices and then progressed to the larger smartphones we are using today, a similar trend is happening in the smallsat industry. Some of the underlying reasons for these advanceement are similar, as well.

Lowered costs along the entire supply chain brought the satellite industry the flexibility to design, build and deploy satellites better suited for high-power missions. This power demand stems from the sophistication of their payloads and a need to use micro-electric propulsion.

Larger Satellite Platforms

Advances in camera technology, microelectronics and computer miniaturization have enabled companies to produce optical imaging with high ground resolution or radar observations using synthetic aperture radar (SAR) that do not require the large satellites used in the recent past. Services such as tipping-and-cueing provided by optical and SAR satellite pairs were previously available only on larger platforms — they are now feasible from smallsat platforms.

3D printing, innovative material technology, artificial intelligence (AI) and machine learning (ML) have helped manufacturers to overcome some of the hurdles in the development of advanced small systems that are capable of performing multiple missions in space. These developments enabled new applications in the fields of telecommunications, EO, military reconnaissance, and tactical communications.

Cost Efficiencies

Mission costs are split between payload development, spacecraft manufacturing, launch and operations. Minimizing the overall mission cost requires optimization of the balance between these elements.

The reduced cost for manufacturing platforms, sub-systems and components, as well as the advancements of the aforementioned technologies, allowed and required the development of more sophisticated payloads and with that a demand for the larger microsatellites. Microsatellites can also accommodate redundant subsystems that significantly improve a satellite’s reliability and mission success.

While a larger microsatellite would incur slightly higher cost when compared to a nanosatellite (although, in some cases, this is less than a 10 percent increase, due to fewer non-recurring, engineering costs), this would be offset by significantly better satellite performance for the mission.

Lower prices for launches also support a change of platform size. Launch represents a significant expense that can account for nearly one-third of the total mission cost. With the number of launch providers increasing, prices are expected to be reduced even further and that move negates the need to reduce satellite weight and limit their performance.

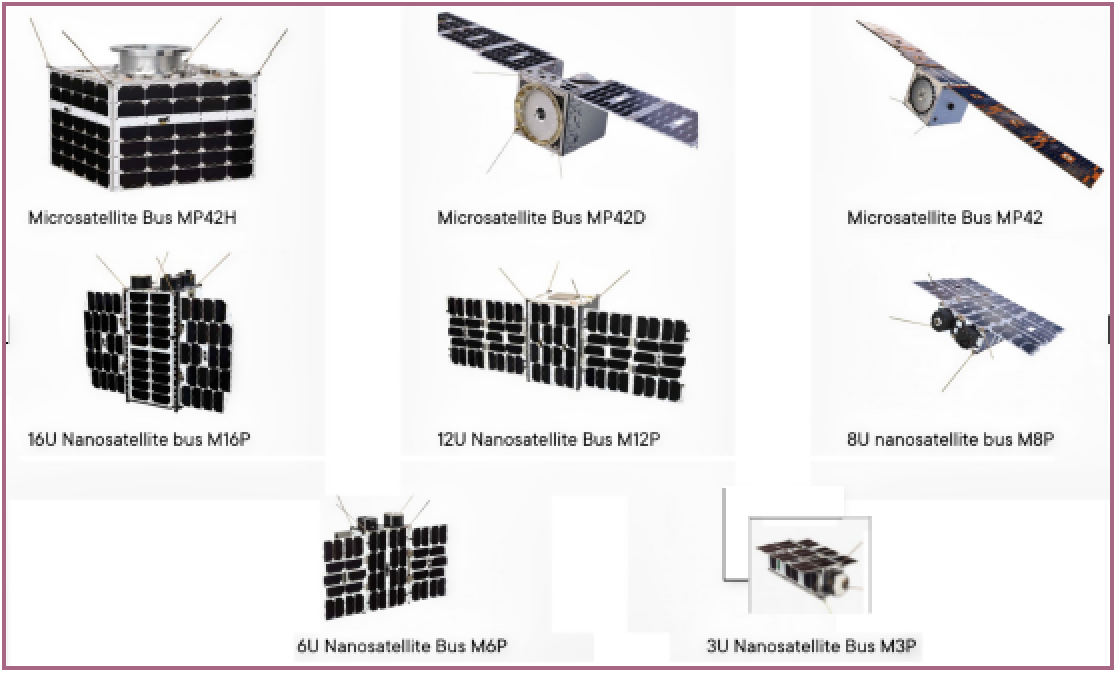

Based on its own data from customer requests between 2020 and 2022, platform manufacturer and mission integrator NanoAvionics has already seen stagnation in 3U platform requests, a modest increase for 6U to 16U as well as an exponential hike in microsatellite platform requests.

From Nano- To Micro- Technological Benefits + Challenges

Many companies have proved their technologies on the smaller and less expensive nanosatellite platforms. However, having tested their technology on-orbit, many companies realized that, for delivering commercially viable services, be that data or communications, they need to boost their payloads performance and their satellites’ general capabilities. These capabilities include redundancy as well as powerful propulsion systems, either for on-orbit maneuvering or to comply with the increasing number of space debris regulations.

EO and two-way telecoms customers, in particular, need payloads with enhanced technologies, which in return require higher power and heat dissipation, as well as other parameters such as downlink redundancy and duty cycles that smaller platforms simply are unable to provide.

The change from using a microsatellite instead of a nanosatellite platform is not just a matter of volume. While some of the more sophisticated payloads might still fit into a 16U nanosatellite platform, such a decision can create several important issues that could compromise mission capabilities.

The differences and advantages become clearer in a direct comparison of the same EO payload with an imager in a 16U nanosatellite and a lighter than 50 kilograms microsatellite platform.

Duty cycle:

A 16U platform has a 5 percent duty cycle, due to limited power generation of the solar panels fitting into the platform. That means it can only take images for 5 percent of a full orbit around the Earth. The larger microsatellite platform is capable of a 50 percent duty cycle with ten times more imaging time. This can have a significant impact on revenues.

Thermal controls

The nanosatellite platform cannot house an active cooling solution that dissipates heat, leading to limited thermal control and potential overheating which might reduce operating times. Microsatellites have enough power and room for active thermal cooling to maintain a narrow temperature range for the imager. As a result, the imager can be used more often and longer. Alternatively, more subsystems and processes can be kept running at all times.

Communications

There is not enough space in a nanosatellite for a redundant downlink channel in case the main link fails during a multi-year mission. A microsatellite can already handle a fully redundant communications payload that covers X-band, high and low data-rate S-band (backups) as well as UHF.

Agility

The high-power reaction wheels (RW) inside a microsatellite, versus the low-power RWs in a nanosatellite, provide more torque and momentum, giving it greater agility and allowing full imaging operations for more image opportunities.

Orbital maneuvers

While the propulsion system would have enough propellant to meet mission requirements, albeit at lower thrust levels, a microsatellite will have propellant remaining for additional operations, such as collision avoidance and other traffic management maneuvers.

Already, the ability to slot satellites into space is helping to monitor and fight pressing climate, food and health problems on Earth as well as tackling the growing issues of space collisions and debris.

For example, German-based space data and services company, Constellr, is planning to initially launch two microsatellites into LEO with the aim of helping saving 60 billion tons of water globally via a smallsat constellation. Having raised 10 million euros, Constellr has already ordered two satellites to start developing the world’s first scalable, water stress, monitoring system.

These first two satellites of the planned constellation are expected to be deployed in 2024.

To deliver high quality images that allow a precise measurement of the water needed in agriculture, the thermal infrared payloads for the mission require high agility, stability, and significant power. Within five years, Constellr expects to help save 60 billion tons of water (about 40%) and avoid 14 megatons of CO2 emissions, while generating billions of euros in gross revenue for farmers.

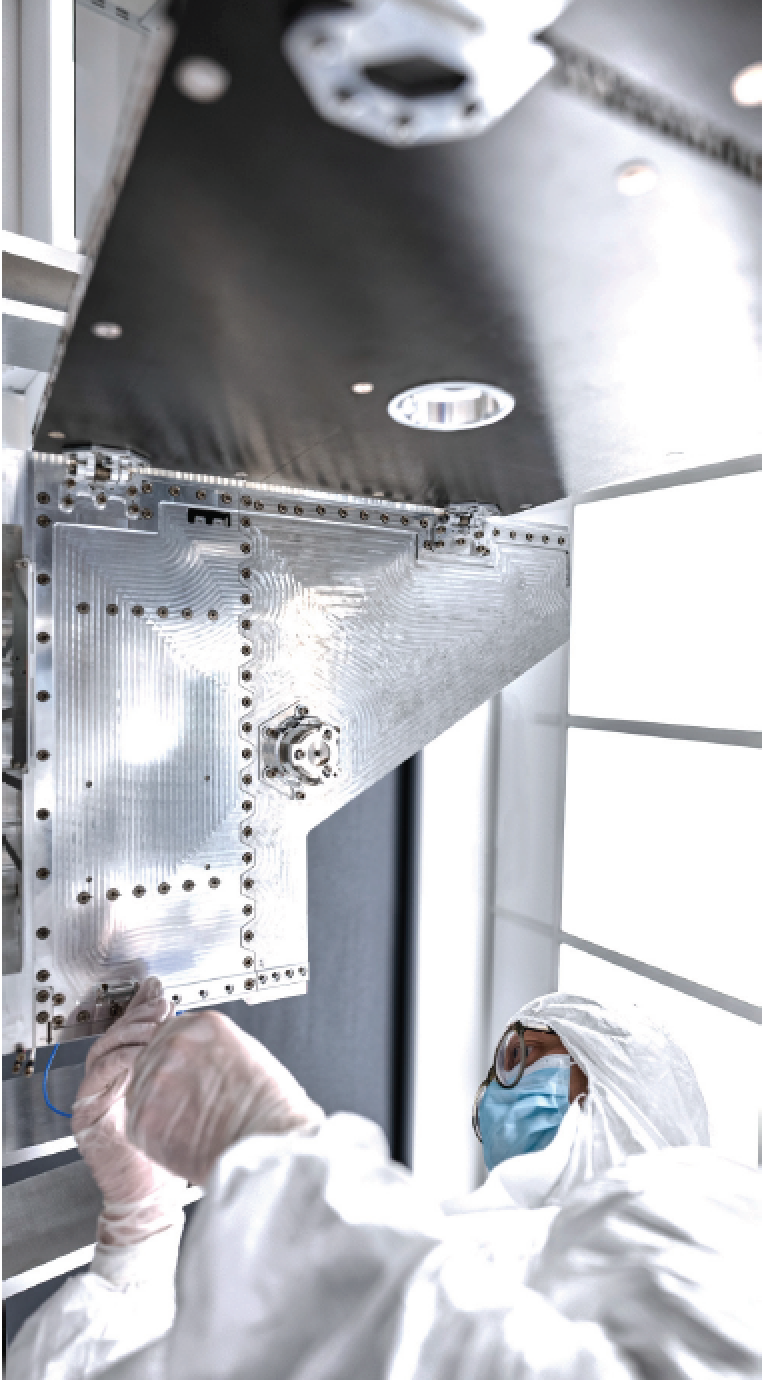

NanoAvionics MP42 smallsat bus assembly.

Globally, more than 70% of freshwater is used for agriculture, according to the Food and Agriculture Organisation of the United Nations (UN) — 60% of that water is wasted. The UN also estimates that 50% more food will be needed by the Earth’s population by 2050, leading to a massive increase of freshwater demand for irrigation.

With Constellr’s satellite images and high-precision data, impending droughts can be recognized earlier than existing methods are capable of accomplishing and fast enough to mitigate them through targeted irrigation. These reliable forecasts can reduce crop loss and farmers can determine their yield more accurately and much earlier and avoid potentially catastrophic supply chain effects.

Marius Bierdel, CTO of Constellr, said, “We needed a microsatellite able to address the high-performance requirements of our constellation. It must provide high agility and stability, and significant power to deliver high quality infrared images that allow us to precisely measure the water needed in agriculture. With NanoAvionics’ expertise and their modular satellite buses, we have found the right partner for this mission.”

Another example for a mission that needs the advanced capabilities of microsatellites is the space-based. maritime surveillance mission that will cover the North Sea area by Kongsberg Defence & Aerospace (KDA). Their antenna payload for retrieving radar signals would not have fitted into a nanosatellite envelope and required a larger microsatellite platform.

Their payload of the three microsatellites will include a navigation radar detector and an automatic identification system that analyzes the radar use of vessels in the North Sea. Combining the received data will provide an overview of ship traffic in this area, including the detection of vessels not reporting correct AIS data.

The mission will also make it possible to rapidly identify vessels engaged in environmental crimes, illegal fishing, smuggling and other illegal activities. Supporting search and rescue for vessels in distress are also among the capabilities of these smallsats. The plan is to expand this mission into Norway’s first satellite constellation to increase the coverage areas and revisit times as well as equip the satellites with different sensors for other types of data to enhance situational awareness capabilities.

Other commercial applications for microsatellites include 5G IoT and communications, on-orbit assembly and servicing, EO at sub-meter resolution, enhanced global positioning system (GPS), global Wi-Fi connections, surveillance, autonomous vehicles, and broadband streaming.

Outlook

With the commercial New Space sector still in its early days of testing payloads and applications, the smallsat market continues its significant expansion in terms of capabilities and response to user demands. A BIS Research report on the global nanosatellite and microsatellite market suggests that more than 6,500 satellites, including nano-, micro-, and picosatellites, are expected to be launched during the forecast period of 2020 to 2026.

The report also revealed that EO and remote sensing applications will possess the highest market share of 49.42%, followed by communication applications.

These findings are further supported by a 2021 study by the Air and Space Academy of Germany’s space agency, DLR (Deutsche Gesellschaft für Luft- und Raumfahrt), which looked at planned launches from 2018 to 2028. In their “Small Launchers: A European Perspective” report, 51 250 kg class satellites (microsatellites) out of the overall smallsat range will see the largest global growth in launched numbers.

Another development that will also lead to a future increase in smallsats is the adoption of a space strategy by non-space companies. One early example is Dubai Electricity & Water Authority (DEWA). Their ‘Space-D’ program aims to improve operations, maintenance, and planning of its networks using satellite communications and EO technologies, DEWA also wants to train Emirati professionals to use space supported technologies for further network improvements and operational cost savings.

For now, nanosatellites remain in high demand because some applications will not require larger platforms. However, considering the numbers and the technological and economic benefits, the demand and trend from nano- to microsatellites will continue to increase. They are the ones that will offer new opportunities with more room for more advanced missions and applications.

nanoavionics.com

Vytenis J. Buzas

Vytens Buzas is the CEO and co-founder of NanoAvionics, renamed Kongsberg NanoAvionics following the acquisition by Kongsberg Defence & Aerospace in 2022. He was the leader and initiator of the first Lithuanian satellite LituanicaSAT-1 mission and project manager for the Lithuanian satellite project LituanicaSAT-2. He was also a scientific researcher at NASA Ames Research Center where he was involved in projects related to liquid mono-propulsion systems for small spacecrafts. Vytenis acquired a BSc in Aeronautical Engineering at Vilnius Gediminas Technical University, Lithuania, and a MSc. degree in Mechatronics at the Kaunas University of Technology, Lithuania.