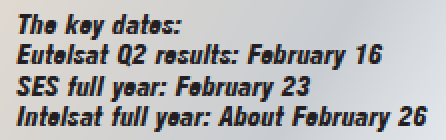

A few weeks from now, in February, the ‘Big Three’ satellite operators will unveil their latest numbers — those numbers may not look good.

Over the past few quarters, each of the trio have issued extremely cautious expectations for 2018 and the market will be watching intently for signs of recovery, no matter how gentle.

However, if December 2017 was any guide, those green shoots of recovery may be extremely stubborn to show. For example, on December 15, Luxembourg-based SES saw their share price — consistently under pressure these past few months — plummet another 5 percent to a miserable 12.93 euros and perilously close to the company’s ‘all time low’ of 12.40 euros. As a comparison, in the spring of 2015, their price regularly topped 30 euros a share.

This steady slippage wasn’t helped by a disappointing set of Q3 results on October 27 when SES was given a tough time by many analysts during the company’s analysts’ call, with some expressing frustration with claims that the company’s guidance was far too complex and lacked “absolute growth rates” and revenue guidance for 2018.

SES declined to elaborate any further, at least until the February (and end of year for 2017) results were available and a more stabilized position could be released. Not helping is the position at playout and facilities subsidiary MX1, where the CEO stepped down unexpectedly on October 3 and where revenues are less than expected and a degree of rationalization is taking place.

“We want to refocus the portfolio of services of MX1 on differentiated growth opportunities consisting mainly in offering to our customers kind of unique combination of those traditional broadcast and IP based end to end solutions for those linear and non-linear content distribution,” said Ferdinand Kayser, the CEO of SES’ Video division.

Distilling management’s answers, it would seem — in Sami Kassab’s view (media analyst at investment bank Exane/BNPP) — that 2018 will see SES organic revenue ‘growth’ slip well back to -4 percent.

SES’ CFO Padraig McCarthy said that the downturn at MX1 would not lead to a formal impairment at the play-out business. “Overall this is a very good business, it’s a very good strategic fit for us,” he said.

SES CEO Michael Sabbagh.

However, CEO Karim Michel Sabbagh issued a warning in regard MX1, stating, “As I’ve said many times in the past, in the areas where we believe [the business] is commoditized, we will deliberately exit if it doesn’t make sense for us, so we can refocus on our resources.”

SES said that the ongoing litigation between former staff at MX1 and the company was continuing, but the counter-writs placed on SES were without substance (read the end section of this article).

The news was taken badly by the market and knocked another large chunk out of the operator’s share price and market capitalization. Back in the spring of 2015, SES shares were trading above 30 euros. The price, as of this writing, is down at the 13 euros level with a commensurate collapse of the company’s market capitalization.

A snapshot of SES’ numbers reveal that total TV channels at SES grew 6 percent year-on-year to 7,743 TV channels, with increases in all three of SES’s major regions — Europe, North America and International. The principal changes compared with Q3 2016 were:

SES disaster recovery communications support.

• Seven percent increase in High Definition (HD) to 2,601 HDTV channels, now 33.6 percent of TV total channels (Q3 2016: 33.3 percent)

• The proportion of total TV channels broadcast in MPEG-4 increased from 59.9 to 63.5 percent

• Commercial Ultra HD (UHD) channels on the SES network increased from 17 UHD channels to 24 UHD channels and has since expanded further

• 2+ million homes now viewing SES’ HD+ platform over Germany and Austria

• Solid performance with U.S. Department of Defense

• “Progressive dividend” promised

“The business remained solid,” said SES, “underpinned by long-term contracts and a substantial contract backlog, including an important capacity renewal with Sky Deutschland, covering 7 transponders at SES’s prime video neighborhood of 19.2 degrees East, to continue to deliver content to millions of subscribers.”

There is potentially more good news to come. For example, SES is investing in fleet expansion for their O3b division in what it describes as new ‘mPower’ satellites. The company is ordering up seven MEO craft from Boeing at a cost of around $1 billion. The first of the “mPower” satellites should be flying by 2021.

The order prompted a note to investors from investment bank Jefferies, where satellite analyst Giles Thorne said, “mPower is a material expansion on the initial O3b concept, taking many of the commercial proof points from O3b since launch in September 2014 and building upon them. This is not some foray into a new “build it and they will come” fantasy. In many ways, it couldn’t be more de-risked: SES knows who its customer is; what they value; how to service them; and how much they’ll pay. At the same time, being the apotheosis of the “distributed network” concept (i.e., flexible capacity that can morph to service any customer, anywhere, at any time) then productivity of the constellation should be far higher than traditional “stranded” geostationary configurations. This further de-risks the investment, in our view.”

An October 27 report from Jefferies headlined as “Growing Pains” and then bluntly said that it was the evident “lack of growth” was the problem and that confidence in SES was now “fragile.”

SES “Beyond Frontiers” satellite launch.

Thorne stated that he was in a “quagmire” as to the operator’s Video division. “The deterioration in growth (now, -5.6 percent from -2.0 percent / -4.2 percent) was well flagged at Q2, given the anomalies on AMC-9 and the y-o-y impact of periodic revenue — but we now have a new headwind disclosed — the SES choice not to renew some legacy MX1 contracts (“we have chosen not to renew low value legacy re-seller contracts as we want to re-focus on differentiated growth opportunities”). The underlying performance is certainly improving (-0.3 percent in 1H17, -0.2 percent in 3Q17) and management said will improve further in 4Q17. Other bright spots are that the channel count, HD channels and UHD channels are trending in the correct direction and, separately, SES has now contracted some of the transponders that were handed back by a number of FTA customers in 4Q16 following a compression migration. But, until SES can put together a coherent and unequivocal y-o-y growth performance, without caveats, then we expect sentiment will remain hugely constrained.”

Berenberg Bank was similarly downbeat. “As the share price indicates, the market has lost faith in SES’s ability to deliver on its promises of long-term growth, and, given the sustained period of disappointment, it will take more than just meeting expectations to restore confidence. We think SES must show a sustained return to growth before investors will give the company credit for its ambitious plans. This suggests that the stock is unlikely to go anywhere for a year or so (we forecast that the company does not return to organic growth until Q3 2018, and even then it will be very modest growth, with the real pick up being in Q4 2018), particularly as the declines that the company will report for Q1 and Q2 will likely be sequentially worse than in Q4 2017.”

Moving over to Intelsat, that company’s worries have been well-flagged over the past couple of years. However, thanks to some savvy financial restructuring of debt and an on-going application (with Intel) to the FCC as to how its valuable C-band frequencies are used over metropolitan areas of the USA ,has helped build some confidence.

The FCC news prompted a near-instant doubling of Intelsat’s share price to a spectacular $7.35 (on October 12, 2017) only for the initial enthusiasm to fall and a more typical $3.30 level was in place by mid-December.

However, the C-band news only prompted an outcry from Intelsat’s rivals. SES, for example (although there were plenty of other grumbles) argued strongly that the proposed “close co-existence” of telco and satellite-based services “was impossible,” adding,

• Numerous and undisputed evidence demonstrates that a coexistence of terrestrial mobile services with incumbent satellite networks in C-band in the same area is extremely challenging, not to say impossible

• C-band Earth stations, receiving signals from satellite, are highly vulnerable to terrestrial interference and must be separated from terrestrial transmitters by tens or even hundreds of kilometers to prevent the degradation of the satellite signal

• The deployment density of satellite C-band operations makes it extremely difficult to add new terrestrial operations into this system without disrupting dramatically the satellite operations

• Any plans to let terrestrial wireless systems enter the ecosystem could cause massive disruption, substantial cost for current operators and destabilize entire and well-established services

• Since those early C-band responses, it seems that the likes of SES — and even Eutelsat — might be prepared to modify their attitudes. “We have invested billions of dollars into C-band space capacity over decades, and our customers have invested hundreds of millions in ground infrastructure and earth stations on top. Even if we are open to use parts of the spectrum differently, any plan to change this highly efficient ecosystem and let terrestrial wireless systems enter risks to cause massive disruptions and substantial cost and therefore needs the most careful analysis.”

SES is now saying — perhaps — there could be some flexibility. The company, in a November 2017 statement, said that the firm is open to exploring any approach to a joint use of C-band, but only if its meets two essential criteria: “It must create appropriate financial incentives to justify the extremely high cost of such an approach, and it must ensure that we can continue to deliver services to our customers without any disruption. We cannot achieve this unless we open only a limited portion of the respective band.”

Intelsat’s headquarters at Tysons Corner... complete with a shopping mall.

Indeed, on December 14, 2017, SES announced they were involved in an European Space Agency-backed experiment designed to demonstrate how satellites can be used in the growth and management of 5G telephony.

The testbed infrastructure will comprise SES’s fleet of GEO and MEO satellites, which will be integrated with terrestrial networks. In addition to providing the space segment, SES’s headquarters in Luxembourg will also host a SATis5 testbed node with prototypes of networks for satellite integration, along with other nodes located in Berlin and Erlangen, and an additional portable node.

Intelsat, in its November 15 supplementary filing to the FCC, admitted that existing spectrum and the services that depended on C-band would have to be protected, and that there were complex problems to be solved.

However, the FCC filing stated, “The Intelsat-Intel proposal best achieves the ultimate goal shared by many commenters of making mid-band spectrum available for 5G services. The Intelsat-Intel proposal will harness market incentives to make highly-valuable mid-band spectrum available where it is most needed to support terrestrial mobile demand voluntarily, at least cost to society and existing FSS customers, quickly (within 1-3 years).”

Paris-based Eutelsat is somewhat immunized from these C-band arguments, but is not wholly impervious to assorted challenges. The company’s February 16 half-yearly financial report (to December 31, 2107) will show whether there’s been any positive movement from the company’s Q1 position (reported on October 26). Q1 noted a 9.3 percent fall in reported revenues to 349 million euros (although 6.7 percent when ‘like for like’ numbers were measured) and including a 11.7 percent tumble in its ‘Fixed Data’ division when compared to Q1/2016.

Video revenues were flat, with a 0.8 percent fall (from 226.5 million last year to 223.3 million euros in Q1/2017-18). The market for Professional Video was said to be “tough.”

The overall fall was not helped by last year’s Q1 buoyant position due to termination revenues received from channels pulling their services off Eutelsat (notably France’s ‘tv d’Orange’). Future prospects on Video are better and will be helped by an improving revenue picture on Eutelsat’s Hot Bird orbital slot, where five transponders are being marketed with a new rate-card pricing structure.

Prospects have also been impacted by a delay in the launch of its ‘Konnect Africa’ broadband service, which now slips back to 2019-2020 (the Al Yah-3/YahSat-3 satellite which supplies the capacity will not launch until late-January 2018).

YahSat-3’s launch has now slipped twice and is more than four months later than Eutelsat’s most recent assumptions and a half-year later than was originally expected. The satellite will now not enter service until June of 2018 (and the last month of Eutelsat’s financial year) and will have little influence on Eutelsat revenues.

Eutelsat’s Q1 (July-Sept) channel count grew by a very healthy 6.6 percent — since last year — to 6,755 channels. HDTV channels grew from 14.8 percent of that total to 17.9 percent (to 1,210 channels from 940 last year). However, the decline in video revenues only showed that the average price per channel (or per MHz) carried has also fallen over the past year. Eutelsat’s all-important contractual backlog fell back from 5.4 billion to 5.2 billion euros and represents some three-and-a-half years of business. Eutelsat’s Video division represented 86 percent of that backlog.

Berenberg Bank admitted they were disappointed by Eutelsat’s Q1 numbers and said, “It is true that Q1 was a touch soft, and perhaps there is an immaterial underlying downgrade, as detailed above. There were, however, promising signs from Video and Government. Q1 revenues are tracking below the new “between -1 and -2 percent” full-year expectation, meaning that the company has to play catch-up (which it should) through the remainder of the year. Management did well on the [analyst] call, in our view, to suggest that excluding the delay in Fixed Broadband, the other segments are all on track and that growth should improve throughout the year. With Eutelsat 172B only becoming operational in November, with a high pre-sell rate and the removal of SES revenues out of the comparables in Q3, we fully expect growth to progressively improve from here.”

Eutelsat now has a superb ‘ace’ up its sleeve in the shape of Noorsat, a Dubai-based capacity reseller that Eutelsat acquired on October 13, 2017m for $75 million and where revenues can now be consolidated. Noorsat has some 30 transponders under overall contract at the Nilesat/Eutelsat ‘hot spot’ at 7/8 degrees West as well as capacity co-located with Arabsat at its ‘hot spot’ at 25/25.5 degrees East. This capacity is used by Eutelsat on the Es’hail 1 satellite.

Indeed, with significant access to these two positions alone, Eutelsat is now even more directly involved in the ever-expanding Middle East television landscape, which shows absolutely no signs of contraction. Noorsat is a prize catch. Ultimately owned by the powerful Saudi Arabia-based Mawarid Holdings conglomerate, Noorsat has, since its formation in 2004, built up a very useful portfolio of clients under CEO Omar Shoter (who used to run Arabsat).

Eutelsat also has a powerful friend in the shape of ViaSat, headquartered in California and the joint-venture for the current exploitation of Eutelsat’s broadband-by-satellite Ka-Sat craft and the prospects for a ViaSat-3-class satellite over Europe. Also helping is a French government initiative to use satellite to supply broadband to homes in France. The new initiative includes funding 150 euros per home to equip satellite or 4G reception. The intent is to reduce the number of households with low-quality (or zero) internet access from today’s typical 15 percent to only 6 percent by 2020.

Investment bank Exane/BNPP says this will help Eutelsat, and j-v partner ViaSat, in filling some of its available capacity. “Assuming 10 percent of the 2 million French households take a Eutelsat satellite access package, we estimate that Eutelsat would generate 30 to 40 million euros of additional annual revenues, or about 2 to 3 percent of group revenues. Consensus expects around 30 million euros [overall] revenue growth for Eutelsat’s Fixed Broadband division, including Russia, Sub-Saharan Africa and other countries. These expectations [as a result of the French initiative] could be met by France alone.” The bank added, “In other words, we take this announcement as a positive for Eutelsat. It underpins its residential broadband strategy and offers support to consensus expectations.”

In summary, the February results season should be an interesting time for all three giant players — and the industry. Some insight into progress across all of the key ‘verticals’ will be gained as well as how the In Flight Connectivity market is progressing, a technology of key importance to each of the three companies (as well as Inmarsat, not covered in this report). No doubt, we live in interesting times.

Senior Contributor Chris Forrester is a well-known broadcast journalist and industry consultant. He reports on all aspects of broadcasting with special emphasis on content, the business of television and emerging applications. He founded Rapid TV News and has edited Interspace and its successor, Inside Satellite TV, since 1996.

Fraud allegations, writs and counter-writs

SES has a few problems to solve with its former SES Platform Services division, renamed MX1. SES President/CEO Karim Michel Sabbagh, speaking October 27, 2017, was blunt in saying that MX1 was being rationalized and refocused and that SES would exit the business if margins could not be maintained. At the core of the problem are unexpected non-renewals during Q3 at MX1 which cost SES some 7 million euros in lost revenue.

MX1 came about with the SES purchase of Tel Aviv-based (but NASDAQ listed) facilities outfit RR Media and which closed in July 2016. SES paid a bullish $242 million in an all-cash deal for RR Media, a 52 percent premium to the company’s market valuation and a price that surprised many in the industry.

In the previous few years prior to the sale, RR Media’s value had slumped to as low as $117 million. RR Media was floated in 2006 with a value of $210 million, and at the time of the SES purchase, enjoyed a market capitalization of $148 million. RR Media was led by Avi Cohen and he was appointed CEO of the merged MX1 unit. At the time of the purchase, RR Media was said to have had full year revenues for 2015 of $140.3 million.

RR Media was said to supply digital services to “more than 1,000 media companies globally” and populating content to more than 100 VoD platforms.

Earlier in 2017, MX1 opened up a legal action against three former senior employees at RR Media. The case alleged “concrete deceit and fraud.” The three were alleged to have “conspired to steal MX1’s customers and use its commercial secrets in order to [establish] a competing business. They did this not only after leaving their jobs in the company (during which they received huge sums of money), but also when they were still employed by MX1,” according to Court filings.

The case alleges these three accused individuals transferred some customers to a competing company they had founded in the British Virgin Islands and Switzerland and “for which they work to this day.” The company is the iKO Media Group AG, registered in Switzerland and operating a teleport near Rome.

The accused former staffers responding with their own counter-action, alleging in March of 2017 that the company’s CEO Avi Cohen “made sure to put money into the pockets of those close to him at the expense of the company.”

There were also serious allegations that before the company was acquired by SES, MX1 paid bribes under the table to various agents and organizations close to its customers that “took care” of ongoing dealings between the sides and, they allege, bribes that continued.

Mr. Cohen left SES in October of 2017. SES said that the ongoing litigation between former staff at MX1 and the company was continuing and that the counter-writs placed on SES were without substance.