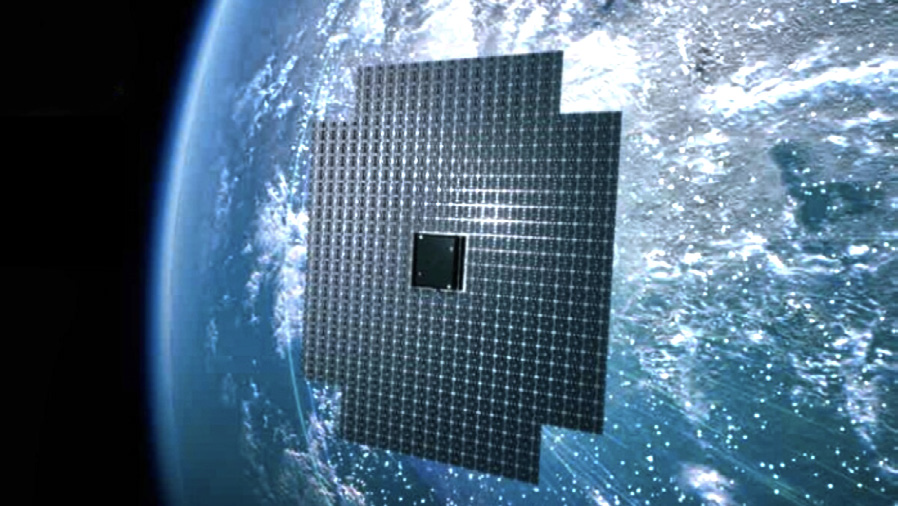

AST SpaceMobile launched the firm’s first five BlueWalker 3 Block 1 satellites on September 12th at 4:52 a.m., EDT. mission lifted off via a SpaceX Falcon rocket from Cape Canaveral, Florida, and delivered the five, largest-ever, commercial communications arrays into Low Earth Orbit (LEO).

The battle for Direct-to-Cellular (D2C) consumers is now underway. The problem for AST is that SpaceX’s Starlink already have around 130 satellites which they claim can do the D2C job perfectly well.

The Federal Commuications Commission (FCC) has meetings scheduled on September 26 and October 17 where issues of terrestrial interference can be discussed and determined.

While both players have their terrestrial supporters, it is likely that the FCC — and, by implication, the International Telecommunications Union (ITU) — will have to rule on a number of highly controversial elements. However, the larger question to ask is, once the satellites are in place and the rules and regulations determined, does a market truly exist?

The investment analysts are agreed: there is a market, although some variations have been expressed as to the probable outcome. All are agreed that a successful AST launch could revolutionize the telecoms industry and totally reshape how the world and cellular subscribers connections.

Indeed, Andres Coello, an analyst from Scotiabank back in May of 2022 stated that AST could dramatically disrupt the cellular tower industry: “ASTSpaceMobile could disrupt the global tower industry while providing carriers with an alternative to save Capex and/or operating leases in uncovered areas and create new monetising opportunities and take advantage of underused spectrum holdings.”

Another bullish investment bank enthusiastic regarding AST is Morgan Stanley. The bank states it expects tens of millions of users would pay $3 a month for a D2C device. AST’s president, Scott Wisniewski, has spoken of pricing closer to $10 to $15 a month for service and a 50/50 revenue share between the terrestrial operator and AST. In some “emerging markets” Scotiabank is more cautious, saying that Average Revenue Per User (ARPUs) could be as low as $0.95 cents per month.

Analysys Mason’s thoughts on satellite D2D

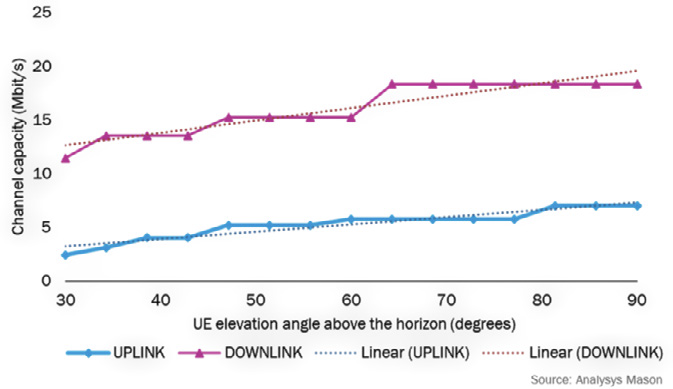

The professional number-crunchers at Analysys Mason summarise the enthusiasm saying: “It must be emphasised that SpaceX is not poised to become the winner in a ‘winner-take-all’ market because of the complexities and dependencies surrounding regulation, mobile value chains and spectrum uses. Apple’s services delivered in partnership with Globalstar use MSS spectrum, as will Iridium’s 5G satellite services to standard phones. However, most other D2D players (including SpaceX) use MNOs’ spectrum, for which they need special permission. Lynk Global and AST SpaceMobile were first to validate D2D messaging and broadband respectively using mobile spectrum through their in-orbit prototype satellites. These players have conducted numerous trials successfully and signed strategic deals with telecoms operators including major MNOs such as AT&T, Verizon and Vodafone.” Calculation of SpaceX’s D2D channel capacity, Analysys Mason’s NCAT4.

Calculation of SpaceX’s D2D channel capacity, Analysys Mason’s NCAT4.

Scotiabank, in its August 15th report, updated its numbers with an ARPU of $9.00 per month (and a split of $4.50 between the telco and AST). On August 26th, Coello raised AST’s shareprice target from $28 to $45.90. The numbers suggested by the bank would give AST a spectacular valuation of at least $120 billion.

Scotiabank has also re-quoted comments made by AT&T’s John Stankey who stated that 30% to 40% of his customer base would be willing to pay for permanent connectivity. If correct, that would represent a truly staggering market in the U.S. alone. AT&T and Verizon (Verizon is an operating partner of AST) have around 146 million, post-paid clients (and 184 million when pre-paid are include).

The bank extrapolates these numbers, saying this would represent annual revenues for AST of between $5.3 to $10.5 billion.

One, clearly excited and enthusiastic shareholder Tweeted on X that if $4 per sub was AST’s ‘share’ and a global cellular subscriber base already aligned with AST of some 2.8 billion users, then this would translate to an annual revenue stream of about $11.2 billion.

His comment inevitably generated a “and pigs might fly” response from some observers, which might not be unreasonable. However, while his $4 a month revenue share might be highly optimistic, there must also be room in the equation for government and military contracts, first-responders and other non-governmental organizations. They will all add up to a near-guaranteed income stream.

The comments helped investment bank UBS confirm its own thinking, saying: “Initial US regulatory approval, the imminent launch of its first commercial satellites, and partner/funding progress add to our conviction,” UBS analysts wrote in a note to clients, adding they see “a meaningful revenue ramp in 2026 in target areas.” UBS gave a price target of $30. UBS said it now anticipates revenues for AST by 2028 of $1.88 billion and recommended a “Buy” rating. “While UBS still sees AST SpaceMobile as a high-risk, high-reward investment, initial US regulatory approval, the imminent launch of its first commercial satellites, and partner/funding progress add to the firm’s conviction in the commercialization and scalability of AST’s plans,” the bank’s analyst told investors in a research note.

AST says it hopes to start beta tests this coming winter on the ‘Block 1’ satellites, while 17 ‘Block 2’ craft are in construction. The FCC has given permission for testing to go ahead using the satellites V-, S-, and UHF frequency bands.

Scott Wisniewski

AST president Scott Wisniewski declined on an analysts’ call to be specific as to who would be launching the next batch ‘Block 2’ satellites which would occur during Q1 next year. The ‘Block 2’ craft are three-times the size (223 sq. m.) of the five ‘Block 1’ Blue Walker satellites.

AST also has 17 of its advanced ‘Block 2’ satellites under construction at its Midland, Texas, facility. AST’s CEO Abel Avellan told analysts during the firm’s Q2 results call that the business was in good shape financially and would not be tapping the public markets for more shareholder equity cash this year.

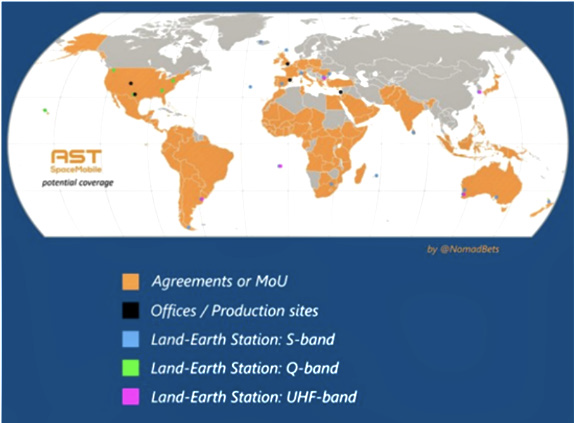

AST stated, “We are building the first and only global Cellular Broadband network in space to be accessible directly by everyday smartphones (2G/4G-LTE/5G devices) for commercial use, and other applications for government use utilizing our extensive intellectual property (“IP”) and patent portfolio.”

The 17 new craft being built will start launching in Q1/2025.

Avellan confirmed that he expected to provide nationwide, 100% geographical coverage to the target of the continental U.S. on premium 850 MHZ, low-band spectrum, helped by AT&T and Verizon, and with as many as 5,600 active cells.

“[We] continue to advance discussions with additional strategic partners, following the blueprint of commercial prepayments alongside commercial agreements.”

AST says it will be reaching about 70% of U.S. cellular users. Thereafter, AST would be targeting beta-testing with the likes of Japan’s Rakuten and other telcos.

At the other end of the scale, telco One New Zealand, a partner with Starlink, has formally publicized the company intends offering D2C services later this year, stating “This brand-new satellite technology will provide coverage to all of New Zealand on eligible 4G VoLTE mobile devices where there is line of sight to the sky, and up to 12 nautical miles out to sea, complementing our award-winning mobile network, filling in the roughly 40% of the country which currently is outside of mobile coverage, mainly due to challenging and isolated geography and the costs of doing so.”

Avellan said that AST had won new U.S. government contracts in recent months, with the outlook for additional and larger-sized contract awards. The value of the government contracts won during Q2 was about $900 million.

AST ended June 30, 2024, with a $287.6 million cash position, plus $51.5 million additional liquidity in a credit facility. This was a bit less than expected but does not include the money they raised in July of Q3, which is reportedly a lot more.

AST’s revenue-generating financial future was also explained: “Our vision is that users will not need to subscribe to the SpaceMobile Service directly through us, nor will they need to purchase any new or additional equipment. Instead, users will be able to access the SpaceMobile Service when prompted on their mobile device that they are no longer within range of the land-based facilities of the MNO operator or will be able to purchase a plan directly with their existing mobile provider. We intend to seek to use a revenue-sharing business model for SpaceMobile Service in our agreements with MNOs.”

The EPFD Challenge

Enthusiasts for AST’s plan might justifiably argue that their forecasts are sensible, and besides, their arch-rival, Starlink, firmly believes there to be a solid market in place for D2C. But well- funded Starlink has a major hurdle in its way as well: an argument that the Starlink satellites are creating interference. It is far from clear that these interference issues can be resolved using existing Starlink technology. The FCC is having to examine and will have to rule on usage rights.

One significant investor (Hennessey Funds) in AST says they expect the embryonic business to evolve into a durable, high- quality company that will manage to achieve global significance.

AT&T and Verizon, each significant investors in AST, have complained to the FCC and demanded that the FCC reject SpaceX’s plan for cellular connectivity. Their argument is that the two giant telcos have told the FCC that a SpaceX proposal to ensure robust coverage for its cellular Starlink system risks causing interference with their own terrestrial — and valuable — networks. “Specifically, AT&T’s technical analysis shows that SpaceX’s proposal would cause an 18% average reduction in network downlink throughput,” argued AT&T.

Verizon’s objections are similar, but added that Starlink “would subject incumbent, primary terrestrial licensee operations in adjacent bands to harmful interference.” Wireless phone performance will suffer, Verizon stated.

SpaceX is seeking a waiver of the FCC’s EPFD rules (Equivalent Power Flux Density) and thus to boost its power outputs and told the FCC in a spirited respons, “Indeed, each time that SpaceX has demonstrated that it would not cause harmful interference to other operators - often based on those parties’ own claimed assumptions - those competitors have moved the goalposts or have claimed their analysis should not have been trusted in the first place. These operators’ shapeshifting arguments and demands should be seen for what they are: last-minute attempts to block a more advanced supplemental coverage partnership and siphon sensitive information to aid their own competing efforts.”

Of course, any number of forecasts and predictions are only good once they have been proven accurate in the real world. It must be said that SATCOM history is littered with wonderful predictions that have evaporated in the real world (Teledesic, et al.).

AST’s upcoming launches and ‘beta’ tests will certanly demonstrate user enthusiasm, as will Starlink as it populates their own D2C fleet well beyond today’s 130 or so suitable satellites.

Chris Forrester

Author Chris Forrester is the Senior Columnist and Contributor for SatNews Publishers and is a well-known broadcasting journalist and industry consultant. He reports on all aspects of broadcasting with special emphasis on content, the business of television and emerging applications.