Telesat was the last of the Big Four (Intelsat, SES, Eutelsat and Telesat) satellite operators to reveal its quarterly numbers on November 5. Telesat’s 9-month revenues were down by 8 percent to C$571 million. The 3-month numbers showed revenue of C$192 million, a fall of 5 percent when compared to the same period in 2020. Some 60 percent of the decline was due to the non-renewal of North American DTH customer Shaw Direct.

North America accounted for 82 percent of Telesat’s overall revenues, Latin America 8 percent, Europe and the Middle East (EMEA) 5 percent, and Asia 5 percent.

TELESAT

Telesat has a problem with their Lightspeed planned constellation... more regarding this issue in a moment.

“I am pleased with our results for the third quarter and first nine months of the year, particularly given the fact that the COVID-19 pandemic continued to restrain certain business activities,” said Dan Goldberg, Telesat’s President and CEO.

He continued,“Although revenues and Adjusted EBITDA, adjusted for foreign exchange rate changes, were modestly lower, we continued to generate strong cash flows and maintain an industry-leading Adjusted EBITDA margin, high- capacity utilization and a substantial contractual backlog.”

That contracted backlog totaled C$2.2 billion and fleet use was at 80 percent of capacity.

Goldberg’s comment on ‘certain business activities’ being affected referred in the main to the company’s planned LEO ‘Lightspeed’ constellation of 298 satellites. During an analysts call, he said that Telesat’s Lightspeed was likely to be delayed. There are, he said, component shortages at Thales Alenia Space, the manufacturer of the Telesat satellites.

Thales Alenia have a substantial $3 billion contract to build the Lightspeed constellation — the delays could have a material impact for Telesat due to the presence of ITU rules.

The ITU requires that the Telesat constellation initiates the launch of at least 10 percent of those satellites by February 2023. That obligation now looks in considerable doubt. Telesat suggests that it would hope to obtain an extension to that date. The delay will also impact the agreement that Telesat has in place with its financing for Lightspeed (from Export Development Canada and France’s BpiFrance).Also learned was that Thales Alenia Space has yet to receive a full go-ahead for the Lightspeed build.

These headaches will, no doubt, be solved, but also coming up before the end of this year is the Nasdaq IPO and stock-market listing for what is best described as ‘new’ Telesat which is the result of the Loral + Telesat financial reconstruction. Not helping with the ‘headaches’ is the need to keep — in effect — two separate sets of financial records at Telesat’s Ottawa HQ. There is a requirement that Telesat’s existing geostationary business be separated from the Lightspeed operation.

On the upside, there are definitely signs of an improvement in Telesat’s finances. Losses are under control and revenues are looking healthier. Goldberg said on Telesat’s investor call. “[COVID] is going to continue to restrain our ability to get back on track with our aeronautical customers and our maritime customers — they’re still very much suffering from COVID. But it’s not our expectation that this year we’re going to be facing the kind of headwinds that we had to face in 2020.”

INTELSAT

Goldberg’s sentiment —– and hopes — were echoed by each of the major players. Elements appear to be getting better, especially with the recovery in airline travel and the cruise market restarts. Intelsat, despite the company’s seemingly never-ending Chapter 11 bankruptcy, unveiled its Q3 numbers and showed a major highlight in their Network Services division (and 46 percent of Intelsat’s total revenues), which grew by 43 percent when compared with the same 3 months in 2020. This growth was helped considerably by revenue from Intelsat’s ‘aero’ division (the in-flight passenger side of the Gogo business which the firm purchased in 2020).

Despite this major uptick, Intelsat’s Q3 results again showed the satellite operator suffered another net loss, this time to the tune of $145.7 million on revenues of $526.1 million for those three months.

Intelsat’s Media division revenues (34 percent of the total) suffered badly and fell 11 percent to $181.1 million. “The decline in media was primarily driven by a planned service migration by a specific customer from Intelsat’s network to the customer’s own network assets. Other factors impacting revenue were terminations and non-renewals reflecting industry trends. The declines in revenue were slightly offset by new business expansion,” said the company.

Intelsat’s usually reliable Government/Military business (18 percent of total) also tumbled, by 12 percent to $95 million.

Intelsat’s average fill rate as of September 30, 2021, on its approximately 1,620, 36 MHz, station-kept widebeam transponders was 74 percent, similar to the company’s average fill rate at June 30, 2021. In addition, as of September 30, 2021, its fleet included approximately 1,224, 36 MHz, equivalent transponders and that number is consistent with the prior quarter.

Backlog fell by $300 million during the three months (compared to the position as at June 30 this year) to $5.7 billion.

Intelsat is also having to cope with its bankruptcy and reconstruction costs which were $98.3 million, of which $36.4 million were for “professional fees.”

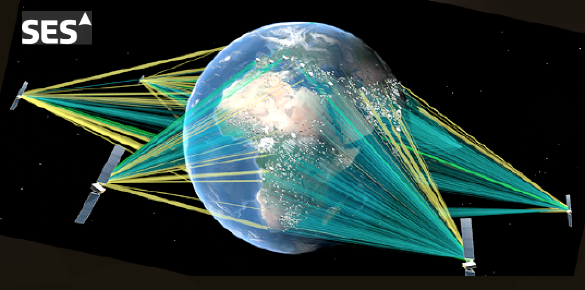

SES

Luxembourg-based SES reported during their 9-months (Q3) results that HDTV channel growth on its fleet had taken the number of HD channels to “an industry leading” 3,150 channels which “reflected early signs of broadcasters considering completing their transition from SD to HD.”

The move to HD, and with video pricing remaining healthy, helped reverse a trend of ever-lower Video division income. There was also a growing revenue stream from its HD+ service in Germany.

Speaking at the post-results analyst call, SES CEO Steve Collar also highlighted the agreement to expand services to Dish Mexico and its 2 million subscribers, which had helped secure more than 85 million euros in incremental backlog to the firm’s overall total. Collar added that there had been important renewals and new business secured at the SES prime neighborhoods with. For example, Globecast (for China Global TV), Comcast, and Sky. Video income was still down (4.6 percent in the 9-month period, but for the same period last year, that fall was 8 percent).

Collar also talked about the 10 million dishes that have been repointed in Ethiopia and that there were excellent prospects for extra growth and revenues from the that market. Moreover, more than 95 percent of its 2021 group revenues were now contracted and in place.

SES says that its growing Networks division’s underlying revenue of 533 million euros was flat when compared with Year-To-Date (YTD) 2020 (-0.6 percent at constant FX) with strong ongoing growth in Government (+7.7 percent) offsetting short-term COVID-related impacts on Mobility (-8.8 percent) and near-term declines in Fixed Data (-2.9 percent). Q3 2021 underlying revenue of 184 million euros (-1.3 percent YOY at constant FX) was 4.8 percent higher than Q2 2021 reflecting a recovery in Cruise, combined with new revenue from Aeronautical, Cloud, and Energy customers.

Collar also stressed that the FCC’s C-band clearing incentive payments were on track and represented an overall $4 billion (pre-tax) of revenue between Q1/2022, when the first $1 billion will be received, and 2023, when the balance is due from the FCC. “This is a big deal, and we are ahead of schedule for the second payment,” said Collar.

Collar added that SES was looking to further C-band opportunities [from other countries and US locations] now that the US position was clearer. SES is working with the US C-band auction winners and he indicated there were opportunities for further monetization.

He spoke about the post-COVID recovery in growth of the firm’s aero and cruise businesses (and a q-o-q current growth of 12 percent).

Overall, SES has updated their revenue guidance for this trading year by about 40 million euros (to between 1.760m-1.800 million euros).

Collar promised “substantial benefits for SES shareholders” would flow from the $3 billion of FCC payments due later in 2023. “The further $3 billion (pre- tax) (and triggered end-2023) used in the most optimal way for the benefit of shareholders.” The initial FCC payment of (pre-tax) of just under $1 billion would be used to strengthen the SES balance sheet.

SES said the firm will continue to “vigorously pursue claim of up to $1.8 billion against Intelsat.” The claim is comprised of $450 million in compensatory damages and the balance in punitive damages. Collar said there isn’t much to add at the moment, but continued to feel good about the company’s position and the claim. and the claim.

EUTELSAT

Eutelsat’s Q1 numbers (Eutelsat has a July-to-June financial year) were dominated by a comment from CFO Sandrine Téran. She told analysts that a merger with another operator was “not a problem if the price is right.” She told analysts that Eutelsat, the world’s third-largest satellite operator, believed it had a solid, stand-alone strategy. “But we would welcome consolidation if it was a good opportunity for Eutelsat and its shareholders. M&A could be a source of substantial CAPEX and OPEX synergies in our industry.”

There are, however, only a limited number of target businesses in Europe that could be potential merger candidates. Telenor’s satellite division, although unlikely, could be one. Hispasat in Madrid is another (and Eutelsat has long coveted Hispasat) but the big prize would be arch-rival SES.

Téran told analysts that a merger faced no special political issues other than the Golden Share veto power held by Luxembourg’s government in SES. But Téran stated that she did not see anything in the industry that would be a hurdle, other than the usual, antitrust examinations.

Either way, it is a problem a new CEO at Eutelsat is going to have to handle, whether it really is the much talked-about merger with another operator, or either accepting or fending off a take-over bid from the likes of Patrick Drahi.

CEO Rodolphe Belmer Departing Eutelsat

Notwithstanding any merger plans, Eutelsat’s revenue numbers were under pressure. Each and every division revealed falling revenues and the company’s all-important contracted backlog also fell 200 million euros y-o-y to 4.2 billion euros. The good news, such as it is, is that Eutelsat has firmed up their somewhat complex “limited” contract with long-term partner Nilesat based in Cairo and serving the MENA region. The two operate the 7/8 degrees West orbital slot. The Nilesat relationship was due to be renewed last summer, but better late than never.

Indeed, the consensus is that the Nilesat renewal covered about half of the previous contract. Eutelsat says it now has

“multiple agreements,” including multi-year, multi-transponders contracts with the UAE’s Du, the important Jordan Media City and Abu Dhabi Media.

_________________________________________

Eutelsat 80A goes to a ‘graveyard’ orbit Eutelsat’s 80A satellite has reached its end-of-life having more than exceeded its minimum design life of 12-years of operation. Eutelsat 80A was launched from Florida in May 2000. It was also called Eutelsat W4 and has thus completed well over 20 years’ service. Various technical data suggests that the satellite was being raised by about 35-36 kms a day above its geostationary orbital location into a so-called “graveyard” orbit and out of any potential conflict with its geostationary neighbors. One report (from TS Kelso at CelesTrak) said the satellite was decommissioned around the beginning of October. The raising of a geo-craft to a ‘graveyard’ orbit is pretty routine. However, for any satellite to get close to a doubling of its design life is amazing and full credit has to go to impressive in-orbit handling by Eutelsat’s technical teams. The satellite was built by Lockheed Martin and launched by International Launch Services on an Atlas IIIA rocket.

_________________________________________

“Management has argued [that Nilesat revenues] is in line with their FY22 guidance. Eutelsat plans to have resold most of the capacity returned by the end of FY23. It has already been able to resell part of this capacity on double- digit price increases in three agreements in the Middle East,” said Sami Kassab, media analyst from investment bank Exane/BNPP.

Some of the numbers are not within Eutelsat’s control. For example, the US troop withdrawals from Afghanistan has meant a lower military demand for connectivity in the region. This resulted in Eutelsat only seeing a 75 percent renewal of their previous contracts with the US and other militaries.

Eutelsat 80A goes to a ‘graveyard’ orbit Eutelsat’s 80A satellite has reached its end-of-life having more than exceeded its minimum design life of 12-years of operation. Eutelsat 80A was launched from Florida in May 2000. It was also called Eutelsat W4 and has thus completed well over 20 years’ service.

Various technical data suggests that the satellite was being raised by about 35-36 kms a day above its geostationary orbital location into a so-called “graveyard” orbit and out of any potential conflict with its geostationary neighbors. One report (from TS Kelso at CelesTrak) said the satellite was decommissioned around the beginning of October.

The raising of a geo-craft to a ‘graveyard’ orbit is pretty routine. However, for any satellite to get close to a doubling of its design life is amazing and full credit has to go to impressive in-orbit handling by Eutelsat’s technical teams. The satellite was built by Lockheed Martin and launched by International Launch Services on an Atlas IIIA rocket.

Eutelsat announced on October 28 a 30 million euros annual deal with Hispasat on Eutelsat Konnect. This comes on the heels of a distribution agreement with Deutsche Telekom in Germany and underpins the view that Fixed Broadband is making solid progress.

Despite these disappointments, CEO Belmer said that the operator’s Q1 revenues “are in line with our expectations.”

Eutelsat stated the firm is on track to receive the first slice of its FCC ‘incentive’ payment for clearing key C-band frequencies over the US. The sum, $125 million, will be followed by a second tranche of $382 million later in 2023.

A Landmark Year

These ‘big four’ operators are the true backbone of the satellite industry — 2022 is going to be special, landmark year for each of them. Two of them (Intelsat and Eutelsat) will have new CEOs. Intelsat will emerge from bankruptcy. The damaging and bitter dispute between SES and Intelsat over C-band payments will be resolved and, hopefully, will return to a more friendly, commercial relationship between the two companies. The first C-band payments from the FCC will be in each of the Big Four’s coffers. The In-Flight market will — hopefully — recover, as will the Cruise market with the relaxation of COVID rules.

The ‘big four’ can then look forward. Of course, there are threats: from Elon Musk’s Starlink, from Viasat’s new satellites (including those from the company’s acquisition of Inmarsat), from OneWeb…. The list isn’t quite endless, but all of us can only hope that, while competition is good, our ‘big four’ can survive and grow. Their success impacts the whole industry.

Author Chris Forrester is a well-known broadcasting journalist, industry consultant and Senior Columnist for SatNews Publishers. He reports on all aspects of broadcasting with special emphasis on content, the business of television and emerging applications. He founded Rapid TV News and has edited Interspace and its successor Inside Satellite TV since 1996. He also files for Advanced-Television.com. In November of 1998, Chris was appointed an Associate (professor) of the prestigious Adham Center for Television Journalism, part of the American University in Cairo (AUC), in recognition of his extensive coverage of the Arab media market.