Chris Forrester, Senior Columnist, SatNews Publishers

An isolated spot in the middle of Wales was a perfect spot for history to be made on January 30th. when a Vodafone engineer made the first-ever, official video call using an orbiting AST SpaceMobile (AST) satellite to his boss, CEO Margherita Della Valle and British astronaut Tim Peake.

We can say the ‘first-ever’ official as it’s obvious that a test call or two must have been made prior to the actual ‘world’s first’ claim. Nevertheless, when Rowan Chesmer, a member of the Vodafone Group’s Future Technology Research Department (FTRD), made the satellite video call with Della Valle via satellite, history was made and much celebrated by Vodafone.

The demonstration led to some highly enthusiastic celebrations from AST themselves and Vodafone which, along with its overseas operations and partners, helps connect millions of cell-phone subscribers.

The demonstration led to some highly enthusiastic celebrations from AST themselves and Vodafone which, along with its overseas operations and partners, helps connect millions of cell-phone subscribers.

Della Valle said, “No one today offers the service that has been designed with AST.”

She explained that, thanks to AST and her Vodafone signals, nobody would be without a signal wherever they lived or worked around the globe.

The test proved that AST’s satellites can handle video calls to ‘ordinary’ and unmodified 4G and 5G handsets. Della Valle and British astronaut Tim Peake in an AST video discussion talked about the video call, made using normal 4G/5G smartphones and satellites that will allow multiple users in areas of no mobile coverage to make and receive video calls, access the Internet and use online messaging services.

Andrea Dona, Chief Network Officer at Vodafone, described the test as “[Allowing] us to close the last remaining gap and keep our customers connected wherever they are.”

Vodafone made no secret that they will initiate European satellite services later this year—once AST has populated its orbit with another 25 to 30 extra spacecraft.

Vodafone used one of five AST SpaceMobile satellites for its test phone calls, but AST will expand its fleet during 2025 and 2026. Vodafone has been an investor in AST since 2019 and has a commercial agreement in place that runs until 2034. The Vodafone agreement extends to many overseas territories and nations.

“At Vodafone, our work is to connect everyone, wherever they are. Our leading European 5G network will be complemented by cutting-edge satellite technology. Vodafone will offer our users the best network, connecting people who have never had access to mobile communications before. This will help close the digital divide, supporting people across Europe to stay in touch with family, friends and work, as well as ensuring reliable connections in rural areas in emergencies,’ Della Valle said.

Astronaut Jim Peake and Voadphone's

Margherita Della Valle

Vodafone plans to conduct further tests in spring 2025, with a goal of gradually commercializing its satellite broadband services from late 2025 through 2026.

Luxembourg-based industry consultant Peter Lindmark said the test call showed that the satellite could solve the many ‘dead spots’ around the planet and “connect the unconnected.”

The AST technology also meant that signals can be switched automatically between today’s mast and tower systems and overhead satellites.

AST in its statement listed the benefits and said:

AST in its statement listed the benefits and said:

Historic first space-based video call in Europe, made by Vodafone engineer to Vodafone CEO Margherita Della Valle.

• Mobile broadband directly to unmodified smartphones supporting voice, full data and video applications, and other native cellular capabilities, without the need of any specialized software or device support or updates.

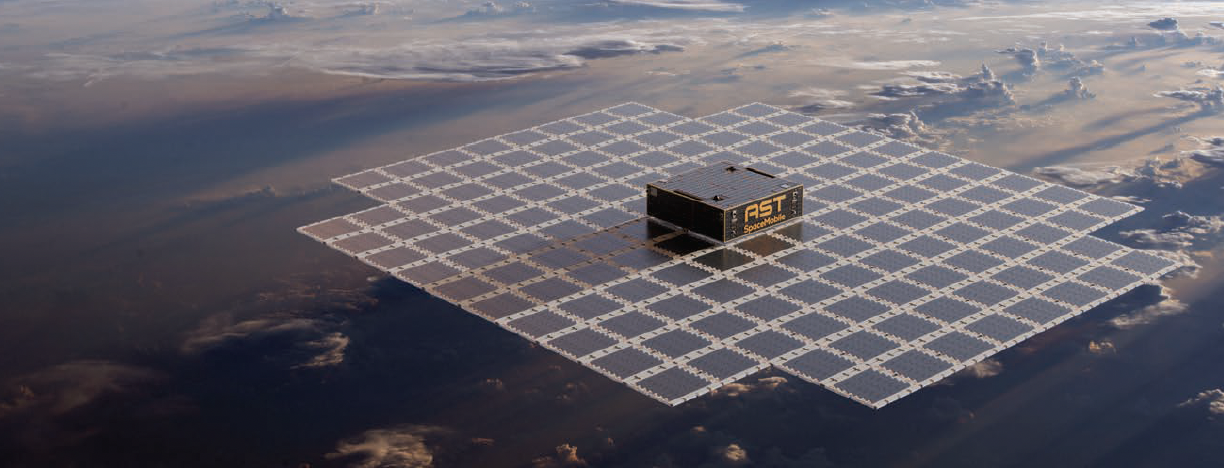

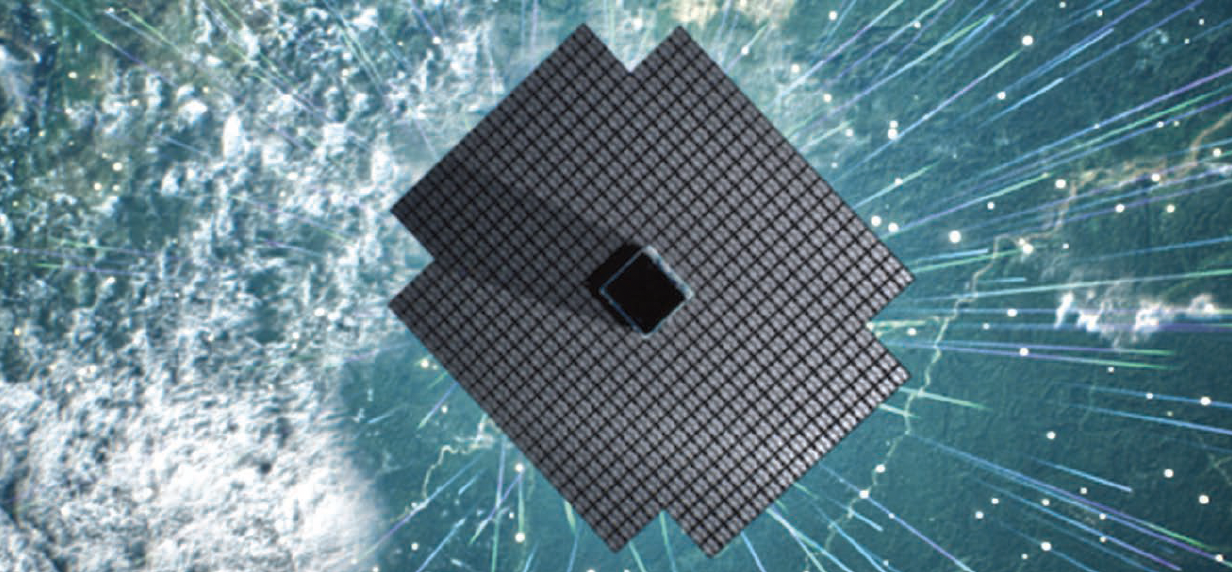

• Powered by AST SpaceMobile’s groundbreaking BlueBird satellites, the largest commercial phase arrays ever deployed in LEO, this is a giant leap toward universal connectivity.

However, other industry experts asked legitimate questions as to how well a satellite would cope during heavy rain or snow, and whether the signals would pass through building walls. (Signals will not be affected for ground delivery, said Vodafone).

Praise was given to AST, and digs at SpaceX’s Starlink, by Vodafone:

“As Margherita’s video call shows, the advantage of Vodafone working with AST SpaceMobile’s satellites is that more bandwidth is available so that other apps and services can be used. At the time of writing, other direct-to-phone satellite services only have enough bandwidth for voice calls and text messages. The AST SpaceMobile satellite that Vodafone used can provide faster mobile data speeds than other LEO-using services as it uses a technique called beamforming. Already used in WiFi, as well as wholly terrestrial 4G and 5G networks, this technique precisely directs radio signals from satellites to their intended destination. This not only helps increase speed, but also minimizes interference, increasing reliability.”

Currently, the world’s military, as well as ocean travelers or pioneer explorers, can tap into Iridium’s satellites for basic connectivity just about anywhere, and ‘first responders’ in catastrophic situations can quickly set up satellite-enabled connectivity. But to date, adding decent video to a simple and unmodified smart phone is quite special.

_________________________________________________

Can the AST tortoise beat Starlink’s hare?

_______________________________

The ‘tortoise vs hare’ battle in this space is crucial. Elon Musk’s SpaceX and its Starlink fleet of Direct-to-Cell (D2C) satellites are already active—but not handling video.

Apple’s iPhones have been providing emergency connectivity, using GlobalStar satellites for more than a year in some specific nations (at least, on Version 14), and Apple’s iPhone devices are now able to test SpaceX-owned Starlink’s D2C capability that provides coverage from space, according to T-Mobile in the U.S.

T-Mobile and SpaceX are currently testing the Starlink cell network on a trial basis after receiving approval from the Federal Communications Commission (FCC) in November of 2024. The trial offers simple ‘text via satellite,’ while voice and data features will be added in the future, according to the T-Mobile website. To access this feature, Apple phones must install the iOS 18.3 software update.

Apple has purchased 20% of Globalstar and will invest up to $1.7 billion for a new, dedicated, D2C satellite constellation that will increase the bandwidth available to its iPhones to provide a more robust data connection, rather than just basic messaging services.

In October of 2024, the FCC allowed SpaceX and T-Mobile to enable Starlink satellites with D2C capability to provide coverage for cellphones in areas of North Carolina hit hard by Hurricane Helene.

The FCC said, “We find that SpaceX and T-Mobile’s SCS operations will yield many benefits, including an increase in access to emergency services in areas where consumers would otherwise not have the capability to access a terrestrial network to call or text 911, as evidenced, for example, through SpaceX’s provision of emergency SCS in areas affected by Hurricanes Helene and Milton.”

Quilty: AST could be “the most valuable” company, analysts at Quilty Space said, issuing their impressive endorsement of AST SpaceMobile.. They said, “If AST is successful in what they’re doing, they could be the most valuable company in the industry that’s not named SpaceX.” Chris Quilty, senior analyst at the research company, added: “It’s down to money. It’s down to time. And then the ultimate question, is this a service that people will pay for?” He continued, “With the potential to connect to millions or billions of end users, even a small piece of revenue through a partner is huge,”

The FCC has authorized Starlink to operate any of the remainder of its 7,500 approved satellites at altitudes of 340, 345, 350, and 360 kilometers. 2025 will see more of these developments, but 2026 will see services become more widely available. Whether Starlink will manage to handle video to a wide audience—and perhaps high demand—is yet to be witnessed. AST also has to populate its orbit with dozens more satellites. When that occurs, “no signal” will be an element of the past, but perhaps at a cost for users.

The AST financial model is for a revenue sharing system with its many international partners. Key to AST’s potential success is that —perhaps uniquely—it doesn’t want contact with users. That aspect of the business the company is leaving to its 40 or more telcos around the world. They already have a customer-facing relationship, and while the contracts between the telcos and AST are confidential, it is generally understood to be a—more or less—50/50 sharing of revenues from user calls.

At the end of January of this year, the news emerged that AST has been granted a ‘Special Temporary Authority’ for two-way transmission tests over the U.S. using its local partners Verizon and AT&T.

AST stated, “This approval enables AST SpaceMobile’s first five commercial BlueBird satellites, operating in low Earth orbit today, with unmodified smartphones in AT&T and Verizon premium low-band wireless spectrum supporting voice, full data, and video applications, and other native cellular broadband capabilities, without the need of any specialized software or device support or updates.”

Also worth remembering is that each AST satellite has approximately 100 times the bandwidth/capacity of a Starlink D2C craft. Nevertheless, Starlink has deals in place with seven cellular operators, while AST has links in place with more than 40, including giants such as Verizon and Vodafone.

Whether AST’s Tortoise or Starlink’s Hare will win this battle is difficult to confirm. Most analysts say there’s plenty of room for two or even three, successful business models. Deutsche Bank, for example, in a recent note to clients, stated that shares in AST could be worth $53 per share.

The bank stated, “We currently expect AST will begin broad commercial service in northern Latitudes during 2026. We expect that by 2030, AST will generate nearly $3 Billion from Northern Hemisphere markets, and about $1.5 billion from Equatorial markets.”

The key catalyst to this upgrade is the contract between AST and Vodafone and, in particular, Vodafone’s “extensive footprint in Europe, Africa, India and the Middle East. [This] represents a large addressable market that will be pivotal for AST in achieving its global ambitions,” said the bank’s report.

Perhaps the January 30th video call will prove to be truly historic.

Chris Forrester

Author Chris Forrester is the Senior Columnist and Contributor for SatNews Publishers and is a well-known broadcasting journalist and industry consultant. He reports on all aspects of broadcasting with special emphasis on content, the business of television and emerging applications.