Eldar Rubinov, PNT and Geodesy Technical Lead, FrontierSI

Global Navigation Satellite Systems (GNSS) have been the backbone of Positioning, Navigation, and Timing (PNT) services for decades, serving billions of users daily across defence and civilian applications. GNSS technologies, along with various augmentation systems, underpin modern society, supporting applications such as maritime navigation, precision aircraft landings, and timing for critical infrastructure.

While GNSS has served, and continues to serve, the global society exceptionally well, there has been a rise in incidents of radio frequency interference (RFI) and GNSS system failures, both on the ground and in space.

In addition to the inherent vulnerabilities of GNSS, there is a significant challenge in its performance in certain environments, such as urban canyons. The world’s positioning needs have evolved significantly since GNSS was originally developed, and in many cases, it no longer fully meets modern application requirements.

As such, it has become increasingly clear that GNSS—in its current form—is insufficient for the demands of today’s and tomorrow’s challenges and multi-layered PNT options are needed. Several alternative PNT technologies are currently being explored with Low Earth Orbit (LEO) PNT constellations emerging as one of the key approaches.

With the increasing demand for assured PNT services across industries such as autonomous systems, logistics, and critical infrastructures, LEO PNT is poised to play a pivotal role in contributing to the future satellite navigation ecosystem.

In January of 2025, FrontierSI released the State of the Market Report on Low Earth Orbit Positioning, Navigation, and Timing (LEO PNT) – 2024 Edition. The report provides an in-depth analysis of the current LEO PNT landscape, covering technological advancements, market trends, and emerging service providers.

The document serves as the first in a series of annual reports tracking the evolution of LEO PNT systems, which are poised to play a crucial role in addressing the limitations of traditional GNSS.

With increasing concerns about GNSS vulnerabilities and poor performance in urban environments, the development of LEO-based PNT solutions has gained significant momentum. The FrontierSI report explores the key technical and market drivers behind this transition, providing a comprehensive overview of existing and emerging LEO PNT solutions. This article provides a summary of the report.

______________________

LEO PNT Ecosystem

______________________

LEO PNT systems differ from traditional GNSS in a number of ways, described below:

Orbital Altitude—GNSS satellites are positioned in Medium Earth Orbit (MEO) at altitudes of 19,000-23,000 km, while LEO satellites orbit the Earth between 500-1,200 km. Number of Satellites—LEO constellations require significantly more satellites (between 200-500 satellites) to maintain enough satellites in view for continuous coverage compared to GNSS (30 satellites).

Signal Strength—LEO satellites transmit stronger signals due to their proximity to Earth, enhancing resilience to RFI. Signal Frequency—while GNSS primarily operates in the L-band, LEO PNT services use a broader range of frequencies including L, S, C, and UHF/VHF, each offering distinct advantages and challenges.

Timescale Reference—unlike GNSS satellites equipped with onboard atomic clocks, LEO satellites depend on alternative time synchronization methods, including ground corrections, GNSS or geostationary satellite assistance, and inter-satellite links.

Ownership and Business Models—traditional GNSS systems are government-run, while LEO PNT initiatives are driven largely by commercial ventures, thereby creating a market driven approach to PNT services.

_______________________

LEO PNT Approaches

_______________________

LEO PNT systems can be categorized into three, primary approaches:

Dedicated PNT Systems—purpose-built constellations designed to provide precise PNT services, similar to GNSS, but in LEO.

Signals of Opportunity (SOP)—using existing satellite signals from non-PNT constellations (e.g., Starlink, OneWeb) for PNT purposes.

Fused Communication and PNT Systems—satellite constellations combining communication services with PNT functionalities, allowing dual-use applications.

_______________________________________

Key Players and Emerging Providers

________________________________________

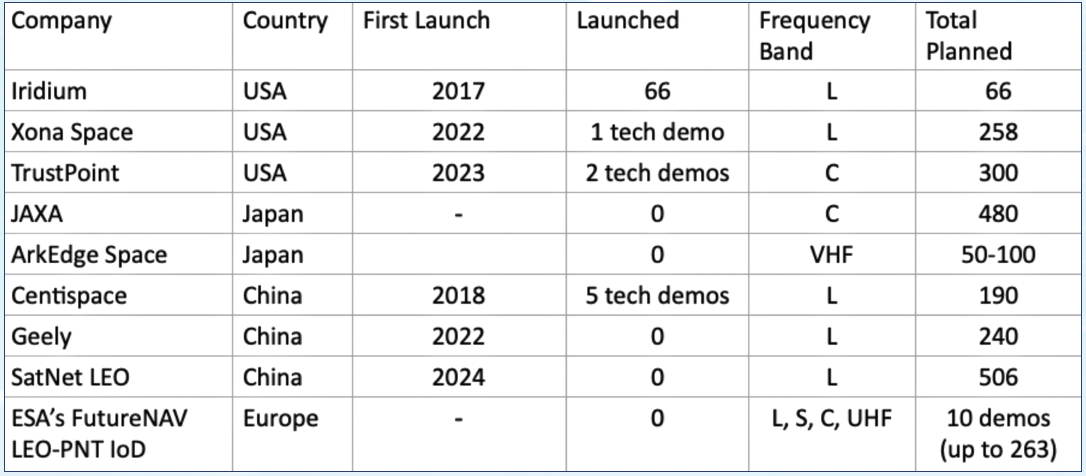

Several companies and agencies are actively developing dedicated LEO PNT services. These include Iridium STL, Xona Space and TrustPoint (USA); JAXA and ArkEdge Space (Japan); Centispace, Geely and SatNet LEO (China), and ESA FutureNAV (Europe). Additionally, Fergani Space (Türkiye) and GNSSaS (UAE) have also announced plans of developing LEO PNT constellations.

Table 1 below summarizes the current landscape of dedicated LEO PNT providers:

Table 1. Current and emerging dedicated LEO and PNT providers.

Currently, Iridium STL is the only provider offering commercial PNT services from LEO, using a hosted PNT payload on the Iridium NEXT satellite constellation.

Xona Space, Geely, Centispace and SatNet LEO are developing LEO PNT constellations to provide services in L-band, making them compatible with existing GNSS user equipment (albeit firmware updates will be necessary in order to incorporate new signals).

TrustPoint and JAXA, on the other hand, are leveraging C-band, which provides some unique advantages, such as less congested spectrum and less susceptibility to RFI.

ESA has commissioned two consortia, led by GMV and Thales Alenia Space, to deploy a 10-satellite mini constellation aimed at testing multiple frequency bands.

Apart from Iridium STL, which has a limited number of satellites in LEO, meaning it can only provide positioning accuracy from several meters to several tens of meters, all other constellations are targeting high accuracy applications at centimeter to decimeter level. They will achieve that by providing additional ranging signals as well augmentation signals.

There is also a significant number of satellite constellations that are currently being developed for communications, high speed internet, telematics, IoT, air traffic management and more, which in principle could also provide some PNT services.

Table 2 below lists the various communication constellations in LEO, current and emerging, including the number of satellites launched (December 2024), total amount of planned satellites and the frequency band that they are using.

Sometimes, the difference between dedicated and fused system is gray as several providers can fit in either category, for example:

Iridium NEXT is a communication constellation of 66 satellites, which has a hosted PNT payload from Satelles, enabling it to provide a commercial Satellite Time and Location (STL) service in L-band, fully independent of GNSS. In 2024, Satelles was acquired by Iridium and the service was rebranded as Iridium® STL. China SatNet is developing the Guowang mega-constellation, which will consist of nearly 13,000 satellites, with the first launch in December 2024. In addition, China SatNet is working on the SatNet LEO PNT constellation, which will consist of small subset of 506 satellites to provide PNT services.

GeeSpace, which is a subsidiary of Zhejiang Geely Holding Group, is building a broadband mega-constellation called GEESATCOM, consisting of 5,676 satellites. The company is also planning to have a dedicated PNT constellation of 240 satellites.

ArkEdge, a Japanese start-up is developing a VHS Data Exchange System (VDES) for maritime use, which is mainly a communications system, but will also have a dedicated ranging component called VDES-R, which can be used to position ships at sea independently from GNSS.

____________________

Receiver Segment

____________________

Receiver manufacturers across the globe are now testing and introducing innovative products designed to process signals beyond traditional GNSS. This shift marks a new phase of evolution in the industry, reshaping the marketplace and creating opportunities for emerging technology companies to enter the user receiver market.

Given this evolution in the market, the GNSS receiver industry is undergoing a pivotal transformation to leverage these opportunities.

Some companies are developing entirely new products to fully leverage the unique attributes of LEO signals, while others are upgrading existing GNSS receivers to integrate these capabilities.

Receiver manufacturers are facing unique challenges and must address various technical and business model considerations, which are often intertwined with one another. As the new PNT service offerings are evolving, the information that is available to make decisions is dynamic.

Some of these considerations include which frequency bands to support, which market to target, and who will pay for the service. The primary factor for receiver manufacturers in choosing which LEO PNT service to support is their confidence in the PNT service provider’s ability to deliver the service.

_________________

Future Outlook

_________________

The LEO PNT market is set for rapid expansion, with most providers targeting Initial Operating Capability (IOC) within the next two to three years and Full Operational Capability (FOC) by the decade’s end. The industry will likely see:

Increased government and military interest in resilient PNT solutions.

Greater collaboration between commercial and public sectors to establish interoperability standards.

Expansion of hybrid GNSS-LEO PNT receivers to support multi-layered positioning solutions.

Advancements in signal processing techniques, improving accuracy and reliability in contested environments.

____________

Conclusion

____________

The transition to LEO-based PNT services represents a paradigm shift in satellite navigation. While GNSS will continue to serve as the foundation for global positioning, LEO PNT systems offer enhanced resilience, faster updates, and improved performance in challenging environments.

The coming years will be crucial in shaping how LEO PNT systems integrate with GNSS infrastructure while navigating regulatory and market challenges.

As new LEO constellations come online, industry stakeholders must navigate challenges in service adoption, standardisation, and market competition to fully realise LEO PNT’s potential. Annual updates, such as the FrontierSI State of Market Report, will be essential in tracking progress and guiding stakeholders toward a robust and sustainable LEO PNT ecosystem.

www.frontiersi.com.au

Eldar Rubinov

Author Eldar Rubinov is a PNT and Geodesy Technical Lead at FrontierSI, a non-for-profit research organization in Australia. Eldar has more than 20 years of experience in the field of satellite navigation that spans both industry and academia and is currently working on various projects around GNSS resilience, including LEO PNT.