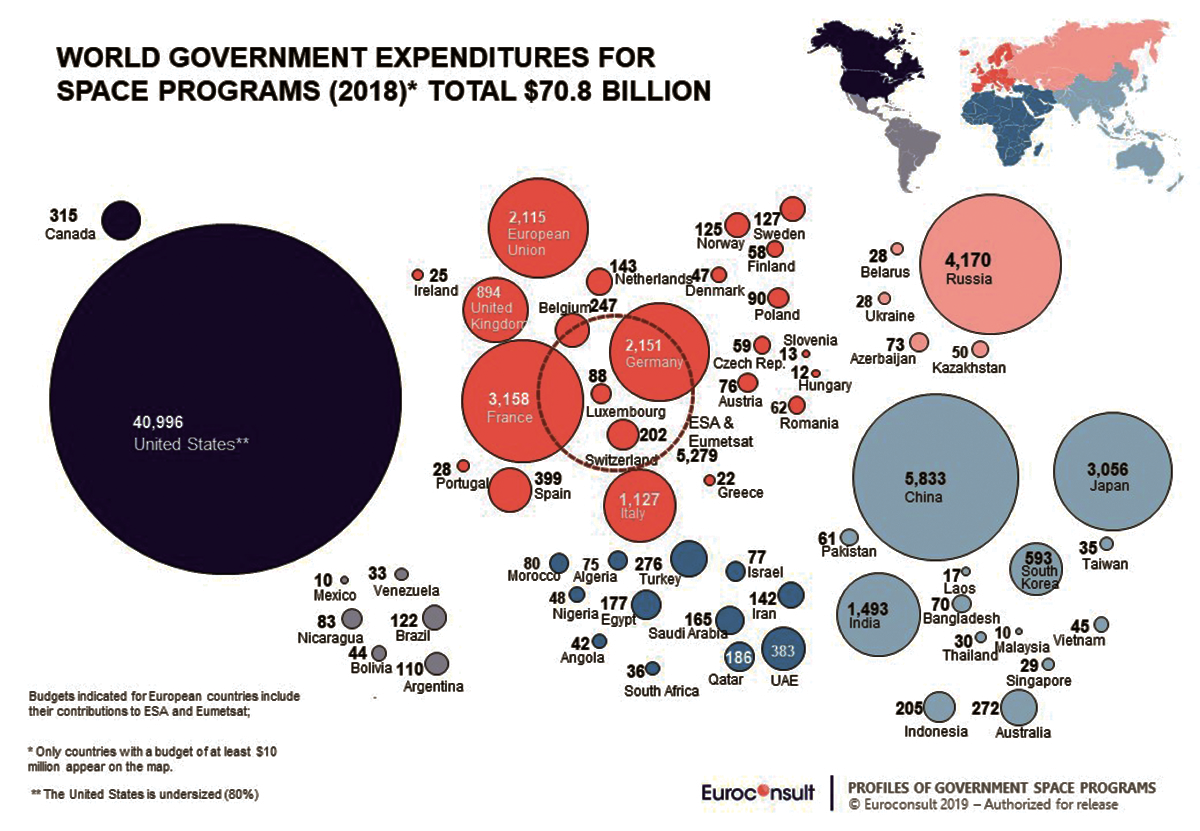

According to Euroconsult’s Government Space Programs 2019 report, published in July 2019, global government space budgets totaled $70.9 billion in 2018, posting a 5Y CAGR of 5.75 percent and continuing the last few years of recovery of space budgets since the 2015 low of $62.5 billion, the lowest figure since 2007.

This historic low was caused principally by major down-cycling in U.S. defense spending and significant Russian budget contractions, which saw its total budget shrink by nearly 60 percent in USD — the loss was less severe in rubles, at only -22 percent. Of 2018’s $70.9 billion government space investments, 63 percent were spent on civil programs, as military budgets fluctuate on nearly decade-long budget cycles.

Civil programs drive world growth, totaling $44.5 billion in 2018 and 4.3 percent higher than 2017. The U.S. civil budget, growing at 4 percent 5Y CAGR, propelled by the expansion of its space science and exploration, technology, and human spaceflight programs, is a main force pushing global growth.

Civil expenditures of Asia and the Middle East and Africa (ME/A) regions, with 6.5 percent and 5.6 percent 5Y CAGRs respectively, are also contributing factors behind world growth.

World defense budgets in 2018 total $26.4 billion, an 8.3 percent increase over 2017 as they continue their recovery from 2015’s decade-low total of $23.4 billion. U.S. defense budgets represent 72 percent of world’s total in 2018, down from 81 percent a decade ago, as more countries begin investing in military space programs, driven by strong Asian growth, but also newer entrants in ME/A, which tripled its defence expenditures from $195 million in 2008 to $626 million in 2018.

World budgets are forecast to continue their growth trend in the medium term, peaking at an estimated $84.6 billion by 2025, before downcycling.

Over the next decade, growth drivers will reverse from the recent past: while civil budgets are expected to continue to grow moderately at an average of 1.6 percent per year throughout the 2020s, driven largely by leading powers investing in science, exploration and manned flight, short-term growth will be fueled by defense programs, growing by an average of 4.2 percent per year until the mid-2020s as U.S., Asian and ME/A defense budgets maintain their current upcycle until 2026, heavily impacting the world total. After this, world defense budgets downcycle, shedding about 4.4 percent per year until the end of the decade and stalling overall space budget growth.

In 2018, 24 government civil and defense agencies around the world launched 138 satellites over 50 kg., an 84 percent increase from 2017’s 75 satellites. Records were broken in both the number of government satellites launched, as well as the number of different organizations launching satellites.

The most prolific countries are China (58 satellites), the U.S. (22) and Russia (17). Of 2018’s 79 civil satellites, 42 percent are Earth Observation (EO), followed by SATCOM at 15 percent, while 59 were for defense.

Governments are set to launch 1,553 new satellites over the next decade, averaging more than 150 per year. Of the 510 missions currently approved, 140 are for defense missions, with 75 percent launched by either the U.S., Russia or China, with 34 percent for satellite navigation and 27 percent for EO. 370 civil satellites are in backlog, of which 46 percent for EO.

Regarding the top five national space programs, the U.S. budget in 2018 totaled $40.9 billion, 58 percent of the world total, down from 75 percent in the early 2000s. The U.S. is currently in a transformative phase, implementing significant institutional, policy, and legislative changes as it heads into the 2020s.

China solidified its second place ranking, with an estimated $5.83 billion budget and posting a 9.4 percent 5Y CAGR, as it looks to commercialize and internationalize its space sector.

Russia’s budget continues to decrease from 2013’s high of $9.75 billion to 2018’s $4.17 billion, though a recovery is expected in the coming years.

France currently tops European national spending at $3.16 billion, overtaking Japan in 2018, which stagnated at $3 billion for the past 3 years.

At $11.8 billion, EO and Meteo is the highest-funded space application, often the first investment for emerging countries and popular with leading programs due to its civil and military benefits. Manned spaceflight, at $11.6 billion, concentrates investments in nine countries, though more countries, such as the UAE and India, are launching their own astronaut programs.

Space Science and Exploration total $7 billion, with strong growth forecasts as post-ISS and exploration missions gain momentum. Launch funding ($6.7 billion) growth remains modest, as development is increasingly outsourced to the private sector.

SATCOM spending has halved from its historic high down to $5.8 billion in 2018, mostly due to U.S. Department of Defense (DoD) cycles. Satellite navigation’s $3.6 billion will grow until 2022 as the EU and China complete their respective constellations, then stabilize as systems are replenished and upgraded.

Space security, at $2.1 billion, in the past monopolized by the U.S. and Russia, has seen more programs begin investments, as SSA increases in interest, both on the government side but also by private actors.

The number of countries investing in space continues to rise, totaling 88 in 2018, an all-time record. A decade ago, the number was slightly more than half of this, demonstrating that governments consider space as a valuable investment to support their national socio-economic, strategic and technological development.

In 2018 alone, five new space agencies were launched, including Luxembourg, Australia, Zimbabwe, Greece and Portugal. The growing number of countries investing in space indicates that governments recognize that space assets not only bring socio-economic benefits to a country, for example to measure agricultural yields, monitor natural resources, and provide command and control capabilities to armed forces, but also that space can also serve to raise the human capital and technological levels of a country.

However, a new rationale is also beginning to take hold, one of a country wishing to secure for itself a part of the growing commercial revenues generated by the space industry, valued at $271 billion in 2017 by Euroconsult. Indeed, a number of countries have launched space agencies with this explicit goal in mind, including Luxembourg, the UK, Australia and the UAE, with these (and many others) having the intention to set up commercially viable space ecosystems as part of their national space policies and strategies.

Looking forward, over the next decade, world space budgets are forecast to continue their growth trend in the medium term, peaking at an estimated $84.6 billion by 2024 before downcycling to the end of the decade.

Civil budgets are expected to continue to grow smoothly at an annual average of 1.8 percent per year, driven by new entrants and leading powers investing in long term science, exploration and manned flight programs.

On the defense side, budgets will be fueled by increased spending in leading space powers, with India, Japan, China, and the US all placing additional emphasis on space security as they invest in next generation systems, including a marked interested in Space Situational Awareness (SSA) programs.

As a result, world defense spending will surpass 2009 ’s record high and peak in 2025 at $34.3 billion, before beginning to downcycle afterwards, mostly due to U.S. program cycles.

The report can be purchased here:

www.euroconsult-ec.com

www.euroconsult-ec.com

A free extract of the report is also available

Simon Seminari is a Senior Consultant at Euroconsult, the world’s leading space sector consultancy. He is also the Chief Editor of the “Government Space Programs: Benchmarks, Profiles & Forecasts to 2028” report, published in July 2019.