Historians point out that a common effect of pandemics is the acceleration of trends already underway. This concept may well apply to high-profile SATCOM players filing for Chapter-11 during 2020, all within a relatively short period of time; a scenario previously foreseen but precipitated by the pandemic.

The emergence of LEO mega-constellations also exhibited accelerated progression during 2020, with SpaceX reaching a remarkable cadence in satellite manufacturing and launch, to name only a few SpaceX achievements.

The looming completion of Starlink’s first sub-constellation with 1,584 satellites points to structural changes in the years to come as other Non-GEO and VHTS players enter the race, pressing for “multi-orbit” competition in data markets.

Interestingly enough, as far as satellite capacity pricing is concerned, several markets are approaching price stabilization across regions, if only temporarily.

Mobility applications (namely maritime and aero) that were the “star” performers driving pre-pandemic revenue growth for operators became the ones most adversely impacted by the pandemic from a demand standpoint. Supply-demand dynamics always influence capacity pricing, but under the conditions of a COVID-19-inflicted demand drop, expected to be temporary, it is also worth looking into other just as important factors affecting pricing for each application.

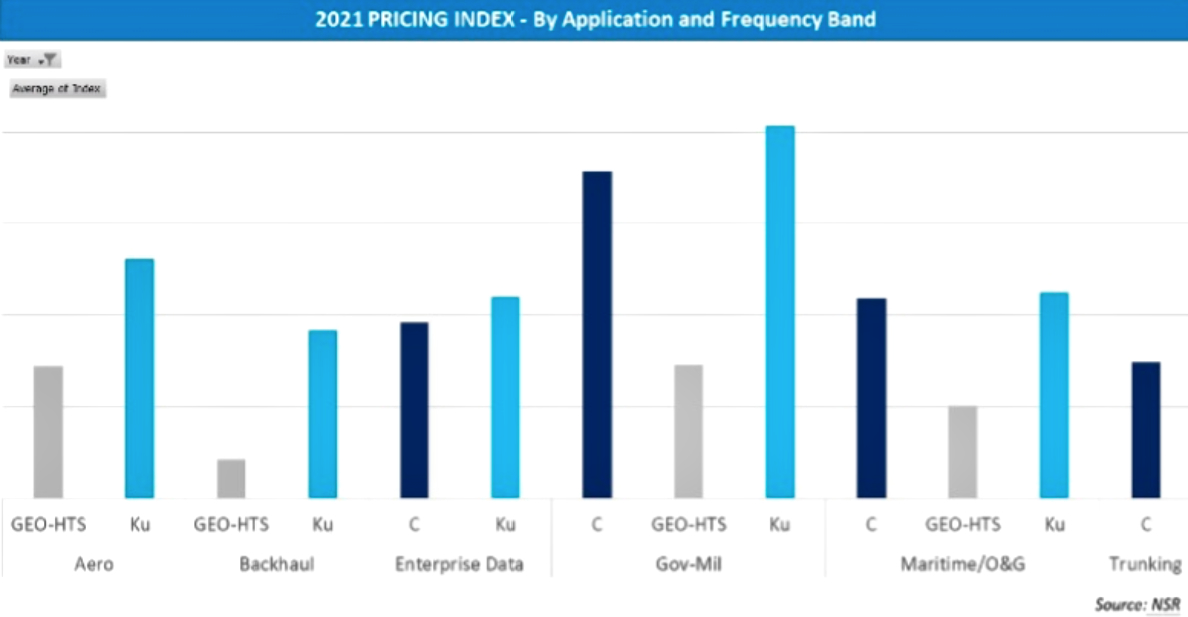

In NSR’s Satellite Capacity Pricing Index, 7th Edition (2021) report (SCPI7); NSR digs into many aspects driving pricing dynamics for the main FSS-band applications and across all regions. NSR developed a “Pricing Index Dashboard” to combine and visualize pricing data based on user selectable filters, including regions, frequency bands and applications. Using the dashboard to benchmark and compare the global pricing index for B2B data applications (this article ignores consumer broadband and video/ DTH markets, which are included in the report), we can visualize the effects of application-specific trends:

• Aero: Wide regional differences exist in this segment, where leading regional airlines are at different stages in the IFC diffusion curve and supply-demand affects pricing. Prior to COVID-19, Ku band demand was generally perceived ahead of supply in key battleground regions. During 2021, prices have stabilized or even slightly increased despite COVID-19. Aero will be a key target market for Non-GEO constellations, so current price stabilization led by integrated Ku- and Ka-band IFC GEO ecosystems may give way to increasing levels of competition and price pressure.

• Backhaul: Wireless Backhaul is a wholesale ‘volume’ market and, as such, drives high discount levels in negotiations. FSS and HTS exhibit similar declines on a % basis, but MNOs are increasingly interested in the advantages of HTS, not only in terms of costs but also in terms of the ability for VSATs to grow return link throughput as demand evolves. The pandemic has, as a matter of fact, made LTE backhaul traffic more symmetric, so HTS architectures could run with return-link scalability “plus” in negotiations.

• Enterprise VSAT: Continued pressure on FSS pricing remains from HTS. Enterprise VSAT networks continue to leverage the wide area statistical advantages of widebeam coverage, but HTS offerings “pin” customer price expectations, driving the homogenization of widebeam and HTS per-bit pricing in some regions.

• Gov-Mil: Continuous correction seen in the market towards the highest range of Gov- Mil pricing, though this vertical remains the highest priced. Pricing decline slowed in 2021, but pressures will intensify once constellations complete coverage, and VHTS satellites are launched.

• Maritime /O&G: While price has generally stabilized, the pandemic seriously impacted the bandwidth-hungry cruise sector resulting in large-volume contract renegotiations and revenue losses for end users, service providers and operators. O&G also had a bumpy year, but oil prices returning to reasonable levels point to business recovery.

• Trunking: Declines in C-band trunking price continue on account of C-band repurposing across a few regions and limited alternate uses outside video distribution. Price erosion, combined with high data-rate C-band trunks — which generally use advanced coding and network optimization technologies — continue to push the boundaries of satcom spectral efficiency.

Spectral efficiency and capacity portability are two important aspects at play when benchmarking pricing per application. HTS price in SCPI7 is provided in $/Mbps so applications driving high spectral efficiency can achieve lower price points by virtue of better use of satellite spectral power and spectrum. This can be clearly seen by comparing backhaul pricing versus aero.

Mobility lease contracts often include portability clauses, allowing large users to shift capacity requirements across satellites and beams. Contract re-negotiations affected portability, thus stabilizing or even increasing unit pricing despite certain oversupply conditions.

Each major SATCOM application is exhibiting distinct pricing dynamics with long-term fundamentals for the satellite industry at large remaining positive, albeit with long-term structural shifts driven by looming VHTS and LEO/MEO constellations programs.

The satellite industry is — obviously — not immune to the effects of the pandemic. Less obvious to “black swan” events such as COVID-19 are that unpredictable and often counter-intuitive consequences. Price stabilization and increases can indeed occur so, while supply-demand dynamics apply, pricing is also modulated in new ways, beyond the realm of normal-market expectations.

www.nsr.com/research/satellite-capacity-pricing- index-7th-edition-2021/

Mr. Placido is an independent consultant and senior analyst with over twenty years of international experience in telecommunications and entertainment. Joining NSR in 2007 with focus on emerging technologies and satellite markets, he serves as a regional and IP applications expert on satellite communications and regularly provides his analysis and strategic assessment to NSR’s consulting practice.

Carlos Placido has conducted numerous analytical and management projects, spanning from global market research studies for NSR, to strategic assessment of emerging technologies, to business development support, R&D and project management. Until 2004, he led a service development team at INTELSAT, where he was responsible for identifying and validating future satcom uses of emerging video and IP data technologies. Prior to INTELSAT, he commenced his career as a network engineer at Impsat (now Level 3) and Telecom Argentina.

Mr. Placido is also a regular contributor to specialized industry publications and administrates Satcom Post, an online professional knowledge-sharing platform. He holds an engineering degree (BS+MS) from the University of Buenos Aires and an MBA from the University of Maryland, Robert H. Smith School of Business.