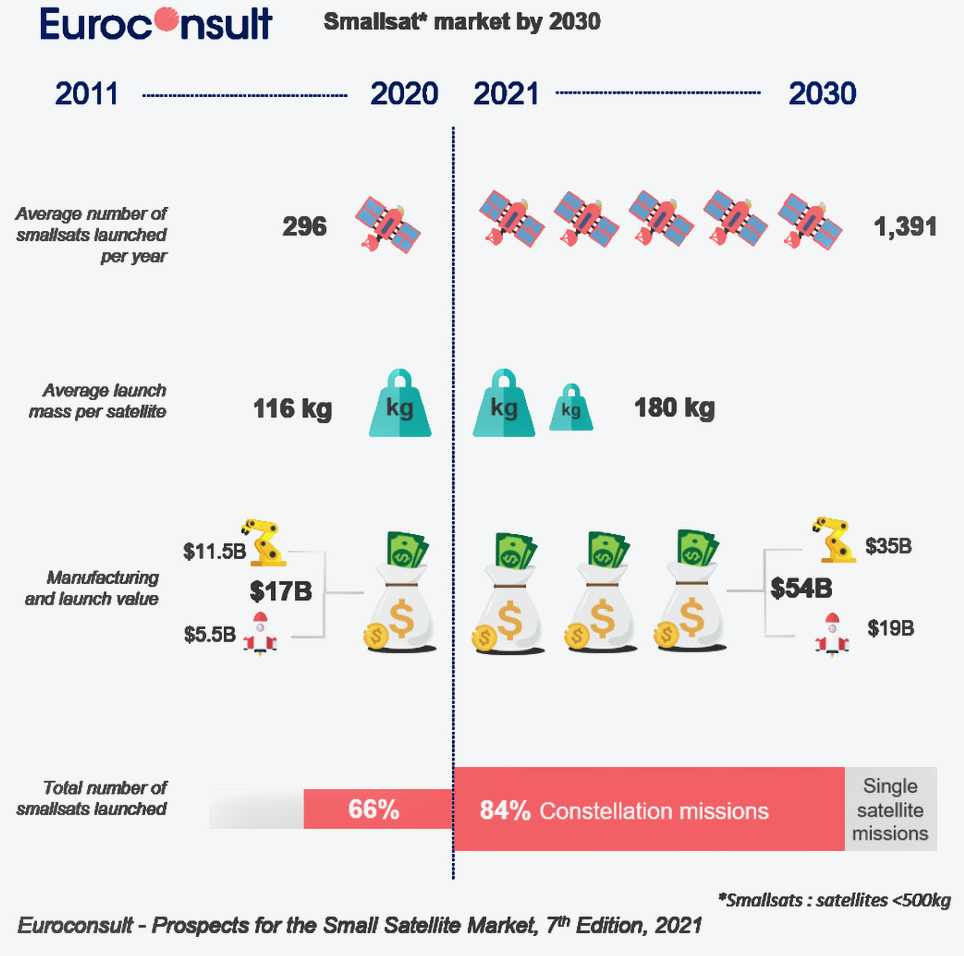

Mega-constellations, resilient to the COVID-19 pandemic, are set to increasingly concentrate smallsat market shares. In fact, Euroconsult anticipates that about 13,910 satellites <500 kg will be launched in the next ten years, according to the company’s latest smallsat analysis and report.

This total represents a 38 percent increase over the 10,100 satellites that were expected in the previous edition of this report. Growth is driven by several factors and must be contextualized, as a few mega-constellations concentrate very large shares of the market and of growth compared to the previous edition:

Growth occurs despite the COVID-19 situation. Its negative effects were overestimated in the past edition as the availability of large amounts of capital throughout the pandemic was not anticipated. OneWeb’s re-inclusion to our forecasts following its Chapter 11, subsequent acquisition and on-going revival illustrates this situation.

Investor interest for the space sector is growing tremendously as demonstrated by the growth in the number of IPOs and SPAC listings inthe United States, including many smallsat players such as Astra, BlackSky, Momentus, and Rocket Lab, among others. The availability of capital combined with the low cost of smallsats is a key growth driver.

ATCOM mega- constellations concentrate increasingly large shares of the market as they prove to be resilient to the pandemic, led by Starlink which in 2020 became the world’s largest operator (over 1,000 units in orbit), and launched an operational service. Most of the growth compared to the previous edition consists of Starlink alone, for which we have added replacement/expansion satellites, as the system grows in maturity and capacity.

Significant growth is expected in China, as it consolidates its various plans for LEO broadband under the GuoWang ITU filings, seemingly a priority of China’s 14th 5-year plan, published in early 2021. China also witnesses growth in commercial constellations.

The smallsat industry is gearing up for significant expansion in terms of capabilities and demand, with the number of satellites to be launched growing more than four-fold over 2021-2030. Numerous companies have developed and keep developing satellite solutions, largely based on constellation projects, to deliver better services and reach out to new users.

Next decade driven by broadband telecom

The market is aided by advances in satellite systems miniaturization, permitted by new technologies in space and space-related sectors, particularly in computational technology and data analytics. As a result, smallsats are now providing operational services that were previously only achievable through heavier satellites. These new and low-cost constellations aim to provide low-latency global connectivity (Satcom) or high- frequency change detection (Earth observation). Smallsats cover a range of applications whose distribution significantly changes in time:

Telecom smallsats are expected to exhibit the strongest growth in terms of units to be launched: close to 8,500 units from 2021 to 2030 (79 percent for Starlink and Kuiper alone).

Although experiencing a decrease in market share, EO satellites are expected to grow in numbers with about 1,812 units anticipated, up from 805 over 2011-2020 (+125 percent). Demand is driven by multispectral and SAR satellites and constellation growth.

STelecom smallsats are expected to exhibit the strongest growth in terms of units to be launched: close to 8,500 units from 2021 to 2030 (79 percent for Starlink and Kuiper alone).

Although experiencing a decrease in market share, EO satellites are expected to grow in numbers with about 1,812 units anticipated, up from 805 over 2011-2020 (+125 percent). Demand is driven by multispectral and SAR satellites and constellation growth.

Other applications, e.g., Security (now including RF monitoring constellations), Science & Exploration and Space Logistics (our latest satellite application featuring IOS, debris removal, last mile logistics and more) are emerging and will account for 693 satellites.

Large overall revenue growth, decrease in $/kg prices

During 2011-2020, an estimated $5.4 billion were the average launch price per kilogram is expected to drop from $54k to $23k (-58 percent), and from $43k to $8k (-82 percent) for >51 kg smallsats (Starlink excepted).

Different trends, however, affect both ends of the mass spectrum: <10 kg smallsats will decrease in cost per kilo from $52k to $26k, a decrease much slower than for >250 kg smallsats which will fall from $10k to $4k due to the weight of Starlink and Kuiper. This is a result of super-heavy-lift capabilities becoming available, e.g., Falcon Heavy, Starship and New Glenn, which are expected to leverage partial re-usability and batch launches to drastically reduce prices.

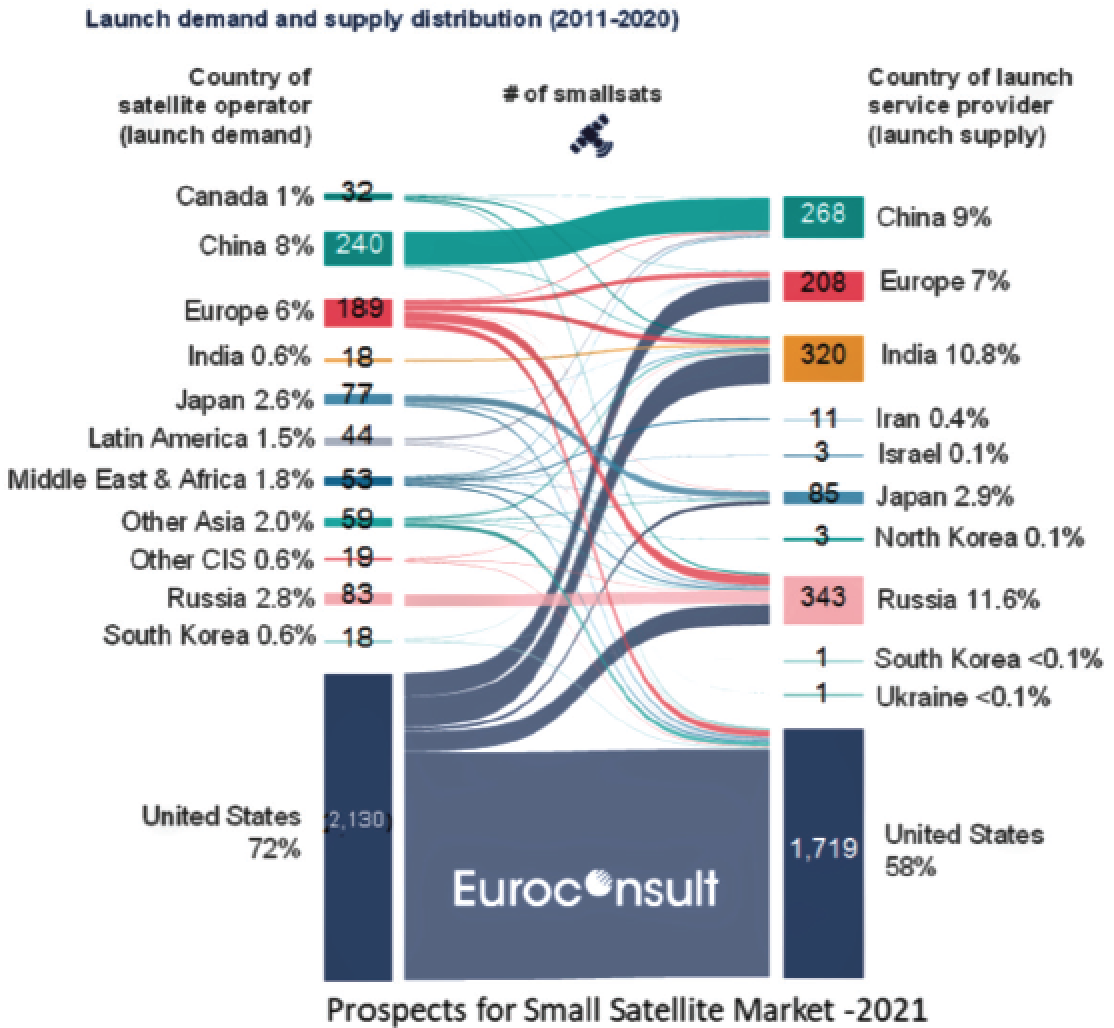

Unbalanced launch supply/demand distribution leads to a global marketplace, retention rates vary depending on regions

The 2,962 smallsats launched over 2011-2020 are not equally distributed between countries of the smallsats’ operators and those of the launch service providers. Only 11 countries own autonomous access to space capabilities and have launched smallsats for their own needs, but also on behalf of 61 other countries as they export their launch services. However, countries with autonomous access to space are not always able to retain domestic demand as local smallsat operators may procure launch services abroad, if a better value proposition exists, or if domestic services abroad, if a better value proposition exists, or if domestic supply is not available, not compatible or not affordable.

With 2,130 smallsats, the U.S. accounted for 72 percent of demand but only launched 1,719 (58 percent) as 411 U.S. smallsats were launched abroad (mostly Russia, India and Europe in the case of OneWeb), not counterbalanced by the 130 foreign units launched in the U.S.

U.S. and China demand are highly captive of their domestic launch industries with a capture rate of 75 percent and 96 percent of their own demand, due to the relevant domestic supply.

Russia and India are the 2nd most active launch providers with 12 percent and 11 percent of the supply. Their market share are fueled by foreign customers accounting for 76 percent and 95 percent.

Only 17 percent of European demand is launched from Europe (i.e. 33 units) as the vast majority of smallsats are launched by Russia (35 percent), the U.S. (22 percent) and India (20 percent).

Rideshare improves retention rate of domestic launch demand

In the U.S, inadequate domestic supply pushed operators to seek launch solutions abroad. Over the last five years, numerous smallsat micro-launchers projects sought to address this demand and retain this segment. While most micro-launchers are still under development, the U.S. retention rate gradually improved, thanks to piggyback opportunities on ISS cargo launches with Nanoracks, rideshares with Spaceflight, SpaceX and Rocket Lab. Rideshares on SpaceX Falcon 9 will significantly improve the U.S. domestic demand retention rate for smallsats.

Smallsat market growth driving spaceport development efforts across the world

To complement and support the development of smallsat- dedicated launch vehicles across the world, numerous spaceport development initiatives are ongoing, supported, driven and funded by government and commercial stakeholders alike. Launch sites have traditionally been operated by government space agencies and military authorities as strategic infrastructure and a critical asset for access to space.

As they are intrinsically linked to the development of a domestic launch capability, launch sites were found only in the few countries mastering launch vehicle technologies. The launch sector has been particularly impacted with SpaceX and Rocket Lab followed by dozens of potential new launch providers developing their concepts and challenging the traditional monopoly of governments in the development of launch vehicles and related launch sites.

The requirements’ diversity of these new players in terms of launch site infrastructures is driving changes in the spaceports landscape around the world in three directions:

Existing government launch sites adapt to commercial launch operators by offering them access to operational installations, e.g., Kennedy Space Center in the U.S., Guyana Space Center in French Guyana.

New launch companies develop proprietary launch sites in order to master their operations independently from other launch vehicles such as SpaceX, Rocket Lab.

New launch site projects emerge to accommodate new privately-developed launch vehicles, often with the support of government funding, i.e., initiatives in the U.K., Germany, Australia, Norway, Sweden, China, Brazil, India and Canada, among others.

Almost 20 new launch sites with an orbital launch capacity are currently under consideration or in planning, supported by various types of stakeholders. These projects have different levels of maturity (technical and environmental clearance, development funding, operation license, etc.) and similarly to new entrants in launch vehicles, only a few will become a reality.

Most importantly, all spaceports will not have access to the same addressable market depending on national/regional preferences for launch service providers, as well as launch azimuths enabled by spaceports’ locations (some will be limited to certain orbits, e.g., polar spaceports limited to SSO launches), and launch vehicle performance.

These considerations only represent the tip of the iceberg. For more details and insights on how to ensure the viability of your business plan in the future decade, a deep dive into the report is highly recommended. To go even further, Euroconsult would be happy to conduct an addressable market strategic study tailored to your needs and requirements, in order to assess the market which your company will be able to address and compete for over the next ten years.

www.euroconsult-ec.com

Author Alexandre Najjar is a Senior Consultant at Euroconsult and his expertise focuses on launch vehicle and satellite market studies, the manufacturing industry, access to space, emerging markets and constellations. He is a regular contributor to Euroconsult’s market intelligence reports, the editor- in-chief of Prospects for the Small Satellite Market, as well as a project manager and contributor to client- specific consulting missions related to launchers and satellites, New Space, and the industrial and economical aspects of the space sector. He has been involved in a wide range of consulting missions covering mega-constellations, spaceports business models, small satellite launch solutions, dedicated launchers, the verticalization of industrial actors, as well as in-orbit servicing. Find more about Euroconsult market intelligence here.