The pressure to streamline, monitor and measure all exploration, drilling and production activities in the age of digitalization has placed unprecedented demands on oil and gas (O&G) companies. With solar and wind energy gaining a cost advantage at a time when skilled workers are in short supply, the energy sector is facing complex challenges that make the industry’s usual boom-to-bust cycles look easy by comparison.

Even if a company is able to maintain a large workforce, current environmental initiatives are driving costs and creating new demands — from corporate ‘net zero’ decarbonization pledges to the capping and monitoring of thousands of orphan wells.

Billions in capital expenditure (CapEx) continue to be pumped into the latest technologies to overcome these issues, and establish greener, more efficient oilfields across the globe. However, ‘smart’ solutions at these remote operations rely on high-bandwidth connectivity in order to really be impactful.

The Digital Revolution

A ‘smart’ oilfield is comprised of a number of varying solutions, all designed to maximize the output of site operations. These include sensors and dashboards, augmented reality (AR) and virtual reality (VR), 3D visualization and design, digital twins as well as cloud solutions. digital twins as well as cloud solutions.

The Internet of Things (IoT) and the growing use of artificial intelligence (AI) is now routinely used to automatically operate devices, especially where it may be unsafe for a worker to execute these tasks manually.

Through these solutions, operators are given the tools to accurately predict trends in data, which can then be used to support real-time decision-making. Data obtained through sensors found in refineries and other areas of the oilfield may also be used to scientifically assist operators when generating future growth trends.

Yet, the usefulness of these solutions depends on the connectivity options that are available. For example, drilling equipment used today in the energy sector can generate thousands of data points per second, with production wells alone generating as much as 10 terabytes of data per well, per day.

To put that into context, 10 terabytes of data is the equivalent of roughly 2.5 million photos, or 5,000 hours of high definition (HD) video.

At the same time, oil refineries are home to hundreds of thousands of highly advanced sensors, all capable of generating even more terabytes of data, yet the vast majority of the information attained from these sensors continues to be thrown away.

Many companies see the process of moving data to a location wehre it can be analyzed and used to make key business decisions as far too difficult or costly.

This is often due to the lack of reliable connectivity for accurate transmissions.

The technologies enabling smarter ways of working are here and can already be actively found in sites across the globe. The problem rests in finding the correct connectivity solution to truly enjoy the benefits.

Harnessing LEO + Cloud Technologies

Two major technological advancements hold the key to turning what has typically been considered a difficult and cost-ineffective process into a truly tangible solution.

One major development has been the Cloud. While this is certainly not a new concept, companies have now begun harnessing this within the energy industry to help increase productivity and profit. The integration of cloud and satellite services is advancing on a daily basis, largely due to the convenience afforded through cloud computing. As a result, the most advanced data solutions have become more affordable, agile and scalable for operators.

However, the majority of cloud-based and cloud-enabled enterprise platforms are unable to handle the latency of Geostationary Orbit (GEO) satellites. This is why the second major development, Low Earth Orbit (LEO) satellites, has been so crucial, allowing many, cloud-based platforms to work successfully over satellites for the first time.

Positioned at an altitude of 500 to1,600 km above the Earth’s surface, LEO satellites are a reliable option for the provision of high-capacity, low-latency connectivity.

Advancements in LEO satellites mean they can now successfully underpin technologies that require real-time connections, including IoT, AR, VR, and 3D digital twin solutions.

Using LEO satellites and constellations produces a step-change opportunity capable of reducing operational expenses (OpEx), while enabling a skilled workforce to service multiple sites and tie distant operations into an operational whole.

In recent years, the market has seen growing commercialization of LEO satellites from operators such as Starlink, OneWeb, Amazon Kuiper and Telesat Lightspeed.

As more companies provide their expertise to drive further innovation in this sector, we may soon see LEO satellites truly reach their potential and overcome concerns related to geographic coverage, performance and licensing.

Smart companies have already started to embrace hybrid approaches, mixing LEO and traditional connectivity offerings — including GEO-based solutions — to achieve dependable committed information rates (CIR) and uptime coveted by energy companies.

Adopting A Hybrid, Automated Approach

Choosing to adopt a hybrid approach enables operators to mix the rise of LEO and the resurgence of the cloud with traditional connectivity offerings, joining GEO, Medium Earth Orbit (MEO), and 4G/5G to deliver reliable, sustainable connectivity, regardless of location.

Implementing solutions that efficiently manage the transition between all connecting paths ensures continuous communication, be it a ship on the move or a fixed oilfield site.

Solutions such as Speedcast’s TrueBeam are enabling automated network management capable of providing proactive monitoring and establishing automatic selection of optimal network paths for remote energy sites.

Removing the need for human intervention by employing a quick and consistent process, operators using TrueBeam and other network management solutions provide a baseline for fast and efficient beam switching.

Intelligent systems like TrueBeam can predict and mitigate potential network challenges, giving energy operators the ability to seamlessly maintain connections.

Similarly, Software-Defined Wide Area Network (SD-WAN) solutions enable an effective hybrid approach to managing connectivity. Should a cellular network be out of reach, SD-WAN will automatically choose the greatest satellite coverage, irrespective of band.

The software will then automatically transition to 4G/LTE or 5G once such is again accessible, returning to the always-on satellite link if other connections fail or are out of range. This ensures sustained connectivity for oilfield sites, even if a satellite or cellular service experience interruptions.

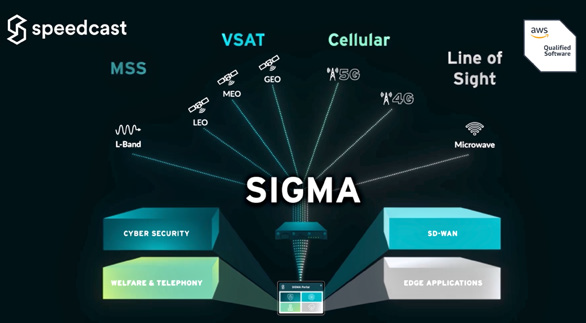

Leveraging smart network management platforms like Speedcast SIGMA can provide these capabilities within an all-in-one service, as they enable quick adaptation to the changing requirements of critical energy operations. Running on the Amazon Web Services (AWS) platform, SIGMA can efficiently manage global VSAT, cellular 4G/5G backhaul and L-band transmission paths, while automatically managing multiple WAN links.

In light of this, many energy companies collaborate with Speedcast to connect their operations, leveraging LEO technologies, backed by reliable GEO-based connectivity solutions, and cloud services, taking advantage of the vendor’s extensive hybrid networking capabilities and expertise as an AWS Advanced Tier Services Partner.

These integrations are already offering greater scalability and the cutting- edge technologies required to transmit petabytes of data reliably and effectively. Subsequently, the majority of data taken from refineries and on-site technologies will no longer be thrown away, but instead can be analyzed to form insights essential to operational efficiency, productivity, and profitability.

www.speedcast.com/

Author Mike Crook is the Vice President, Energy Sales, at Speedcast and has more than two decades of telecommunications experience across multiple sectors, including energy, banking and professional services. Much of his career was spent in various, strategic account management roles at Vodafone UK and Siemens Mobile Devices