The DTC race for satellite connectivity Starlink vs. Kuiper vs. AST vs. Omnispace

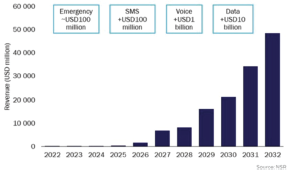

Chris Forrester, Senior Columnist for Satnews Publishers, investigates the prospects for what is turning out to be a major story for the commercial satellite industry. Northern Sky Research believes the Direct-to-Device (D2D) market could be extremely valuable.

First of all, let’s be perfectly clear: satellite telephony connectivity already exists — Iridium in its post-bankruptcy life has proven that there’s a commercial model for their service, whether from ‘first responders’ or military and other specialist users. Apple and Globalstar can already connect users of some iPhone models with SMS and emergency help.

Garmin, for example, offers a near-global “satellite communicator” to adventurers and travellers for use in challenging environments. Viasat and EchoStar/Hughes can provide connectivity to almost any location on Earth.

While the technology is shortly to be in place, the question is whether DTC/ D2D from satellite, with near-zero latency or package loss and available near- anywhere on the planet, has the potential to be a profitable market.

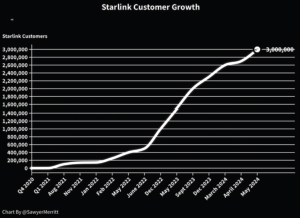

Elon Musk’s Starlink is currently leading the charge and increasingly launching satellites able to handle D2D activity. The company is claiming three million ‘users’ and will probably have achieved four million by year’s- end. If it can open up India and other major markets such as Turkey, then that 4 million could easily be overtaken.

Starlink’s recent addition of the Indonesian archipelago is likely to be another useful market. The opportunities for Starlink are huge in the archipelago of some 17,000 often remote island communities that total more than 270 million people.

Musk visited Bali on the weekend of June 18th and hobnobbed with senior the Indonesian resort of Bali, where the inauguration of Starlink Indonesia’s chief investment minister, Luhut Binsar Pandjaitan. Starlink has now obtained an Indonesian permit to operate as an internet service provider for retail consumers and has been given the go-ahead to provide networks.

Coincidentally, the same weekend saw Starlink go ‘live’ for the 300 or so islands in the Republic of Fiji, marking the 99th nation where Starlink is now available. Fiji is a small nation of barely 1 million inhabitants, but that country’s need for communications is just as valid as with any other country.

Either way, Starlink’s audience is now extremely large and SpaceX clearly wants to expand its current ‘broadband-by-satellite’ services to include direct-tocellular connectivity.

Starlinks's 2024

target countries

British Virgin Islands

Anguilla

Saint Maarten

Antigua

Barbuda

Guyana

Suriname

Bolivia

Mauritania

Senegal

Togo

Chad

Oman

Uganda

Burundi

Tanzania

Angola

Nambia

Zimbabwe

Botswana

Madagascar

Turkey

Azerbajian

Kazakhstan

Kyrgyzstan

Turkmenistan

Papua New Guinea

Tonga

*as of the end of May 2024

However, Starlink is facing a major, potential problem. The background concerns recent transmissions carried out on a UK-registered satellite by SpaceX. The satellite (ICO-F2) was launched by ICO Global Communications in June of 2001.

The satellite was intended to be part of a 12 satellite constellation that would have provided voice, internet and data services over the planet. ICO went bust and emerged from its bankruptcy and is now known as Pendrell Corp.

Crucially, ICO-F2 uses some of the same frequencies as SpaceX. ICO-F2 operates at a much higher altitude (10,500 kms) than SpaceX’s LEO satellites.

The ICO/OMNI-F2 satellite was purchased by Omnispace in 2012. Omnispace is a business with its own objective being the supply of a 5G-type global satellite communication system. Omnispace has some heavyweight expertise on its management team and board of directors, including Lawrence Babbio (formerly of Verizon), Ed Horowitz (formerly of SES and FirstNet), Bruno Fromont (Intelsat CTO), and Gary Parsons (founder/chairman of XM Satellite).

Omnispace has alleged that SpaceX tests harmfully interfered with OMNI-F2 and also claims that it has “empirical evidence” of interference by SpaceX, and that SpaceX’s transmissions would mean that the interference was such that “service cannot be provided.”

“SpaceX’s operations violate the terms of its experimental authorization and must cease…SpaceX again disregarded Omnispace’s requests for information about SpaceX’s test plans. The Omni-F2 MEO satellite at 10,500-kilometer altitude was located more than 17,000 kilometers from the SpaceX test satellite at the time of the observations,” stated Omnispace.

Omnispace supplied detailed signal measurement charts to the Federal Comminications Commission (FCC) as a result of its observations made in January of 2024.

The OMNI-F2 satellite is configured in accordance with the International Telegraph Union’s (ITU) global MSS band with the uplink receive band in the 1980-2010 MHz band.

Omnispace argued to the FCC on May 17 —“If SpaceX’s Direct-to-Cellular service were ever to be deployed at scale, the aggregate interference from hundreds of DTC satellites visible to MSS LEOs would be hundreds of times greater than the levels seen in this test and would render the band unusable by other MSS operators over large portions of the globe.”

SpaceX responded speedily and on May 17 and asked, “Could Omnispace also place on the public record evidence of its actual service and service interruption? SpaceX has been unable to find any evidence that Omnispace provides service to date.”

SpaceX has also volunteered to coordinate its transmissions to obviate any risk of interference.

This is a dig at Omnispace as there are no actual services beamed from OMNI-F2, and therefore, by implication, how could there be interference?

Celebration of the launch of Starlink services in

Fiji with Elon Musk and dignateries.

“Omnispace’s recent letter does not show that SpaceX’s direct-to- cellular experimental testing caused harmful interference in the two limited tests OmnispaceX conducted. Instead, Omnispace has merely demonstrated its ability to intentionally configure its lone MEO satellite to detect SpaceX’s direct-to-cell emissions. This only proves that SpaceX’s direct-to-cell satellites were operating at the time of Omnispace’s tests and detectable under the narrow conditions of those tests, not that SpaceX’s emissions are causing or would cause harmful interference to Omnispace,” said SpaceX to the FCC on May 23rd.

Omnispace has told the FCC it expects to provide initial services in 2026 with 300 LEO satellites.

“We have already completed much of the design and confirmed its viability with vendors,” the company stated.

Omnispace has some powerful partners signed up as investors, not least Intelsat, Fortress Investment, Greenspring VC, TDF Ventures, Columbia Capital and others. It has also announced operational partnerships with the likes of Africa’s MTN Group (“290 million customers in 19 countries”).

Could Kuiper Appeal To Amazon’s Customers?

Amazon’s Project Kuiper announced on May 23rd that it had reached the “final milestone” with its Project Kuiper prototype satellites and was deorbiting the two craft.

A Kuiper antenna.

“That mission achieved a 100% success rate and helped us practice safe satellite operations. Now, we’re gradually bring those prototypes down as part of our commitment to space safety and sustainability, and preparing to deploy our first batch of production satellites,” said the company.

Project Kuiper is gearing up its satellite production facilities. A new 172,0000 sq. ft. factory in Kirkland, Washington State, is now in full production while being supported with parts and components for the firm’s logistics facility at nearby Everett. Kuiper has also taken on a number of technical graduates and apprentices.

Project Kuiper is on record as saying it would start deployment of satellites in this current half-year, but that now seems doubtful. A statement on May 14th did not mention a start date for launching.

Nevertheless, the concept is expected to start delivering five satellites per day that will be shipped down to a processing facility in Florida starting in June and will then be ready for launch.

“With our manufacturing facility in Kirkland coming online, we’re able to ramp satellite production ahead of our first launch and move faster in our mission to connect the world. Just like our advanced satellite design, we conceived our production line and manufacturing processes fully in-house. We also have a top-tier team delivering consistent, high-quality work every step of the way,” said Steve Metayer, Project Kuiper’s VP/ production operations said in the Amazon announcement.

The company added, “Now, the team is shifting focus to the first full- scale launch of Kuiper production satellites, kicking off a regular cadence of launches to deploy the entire 3,232 satellite constellation.”

That team is now about 2000 strong and Kuiper is happy to talk to new talent and is recruiting extra, full-time staff in Florida at a minimum salary of $80,000.

The two prototype satellites were placed in orbit in October of 2023. However. Kuiper is very much on an obligatory tight timetable. It must, according to FCC and ITU rules, launch at least half of the overall 3232 satellites by July of 2026.

Project Kuiper is also dependent on available launches. The firm has its own Blue Origin rocket family, as well as orders with Ariane 6 and the United Launch Alliance as well as SpaceX to handle the launch tasks.

Meanwhile, Kuiper has applied to the FCC for a blanket licence to cover “Earth Stations in Motion” (another way of talking about ground-or-air based users). The licence would cover access to and from the Kuiper fleet by cars, ships and aircraft. In its application to the FCC, Project Kuiper requested that its upcoming satellite Internet system be allowed to operate in vehicles that are “in motion,” including land, sea and air. It wants a “general license” to operate satellite dishes on moving vehicles throughout the U.S. and in international waters.

Project Kuiper stated that the proposed license would apply to three models of satellite dishes: the ultra-compact model, which can offer download speeds of up to 100Mbps; the standard model, which can reach speeds of up to 400Mbps; and “a larger, high-performance model,” which can deliver 1Gbps downloads.

Amazon plans to offer a beta version of its Project Kuiper service by the end of 2024, potentially providing consumers, businesses and governments with an alternative to Starlink.

Then There’s AST Space Mobile

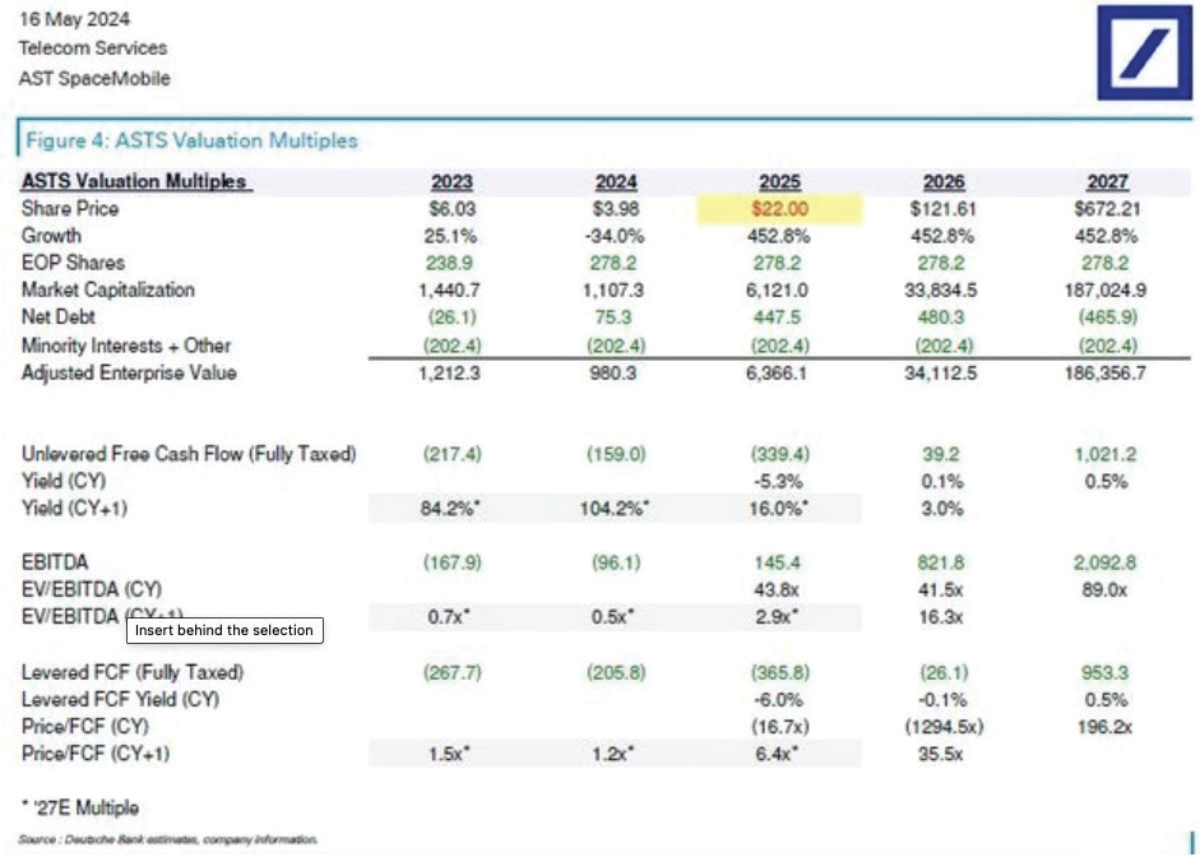

AST Space Mobile has just one satellite currently on-orbit which is something of a test prototype for a planned, global satellite-based, ‘direct-to-cellular’ service. AST’s follow-up ‘BlueWalker 3’ satellites are expected to be ready for launch in batches of five craft starting this summer (in July or August, according to statements from the company) and continuing in batches of throughout 2024 and 2025.

AST is forecasting that, over time, it will be connecting a fair proportion of a target global audience of 2 billion — current — smartphone owners. The firm stated they are aiming for 121 million customers, and that’s said to represent about 10% of all telco customers of the operators it has signed up.

Some observers are highly sceptical of those targets; however, recent reports from investment banks Morgan Stanley and Deutsche Bank talk — perhaps optimistically — of tens of millions of users and spectacular share price value of $100 (per share) by 2026 are considered to be viable. Deutsche Bank currently gives AST a share price target of $22 (up from $19) and still significantly ahead of AST’s current trading.

But AST’s share price rocketed at the end of May (up 69% on May 29th) with news that Verizon was investing $100 million in AST. With AT&T as well as Verizon on board, investors believe that AST is well on its way to success.

The share price uplift has prompted a significant amount of fresh shareholder interest in AST, which has propelled its share price from barely $2 a share to an impressive $9.02 by May 29th.

AT&T’s CEO, John Stankey, talked on Bloomberg about how “excited” he was about AST. Stankey explained that cellular hand-set phone sales were slowing despite spectrum demand growing some 30 percent a year. Stankey said that it had clear ideas about the size of the potential market and who wanted ‘always on’ and always available network access.

“We think there’s good applications and demand, and we want our customers to be connected everywhere they might be [located].” Key to AST’s appeal, said Stankey, was that the service from AST would be seamless as far as the consumer was concerned. “I think customers don’t want to drive off a network, and they want to be able to have a relationship to say that when I’m out on that interstate highway on my trip, that I can be confident if something is going on at home, that I’m going to know about it. And if I’m on that unique vacation where I’m in some place that typically is a bit off the grid, that I’m confident I’m going to be able to at least get the kind of communications done with my work and my office in a way that I feel like I’m not entirely disconnected, or more importantly, post that very, very special picture that sums the day of my experiences up and feel like I can continue to push my brand forward.”

AST is not alone. There are others, not least of which is Apple — that company is working with Globalstar and is currently offering a DTC emergency service on some of its smartphones.

Chris Forrester

The question now is whether Starlink, Apple, Kuiper, AST or the other would-be DTC suppliers can win global audiences for D2C telephony. Can fortunes be made?

Or, might there be a casualty or two enroute to on-orbit services?

Author Chris Forrester is the Senior Columnist and Contributor for SatNews Publishers and is a well-known broadcasting journalist and industry consultant. He reports on all aspects of broadcasting with special emphasis on content, the business of television and emerging applications.