Satellites of less than 180 kilograms are becoming increasingly popular because of their ability to enable new technologies and achieve revolutionary results. No longer used exclusively by government agencies, satellites — and in particular — small satellites (smallsats) are gaining in popularity with the private sector.

Smallsats Gaining Traction with the Private Sector

The satellite industry is no longer reserved for billion-dollar programs. In fact, the private sector is currently the strongest driving force behind the smallsat boom, overtaking government projects. While satellites were traditionally created and operated by a few government agencies, small satellites are now accessible to the private sector as new venture capital is flooding into the industry. Smallsats require fewer resources to create, launch and monitor than those from past programs. As a result, smallsats are most commonly used for commercial projects, especially by start-up companies, which are quick on their feet and willing to take on more risk than traditional players in the space industry.

More Cost-Effective with Less Risk.

Smallsats are significantly less expensive to construct than their traditional, larger counterparts, so more satellites can be launched for a set budget. They can be built more quickly, using off-the-shelf electronic technology or circuitry, standardized communications equipment and star tracker technology — all factors that keep costs low.

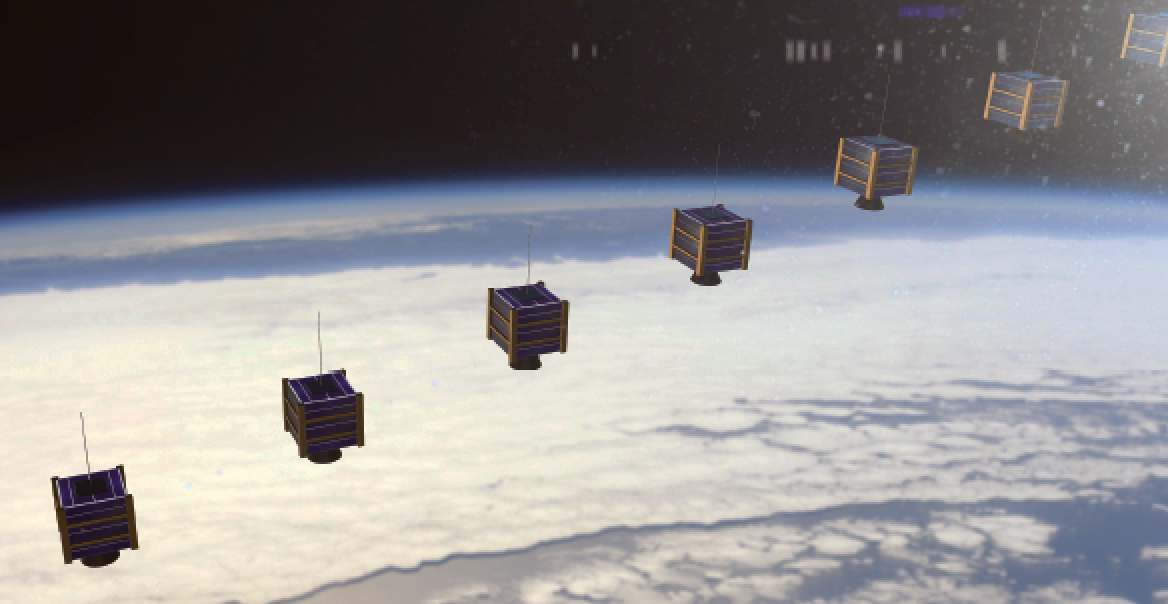

Due to their reduced size and weight, multiple satellites can be launched at one time rather than individually, as is standard practice with larger spacecraft. Companies can split launch costs by using the “rideshare” concept in which multiple small satellites are attached to larger ones. Even when they are launched individually, smaller, more cost-effective launch vehicles and equipment can be used.

Instead of spending 500 million dollars on just one large satellite, a growing number of companies are building smaller, less expensive satellites and spreading the cost among multiple devices which, in turn, reduces their financial risk. For example, when launching 20 smallsats and one fails in orbit, the company will gather data from the 19 working devices and can economically add a replacement satellite on the next scheduled launch. In contrast, the failure of a large satellite has the potential to set large commercial, military or government programs back for months or years.

In addition to the economic feasibility of building and launching smaller spacecraft, the return from smallsats is quicker as well as they have the capability to view different parts of Earth without completing multiple orbits. They offer better access to information from the high volume of spacecraft in orbit at any one time, so they can gather, so they can gather and relay more data more quickly.

Finally, the smaller devices minimize the risk associated with larger satellites in terms of testing new technologies in space rather than the lab, and in terms of the potential for “theft.” As is the case with any high-value national asset, large satellites are prime targets for attacks while smaller satellites are generally considered to be less attractive targets. If they are attacked, they are less costly to replace.

New and Expanded Capabilities

Companies are using smallsats to access information for a variety of reasons — from helping save lives to growing their capacity and extending geographic range to name just a few. One area benefiting from the use of small satellites is mapping, whether for roads, geological formations or information for GPS tracking. During wild fires in California, smallsats provided critical information about fire patterns so operators could then plan where evacuations would be needed.

In the commercial sector, communications companies use smallsats to expand their cellular service and internet coverage over larger rural areas that have no existing infrastructure. Being the first to cover previously untapped geographic areas represents a large growth opportunity and commercial advantage for companies trying to get ahead of their competition. This will be especially impactful in developing countries, allowing them to skip building traditional terrestrial communications infrastructure.

The ability to monitor and survey large areas remotely eliminates the need for dispatch of on-the-ground personnel which improves efficiency and saves on logistics costs, adding great commercial value. Other markets seeing the benefits of satellite technology include mining companies that can more economically locate untapped deposits or energy companies that want to minimize the potential for service outages by locating and monitoring trees growing too closely to power lines, to more effectively plan maintenance measures.

The Role of Smallsats

Space is one of the harshest operating environments for any technology, including small satellites. Instrumentation and imaging devices must be able to withstand extreme temperatures, collisions with meteoroids, debris and many forms of radiation — with no room for error and minimal opportunity for repair. Selecting the appropriate materials for space-based systems and components is critical for successful deployment, accuracy, reliability and durability in operation.

Conventional materials cannot stand up to the demands in space applications, so selecting advanced materials for satellite components is critical. The ideal material features low weight, high specific stiffness, with low co-efficient of thermal expansion (CTE). In general, low CTE is desirable to control thermal effects of components exposed to extreme temperature ranges seen during orbits and high specific stiffness is desirable to tune natural frequency in structural applications.

These specialty materials support the strong growth of the small satellite sector, with newer materials offering engineers and scientists more options than ever before.

What’s Next for Smallsats?

It is expected that venture capital funding for smallsats will continue to outpace government funding over the next few years, as the cost of rocket launches decreases and enables more private sector options. For now, private companies dominate small satellite efforts, but other groups are shifting toward the adoption of this vital space technology.

For example, universities across the United States are expanding course work to include small satellite training programs. University-sponsored teams are working to build and launch their own satellites with the help of corporate partners. These initiatives are driving the growth of this emerging industry and producing a new wave of engineers and scientists skilled in satellite technology, including design, construction and operational infrastructure to support them in space.

With growing concerns about cyber security, the small satellite industry will likely grow in parallel with the need for better, more effective cyber security technologies. In fact, the cyber security industry is expected to increase by nearly three million jobs over the next ten years. Currently, this industry depends heavily on smallsats to enable secure communication processes through laser communication technologies which transfer data at higher rates and make it harder for information to be intercepted.

Government agencies are also embracing the trend. Traditionally, NASA has built large satellite projects, but they, along with other government operations are starting to follow the private sector in developing small satellite capabilities. This paradigm shift will eventually enable larger scale solutions with more distributed costs. Over the next few years, there will likely be continued government support and funding for smallsats missions, and as the industry expands, companies such as Materion Corporation will continue to design and manufacture advanced materials solutions that enable new technologies needed to propel the industry forward.

The Opportunities

Smallsats open a wide range of opportunity for space exploration, earth monitoring and communications. From monitoring polar ice caps, to mapping roads to laser communications, companies are finding they can achieve their missions more cost effectively and with reduced risk when using smallsats. It is expected that venture capital funding for smallsats will continue to outpace government funding over the next few years, as the cost of launching rockets decreases and enables more private sector options.

There will always be a need for large, traditional satellite assets; however, as smallsat capabilities are expanded, advanced materials will play a vital role in bridging that gap to higher performance.

Rob has 40 years of experience working in the beryllium and carbon fiber composites industry. He was a co-founder of R-Cubed Composites and, in the mid 1990s, R-Cubed fabricated and delivered 50 AlBeMet smallsat bus structures for the OrbComm Satellite Constellation.

Rob joined Materion in 2005 and is currently the Manager of Market and Business Development for the East Coast of the U.S.

Materion Corporation, an advanced materials provider, has a proven record designing and manufacturing material solutions that meet the requirements of harsh space environments. The company’s advanced materials address the most common challenges for space structures, including mass, dimensional and thermal stability, ability to perform at both elevated and cryogenic temperatures, ability to handle launch loads and emissivity.

The company began providing materials such as beryllium metal, copper beryllium alloys and precision optics for space-based applications at the inception of NASA’s space program.

Continued innovations and improvements from Materion in the development of advanced materials will support growth and emerging technologies in the space industry. Materion currently offers a range of products that are meet the demanding requirements of space technologies, including AlBeMet®, AlBeCast®, SupremEX® and E-Materials metal matrix composites (MMCs). These materials are light weight, yet provide a unique combination of strength and stiffness that optimize a range of satellite applications. In addition, the company has developed specialized expertise in the design, manufacture and testing of high performance beam splitters and multispectral filter arrays. Materials from Materion have been successfully used on the James Webb Space Telescope, the Hubble Telescope and space-based surveillance and targeting systems for missile defense and commercial satellites and are now contributing to smallsats.