Small satellites (smallsats) are creating new and disruptive opportunities in today’s space industry — applications that were once the purview of traditional satellites in geosynchronous equatorial orbit (GEO) are finding that, in a growing number of cases, those applications (Earth observation [EO], imaging, etc.) are being performed by small satellites in Low Earth Orbit (LEO).

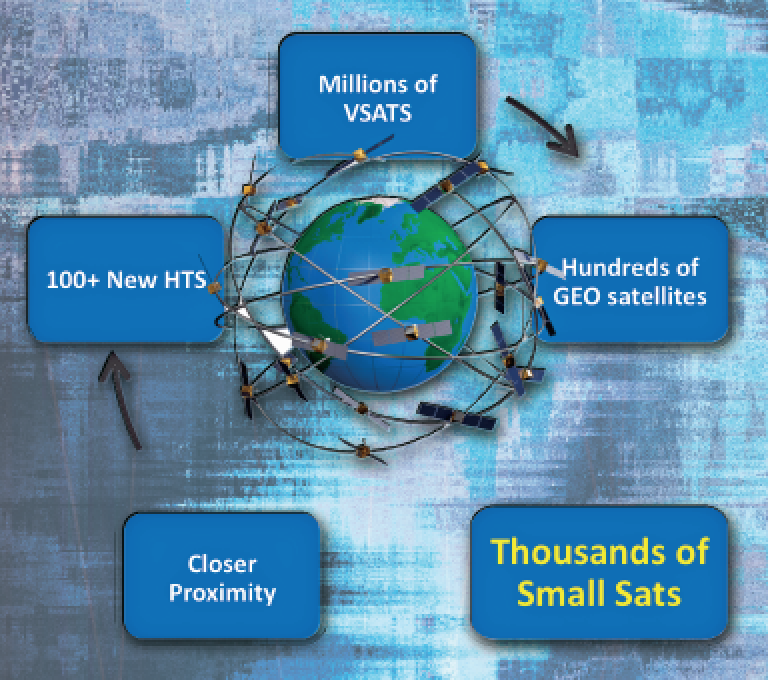

Thousands of smallsats will add to a growing RF interference issue...

Big satellite programs can take decades to procure, build, launch and operate at price tags in excess of a billion dollars. In contrast, the benefits of smallsats can be significant — lower costs to acquire and launch, plus a higher refresh cycle that supports rapid technology insertion as programs and technology evolve.

Additionally LEO satellites offer reduced communication time lag (latency), require less energy to place into LEO orbit and less powerful amplifiers for successful transmission. As such, they are used for an increasing number of existing applications and are poised to add communication applications in the future.

However, unlike GEO satellites, LEO satellites are in non-geostationary (NGSO) orbits and thus require a constellation of smallsats to provide continuous coverage.

Significant Growth Anticipated... Along with LEO/GEO Interference

According to Statistics MRC, the global smallsat market is expected to grow from $2.28 billion in 2016 to reach $7.66 billion by 2023, with a CAGR of 18.8 percent.

Rising demand for high-resolution imaging services, lower costs and continuing technological advances are some of the factors driving the market.

However, the deployment of LEO constellations is apt to significantly escalate interference issues with GEO networks.

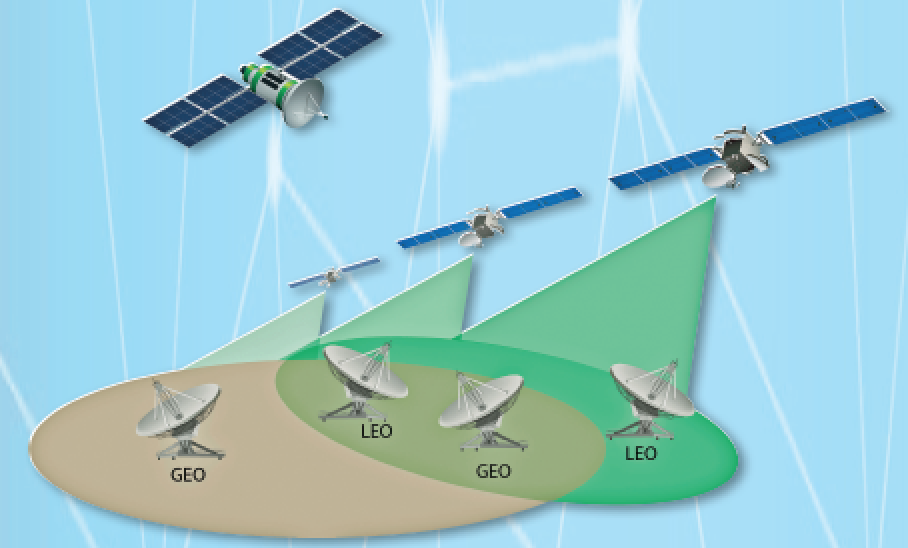

As proposed constellations are launched and the number of LEO satellites increases dramatically, so, too, does the risk of LEO/GEO satellite interference. This is caused when a LEO satellite crosses the path between a GEO Earth station and a GEO satellite.

This problem was first recognized during an earlier wave of proposed LEO constellations some 20 years ago. At that time, the International Telecommunications Union (ITU) stated that NGSO craft bore the responsibility for avoiding interference with GEO satellites.

Per the ITU, the responsibility was with the NGSOs to undertake measures, including power management, pursuant to Equivalent Power Flux Density (EPFD) limits, repointing beams so as not to interfere with the beam footprint of a GEO beam and changing frequency bands to avoid interfering with GEO transmissions.

Fast forward 20 years. Among the advances in GEO satellite technology is a significant increase in the sensitivity of GEO satellites, enabling satellite operators to utilize smaller antennas, i.e., 2 meter vs. 6 meter. On the LEO side, as LEO satellites are closer to Earth, they also use smaller antennas.

While the smaller antennas have much upside, smaller footprint and reduced costs, they also have their downside. Smaller antennas have higher side-lobe gain, increasing the possibility of interference of operational power requirements. In the larger GEO antennas, side lobe gain might be 60 dB down. However, in small antenna, this will be much less so, making them more susceptible to interference

As a result GEO satellites previously protected from interference by LEO, EPFD limits are now more susceptible to LEO satellite interference, even though they operate within the EPFD limits established by the ITU.

At a 2016 conference, Daryl Hunter of ViaSat expressed additional concern that the deployment of smallsat constellations would makes the identification of LEO satellites that are violating ITU rules much more difficult — whether accidentally or intentionally occurring.

Frequency Sharing

To optimize the frequency spectrum, GEO and LEO satellite operators may sometimes share the same Ku-/Ka-band frequency band once the LEO operators, in their licensing application, demonstrate how they plan to minimize this potential conflict.

In this instance, LEO satellites crossing the equator will have to change bands to avoid interfering with the GEO satellite, whose frequency rights take precedence. Once passed the equatorial belt, they can resume frequency sharing with the GEO satellite.

Should LEO satellites achieve the numbers forecast for them, frequency sharing between LEO satellites and existing GEO satellites could become the norm rather than the exception.

Beam Pointing

In the northern hemisphere, GEO antennas point to their satellite in a mostly southerly direction, while LEO antennas will point in a northerly direction so as not to interfere with the GEO signals.

An LEO satellite crossing between a GEO Earth station and a GEO satellite.

As LEO satellites cross the equator, their payload is switched off so as to not interfere, or be interfered with, the GEO antenna beam footprint. Once clear of the footprint, the LEO satellite is switched back on.

Power Management

As discussed earlier, power management on the part of the LEO operator is another means to avoid LEO/GEO interference. The potential issue is that as satellites become more sensitive due to beam shaping, the ground GEO antennas are getting smaller, which means lower Equivalent Isotropically Radiated Power (EIRP) to the satellite, and also less gain on the receive side.

The consequence is that side lobe gain of the antenna becomes relatively higher compared to larger antennas and so more susceptible to interference from legal third party transmissions such as frequency sharing terrestrial systems as well as LEO communication systems.

The question is: will EPFD limits for LEO satellites need to be reduced... and, will that power reduction have any negative effect on their ability to adequately perform their mission?

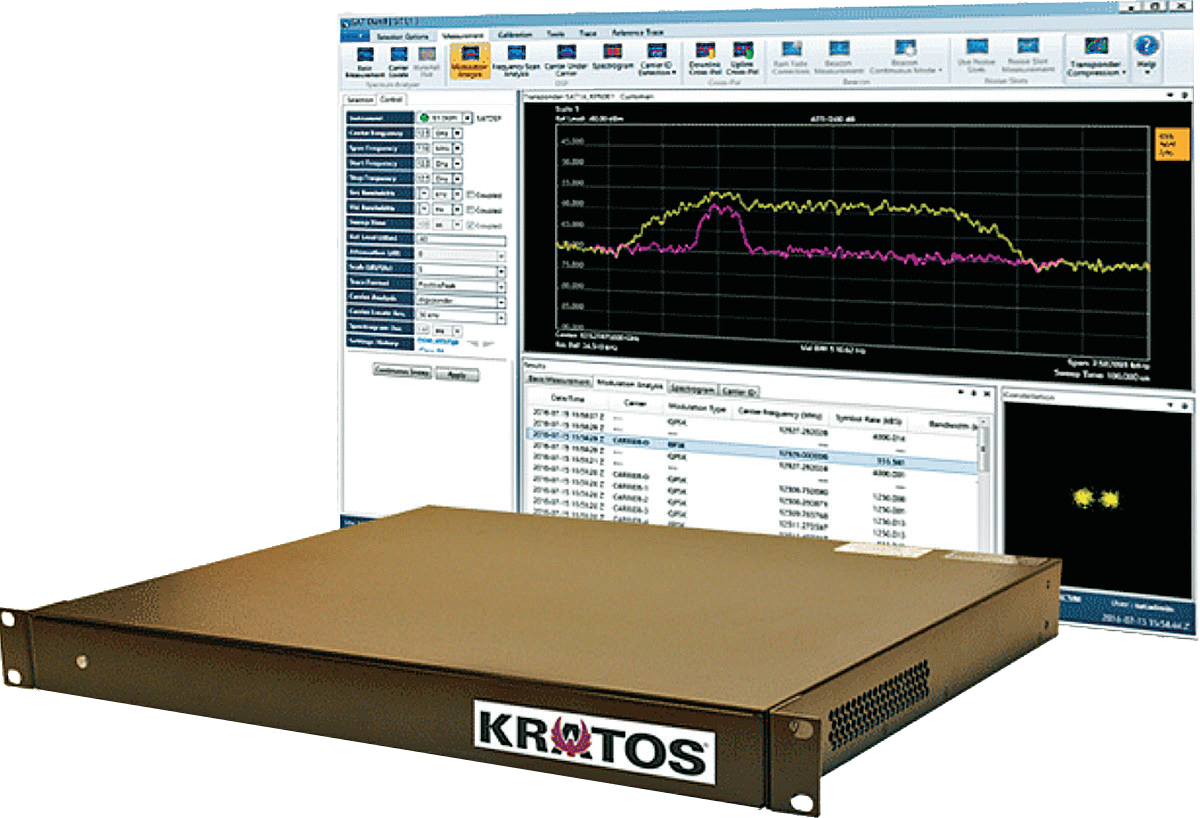

Kratos’ Monics with digital signal processors (DSP).

The bottom line is that while there are approaches to minimizing LEO/GEO interference (power management, beam management and frequency sharing) these are going to become more difficult to manage as space is flooded with hundreds, if not thousands, of smallsats in multiple constellations.

To that end, Kratos is working with a number of LEO operators to enhance, and make more effective, the monitoring and management of EPFD limits, beam pointing and frequency sharing.

Working with LEO operators, Kratos is leveraging the carrier monitoring capabilities of Monics®, the company’s industry-leading carrier monitoring and interference detection solution, the M&C capabilities of Compass® and the data analytic capabilities of Skyminer.

A packaged solution for LEO operators is being developed by Kratos to monitor the performance of a company’s complete satellite network, drilling down to ground systems, satellite performance, beam pointing and power usage to minimize interference with GEO satellites.

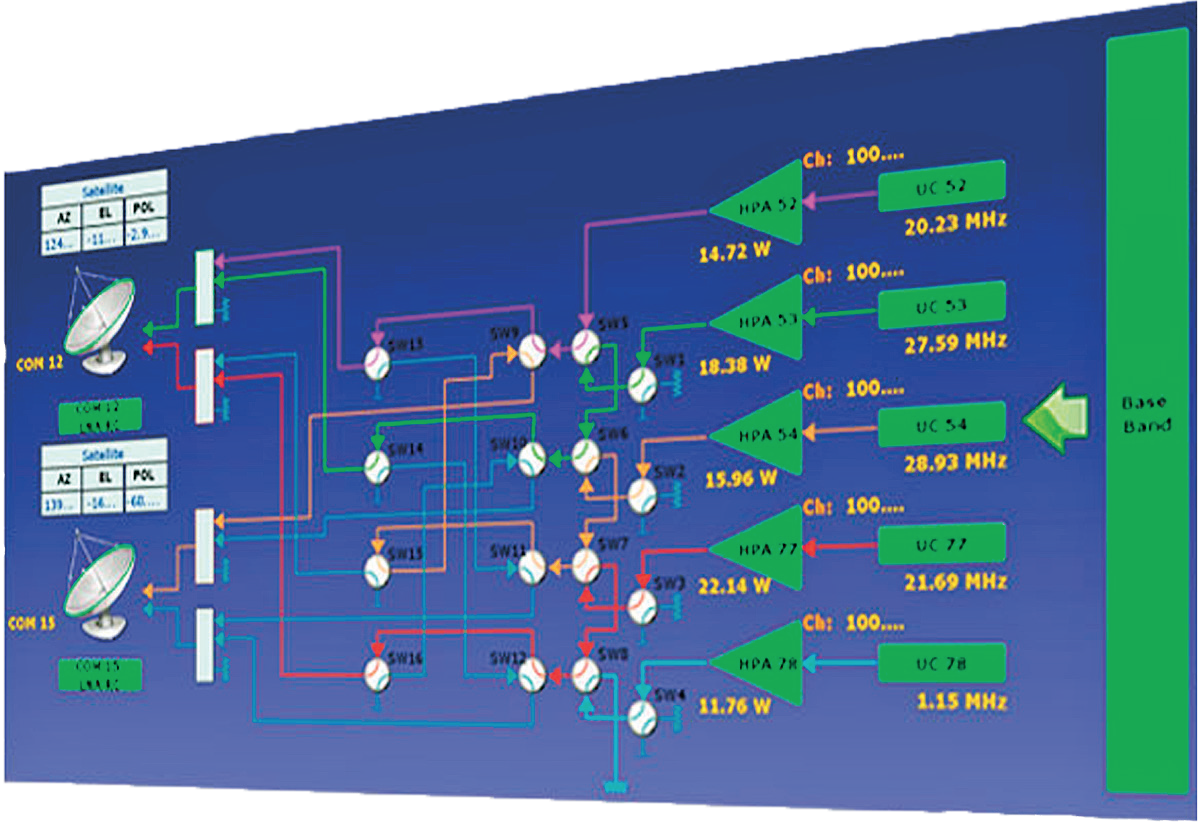

Kratos’ Compass® screenshot.

Monitoring Makes Good Neighbors

Kratos’ approach to minimizing LEO/GEO interference is to enable the new smallsat constellations to act as “good neighbors” to their more established GEO counterparts.

As envisioned by Kratos, in conjunction with LEO satellite operators, Monics will monitor the total performance of the LEO satellite to include beam patterns and pointing as well as measuring the RF energy to monitor compliance with ITU EPFD requirements.

For those LEO satellites sharing Ka-/Ku-band frequency with GEO satellites, Monics will monitor spectrum usage to ensure that there is no spectrum degradation to the primary user —the GEO satellite. Monics’ algorithms and measurements are fast enough to adjust to any Doppler effects (shifts) that might occur during the satellite pass. Additionally, interference characterization, will determine local (terrestrial) interference affecting the LEO gateway.

With Monics, all carrier spectrum monitoring is available through one logically organized client, increasing operational efficiency and reducing time needed to manage and protect the RF spectrum.

Gateway M&C

While Monics monitors satellite performance, Compass monitors the LEO operators’ ground operations. Compass will provide LEO operators with complete visibility to monitor and control equipment from a single management console; enable them to change displays, add devices and perform configuration changes with an easy-to-use interface.

Analysis/Corrective Action

Monics’ satellite monitoring data will integrate with Compass’ gateway M&C data to provide the LEO operator with service level assurance. The RF measurement becomes part of the data network management tool-set thereby assuring data throughput in Bits/Hz rather than dBW and MHz.

Dashboards provide instant system overview and situational awareness of the network, while advanced analytics from Skyminer provide prediction of outages due to external factors such as weather, along with trend analysis and cross correlation to determine localized interference issues. Skyminer offers unlimited aggregation capabilities and predictive analytics that provide the LEO operator the ability to compensate/correct potential performance anomalies (power usage, beam patterns, frequency sharing, etc.)

These proven capabilities — satellite monitoring, ground equipment M&C and analysis — will be integrated into a packaged solution for LEO operators.

Should even two of the proposed mega LEO constellations become a reality, they will affect all GEO satellites; thus LEO and GEO operators will need to actively cooperate to ensure that the best both have to offer are made available to all.

The majority of GEO satellite operators worldwide employ carrier monitoring and interference detection products such as Monics, which can provide early warning of potential LEO interference so that cooperative preventive/corrective action can be taken.

Today, a number of GEO satellite operators are either invested in LEO operators or are actively working with them. The cooperation between the two camps is driven by their common need–to coexist and neutralize interference.

www.kratoscomms.com

Editor’s note:

An interesting article in Intelsat General Corporation’s SatCom Frontier infosite, entitled “Talking Space Technology with Kratos’ Stuart Daughtridge” discusses Continuous Wave (CW) Interference, the new Kratos modems that can address these issues, how interference monitoring can change for HTS as well as other interesting topics. To read this informative article, please visit www.intelsatgeneral.com/blog/talking-space-technology-with-kratoss-stuart-daughtridge/

Kratos and the SmallSat Market

In addition to adapting its traditional satellite products to the smallsat industry as described above, Kratos is committed to the advancement of the industry with quantum®, a fully functional C2 to RF suite of solutions specifically designed to meet the cost, size and ease-of-use requirements of small satellites.

quantum’s hardware agnostic software solutions leverage virtualization technology, reducing risk and eliminating integration labor. quantum’s offering includes C2, signal processing, front end processing, and mission data processing capabilities for high demand applications and is uniquely engineered to support individual spacecraft missions, spacecraft, test, and spacecraft fleet operations.