Each of the ‘big three’ satellite operators—Intelsat, SES and Eutelsat—issued their quarterly results at the end of October, a terrific opportunity to compare and contrast each firm’s progress.

Some major announcements from these respective operators causes concern, as two out of the three majors—in effect—downgraded their expectations and the third is under close observation for the next calendar year.

On October 30, Intelsat’s Q3 numbers were released and issued what were, undoubtedly, disappointing results. CEO Dave McGlade took the news on the chin and admitted that Intelsat was in a “transition period” pending the launch of its three giant ‘Epic’ satellites. “The level of innovation that our sector is experiencing is at much higher level pace than it was at little as five years ago not only with respect to high throughput satellite design, but on other elements of the ecosystem as well,” he told analysts, and stressed that Intelsat was aggressively engaged across the board to identify these new innovations.

He also said that bad (slow-paying) debts were being resolved and would help boost EBITDA margin guidance for the full year to move upwards from 79 to 80 percent. Intelsat’s bad/slow debt burden was costing the company from $8 to $10 million a year—in 2013, that financial strain spiked up to $30 million.

“With Intelsat 30 being placed into operations in the next several weeks [and shortly after to be handed over to DirecTV], we look forward to our three upcoming satellite launches in 2014, including the first Intelsat Epic satellite launching late in the second half of the year. These new assets, combined with new service offerings, will fuel renewed growth in the midterm. For now, we remain focused on reducing debt as an important near-term lever to equity value,” McGlade said.

He also addressed the state of play over Africa, traditionally a stronghold for Intelsat, and said that increased deployment of fiber was one problem. “But it really has been the entry of new satellite operators, most of which have traditional capacity, that are putting the pricing pressures into the marketplace. And that has been most broadly seen through the second tier players. So, they have been the most aggressive in terms of pricing.”

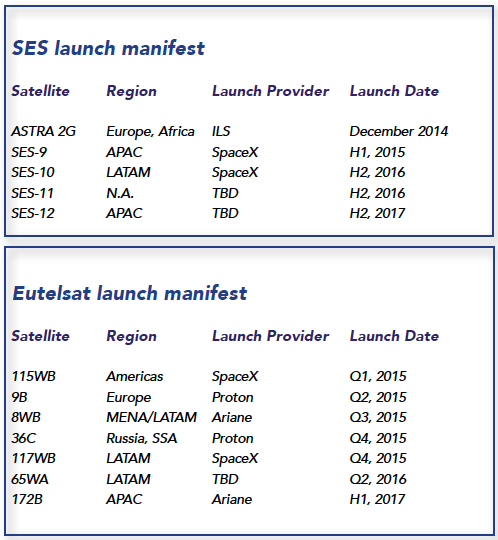

Of course, Intelsat isn’t alone in terms of expansion plans and the threats from tough competition. There cannot be many satellite operators who do not wish expansion. Eutelsat is a perfect case in point, having absorbed Satmex a year ago and is now reaping the rewards of the Mexican acquisition.

Like Intelsat, Eutelsat is under a certain degree of pressure from the U.S. governmental downturn (although its Q1, to September 30, saw something of a bounce back of +2.8 percent in revenues). Overall, Eutelsat is doing extremely well. With revenues up 4.2 percent (on constant FX basis), and guidance for the rest of its financial year to June 2015 staying at about 4 percent, with EBITDA margins of above 76.5 percent.

There was also positive news in the shape of its ‘Value Added Services’ up 14.5 percent and helped by Ka-Sat revenues which saw 12,000 terminals activated in Eutelsat’s first quarter with marketing campaigns likely to build on momentum. The current position is that there are 166,000 activated terminals using Ka-Sat (up Year-on-Year from 108,000) with ”a good uptake in France, Germany, Turkey and Italy.” Revenue for the quarter stood at 26m euros (25m euros in Q4/2013), and 23m euros this same period last year.

However, Eutelsat CEO Michel de Rosen pulled one fascinating rabbit out of his hat in the shape of a proposed Scrip dividend option/issue. Investment bankers Berenberg summed up the situation, and said,“Management was pressed on whether this implied it was under pressure from banks, or was planning further M&A. Certainly, as we have highlighted previously, there is no margin for error in the balance sheet if the group wants to maintain an investment grade rating (to which it reaffirmed its commitment). It will be interesting to see what take-up the scrip dividend receives.”

The fascination will be to see whether the Scrip decision represents a preliminary move towards another acquisition by Eutelsat.

On October 31, in the busy cluster of announcements, Karim Michel Sabbagh, CEO at SES, was not helped by the admitted “strong headwinds” and miserable numbers from North America (revenues down 13.7 percent).

He was, nevertheless, buoyed by the opportunities that are now starting to kick in from O3b Networks. He wants to see further expansion at O3b, the satellite constellation that will serve the ‘other 3 billion.’

However, O3b has experienced technological issues with its first four satellites, which will mean a $315 million insurance claim. The troubled satellites are still flying but will have shorter lives than expected. SES has an option to significantly increase its stake in O3b, which seems likely in the medium term, and Mr. Sabbagh hinted that SES might revise their current guidance toward the end of the year.

Arianespace’s Soyuz lifts off from the Spaceport’s ELS launch facility with four additional connectivity satellites for O3b Networks. Photo is courtesy of Arianespace.

This author is also reminded of a report from bankers Morgan Stanley which suggested that—in its then model—the O3b stake might be worth an Enterprise Value of 4 billion euros and worth 3 extra euros a share. That’s appealing, and O3b’s agreement with Royal Caribbean’s Quantum of the Seas cruise ship kicked in on November 11, which should add more than a few dollars to the revenue picture.

In other words, all eyes will be on O3b as the company gets into gear with a working constellation. The constellation went ‘live’ on September 1 and Sabbagh says it is on track to “operationally” activate the majority of the 30 or so “committed” O3b clients by year’s end. O3b has significant growth potential, said Sabbagh. This comment was amplified by the market.

Sarah Simons of Berenberg, in a “BUY” note to clients on November 7, said that SES had a “hidden gem” and “a positive surprise” in O3b—“O3b has already stated that it is achieving higher throughput from the fleet than originally anticipated. Meanwhile, client feedback has been very good and early customers have already increased order size. Management is already talking about the need for incremental capacity, given the strong order pipeline.”

Sabbagh told analysts that despite a cautionary outlook, the past year had seen transponder capacity grow by 4.4 percent (to 1,534) and utilization grow 2 percent (to 1,110 transponder equivalents). European business is expanding well (up 11.2 percent), as is its “very significant” international revenues, which expanded 7.3 percent. SES specifically highlighted Yahlive’s progress, which was also moving forward well. Nevertheless, 2015’s growth was likely to be more modest.

One SES area that received mostly negative local press in its early period is their HD+ offering. Now in its fifth year of operation, HD+ (which delivers a modest fee to broadcasters for soft-encrypting their HD channels) now has 1.6m paying households and is gathering “a strong momentum,” said Sabbagh. There are now 19 private broadcasters in the HD+ consortium, with more than 30 other FTA channels in the system.

These were the good news elements, but those pesky governmental cut-backs and the revenue declines from North America meant that guidance for 2015 is being reduced to 4 percent, and with EBITDA growth to 5 percent, the next three year revenue/EBITDA pattern is expected to deliver a CAGR of 4 percent. Despite this downgrade, SES stressed they are committed to a “progressive dividend” and that the company expects operating free cash flow to continue improving into 2018-2019. This would allow “organic investment opportunities” and the construction of four, as yet unspecified, programs. There will be additional “inorganic” opportunities, and this included the option to take full control of O3b, which analysts expect to happen in 2015.

Not mentioned—and they never are—are future M&A opportunities for any of the ‘big three.’ Berenberg referred to the likelihood of further acquisitions for SES, although cautioning that “Overpaying for an Asian satellite asset, for example, would be dilutive to fair value.”

SES president Karim Michel Sabbagh made no secret of his enthusiasm for the promising new capacity sales and contract activity at O3b, which one analyst referred to as “the next positive surprise” and “a hidden gem” for SES. The operator owns 47 percent of O3b, and investment costs in O3b have been at 40m euros this year and are expected to be identical in 2015.

The position at SES seems to be that once O3b is confident about their prospects, then SES will buy its minority shareholders out (Liberty, Google, and so on). Feedback from O3b management suggests that the first 12 craft constellation is doing well, technically and in terms of client additions. The mini-fleet of MEO satellites is already earning its keep. Despite problems on the first set of four that will shorten their orbital lives, and with that problem creating more than a few headaches for CEO Steve Collar when the second batch of four satellites had to be returned to Thales Alenia Space’s facility near Rome for corrective work, and the ensuing inevitable delays, the project now seems set for success.

In November, O3b announced a slew of deals and encouragement from investment bankers Berenberg Bank. “Management is already talking about the need for incremental capacity, given the strong order pipeline. This is likely to be funded with the insurance proceeds of $315m.”

Germany’s HD+ bouquet.

“As management has made very clear, it has a path to control of O3b and will look to exercise that option should it believe that the business model is working (i.e., that client business is ramping) and the technology is living up to expectations,” said Berenberg. “Based on comments regarding new business wins and the need for more fleet capacity, we believe that the first of these conditions has been satisfied, and it appears that the strong demand is based on the high quality of the service delivered, suggesting that the second condition has also been fulfilled. This implies that SES will seek to take control of O3b.”

The bank suggests that O3b will be acquired at a ‘fair value’ to all concerned, which it suggests will be at 15 x 2018’s likely net income, although at a 20 percent discount. The bank expects O3b to go EBITDA positive (at 55m euros) in 2016 and building EBITDA to about 435m euros by 2019.

Senior Contributor Chris Forrester is a well-known broadcasting journalist and industry consultant. He reports on all aspects of broadcasting with special emphasis on content, the business of television and emerging applications. He founded Rapid TV News and has edited Interspace and its successor Inside Satellite TV since 1996.