Satellite-based Earth Observation (EO) is carried out with the aid of satellites orbiting around the Earth to view, observe, identify environmental change, and formulate maps. This process uses remote sensing techniques to collect information on chemical, physical, and biological aspects of the Earth.

The information collected through remote sensing is used for several applications such as weather and terrain mapping, reconnaissance and intelligence missions, agricultural monitoring and management, and synthetic aperture radar imagery. In addition, collected information is used by the defense sector for border monitoring, disaster management as well as other, crucial military missions.

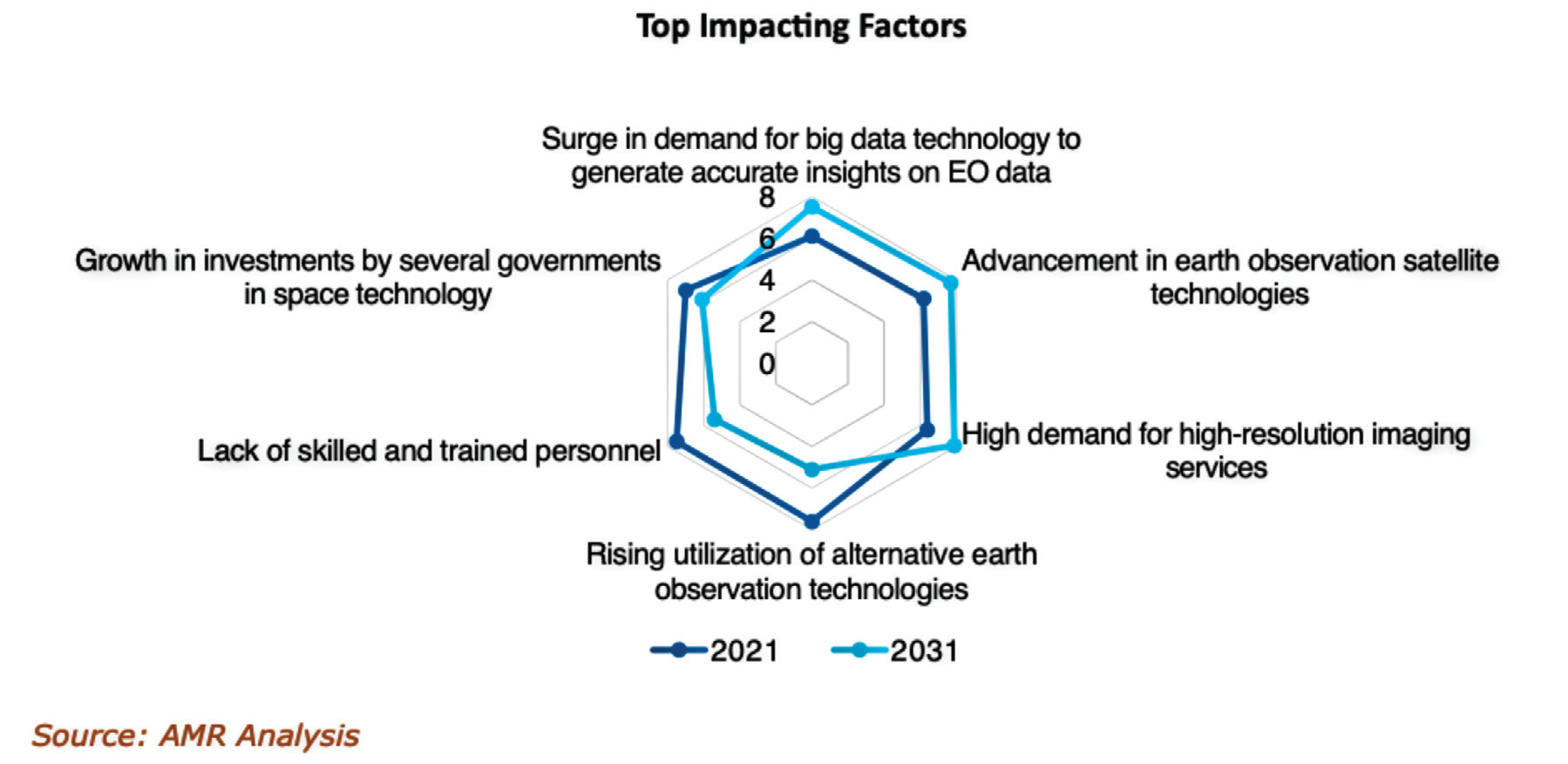

The growth of EO systems has been propelled due to a surge in demand for big data technology to generate accurate insights on collected data, advancements in EO satellite technologies and high demand for high-resolution, imaging services.

In recent years, there has been an exponential increase in EO data volume which, in turn, is proliferating the demand for big data technologies to infer actionable insights on numerous global challenges, such as climate change.

EO satellites produce vast amounts of data each day that are required to be stored, processed and regularly analyzed. EO data is generated in heterogeneous formats, semantics, modalities, and resolutions, propelling the need for big data technologies to process and analyze complex data in a faster way. This requirement results in a high complexity of data sets that requires pre-processing, multi-level fusion and analytics. Therefore, variety, veracity, and volume apply to this kind of dataset, driving the need to deploy big data analytics to generate accurate insights.

However, the rise in the use of alternative EO technologies and the lack of skilled and trained personnel are factors that hamper the growth of the market. In addition, competitors from alternative technologies are hindering the growth of the satellite-based EO market.

Major enterprises such as Google and World View Enterprises, and several startups such as Zero 2 Infinity, are investing in the R&D of high-altitude balloons which, in turn, is expected to affect the demand for satellite-based EO.

In addition, unmanned aerial vehicles (UAVs) such as drones have been used for EO applications, such as archeological surveying, climate studies, and traffic monitoring. These applications from alternative technologies will impact the growth of the market during the forecast period.

Moreover, the COVID-19 crisis has created uncertainty in the market, a massive slowing of the supply chain as well as an increase in panic among customer segments. The impact of the pandemic has resulted in delayed development and launch of satellites, a slowdown in the operation of the key players and a shortage of components.

The pandemic has caused delays in the development of several projects. The Defense Advanced Research Project Agency’s Blackjack program, which is aimed at demonstrating a new communications network for the military in Low Earth Orbit (LEO) was scheduled to be launched in 2022. The launch is expected to be delayed due to shortages of microchips and other electronic components.

Moreover, space agencies used satellite data to track and monitor planet-wide changes in the environment during COVID-19.

For instance, in 2020, NASA collaborated with European Space Agency (ESA), and Japan Aerospace Exploration Agency (JAXA) to use their scientific capabilities in EO for monitoring planet-wide changes in the environment and human society.

These agencies created the COVID-19 Earth Observation Dashboard to combine satellite data with analytical tools for tracking changes in air and water quality, climate change, economic activity, and agriculture, and to enable the public and policymakers to monitor the short-term as well as the long-term impacts of pandemic- related restrictions.

One of the major factors positively affecting the growth of the market is the large number of satellites that have been launched by the various agencies, such as NASA, European Space Imaging, and Japan Aerospace Exploration Agency.

Additionally, the European public funding landscape includes programs such as Horizon Europe, and European Fund for Strategic Investments (EFSI), for product development, research, and innovation. Plus, the European Space Agency (ESA) Business Incubator and Acceleration Centers and the Copernicus Start-Up Program encourage early-stage investments.

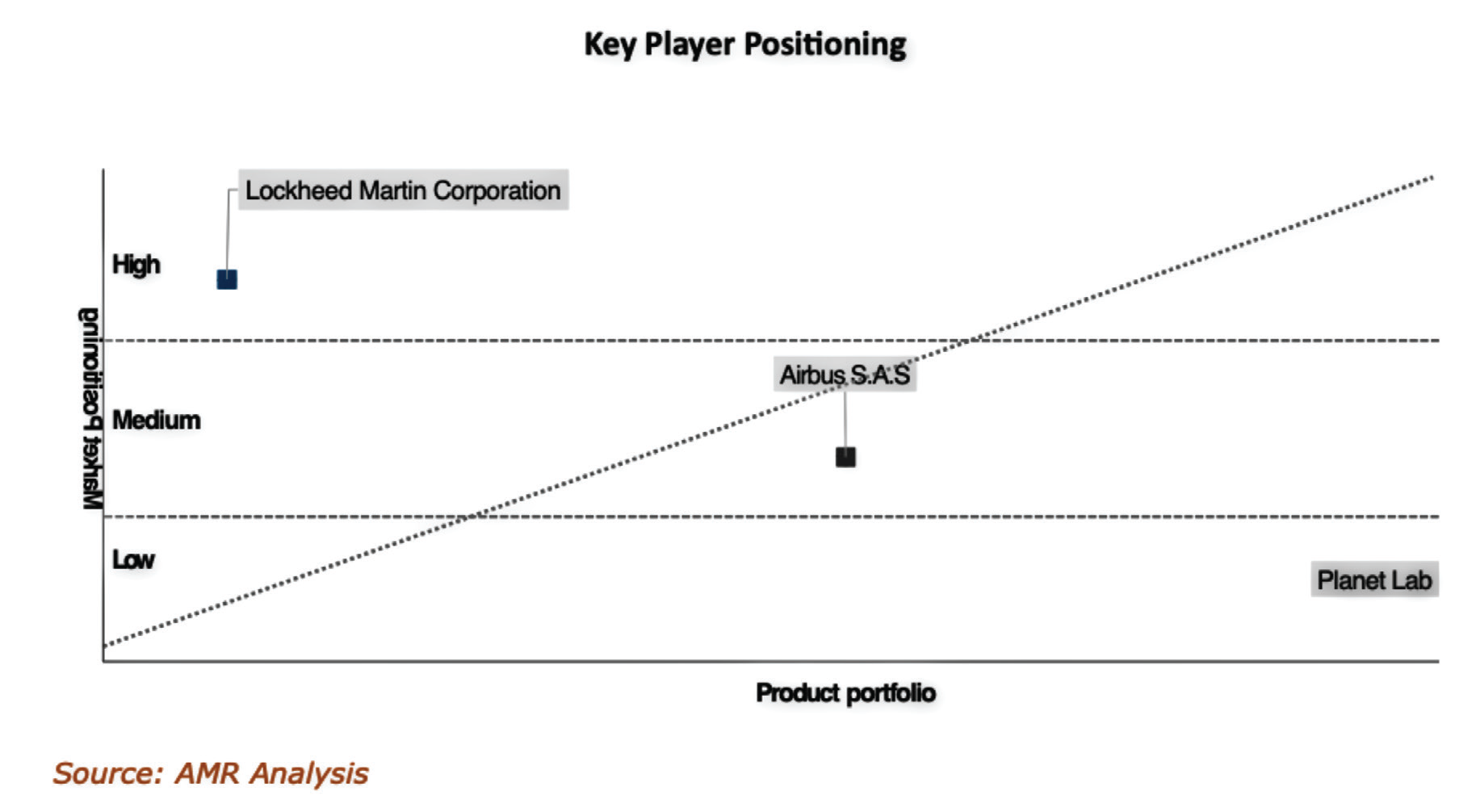

Some leading companies operating in the satellite-based EO market include Airbus S.A.S., Furuno Electric Co., Ltd., Inmarsat Global Limited, Intelsat S.A., Israel Aerospace Industries (IAI), L3Harris Technologies, Inc., Lockheed Martin Corporation, Mitsubishi Electric Corporation, Planet Lab, Raytheon Technologies Corporation, SkyWatch, STMicroelectronics N.V., The Boeing Company, and Thales Group.

Most manufacturers are adopting contract and product launches as their key strategy to gain traction in the market. For instance, in June of 2022, NASA awarded a $6 million, 12 month contract extension to Spire Global, Inc., a leading global provider of space-based data, to deliver EO data to the agency. Under this contract, Spire will continue to deliver a comprehensive catalog of earth observation data, associated metadata, and ancillary information from its constellation of more than 100 multipurpose satellites.

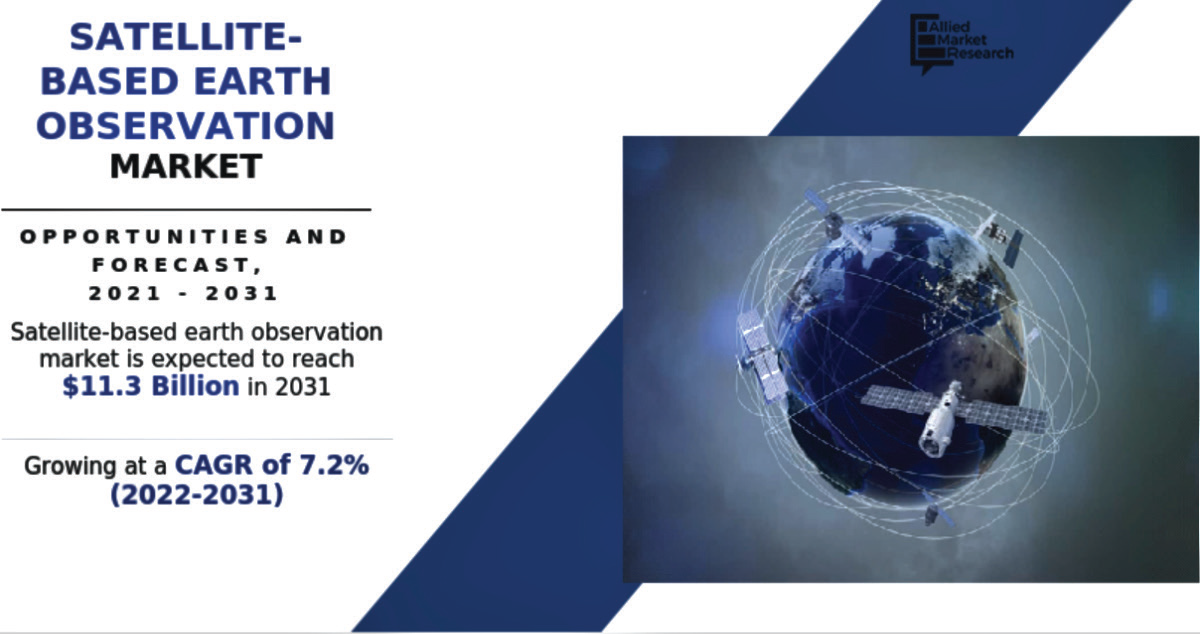

As per the AMR analysis (above, right column), the global, satellite-based EO market was valued at $5,712.0 million in 2021 and is projected to reach $11,329.1 million by 2031, registering a CAGR of 7.2%. During the analysis period, North America accounted to be the highest revenue contributor, whereas Asia-Pacific is estimated to have the fastest growth accounting to be 8.2% from 2022 to 2031.

Many companies operating in the satellite-based EO market are headquartered in North America. This is one of the prominent markets for satellite-based EO owing to the high adoption of satellite data among government and military agencies.

Government and military organizations are investing in satellite communication and navigation services through the launch of several smallsats. The increase in the number of applications in commercial sector,s such as agriculture, real estate, civil engineering, energy, and fleet management, has increased the adoption of satellite-based EO.

Technological advancement in the telecommunication industry and the rise in demand for EO are expected to drive the market during the coming years. These factors provide significant opportunities for players operating in the satellite- based EO market.

www.alliedmarketresearch.com

Lalit Katare

Lalit Katare is a market research consultant who has worked for more than eight years specializing in analyzing and interpreting data related to the transportation industry. He has provided insights and recommendations to businesses and organizations that operate within the transportation sector, helping them to make informed decisions regarding their products, services, marketing strategies, and overall business operations. Companies he has assisted include Volkswagen, Toyota, Mercedes Benz, Caterpillar, Komatsu, Bombardier, and Lockheed Martin, among others.

As a consultant, he has strong research skills and is proficient in gathering, analyzing and interpreting data from a variety of sources, including market reports, surveys, interviews, plus industry publications. He is skilled in supply chain analysis, forecasting, matrix modeling, data analytics, and competitive intelligence. His analysis assesses the strengths and weaknesses of key players and can analyze factors, such as market size, growth potential, customer segmentation, target markets, and competitive landscape to provide recommendations on market entry strategies, product positioning, and pricing strategies.