The Internet of Things (IoT) is changing and impacting the life of almost everybody and everything. New devices, sensors and services are increasing efficiency and provide vital information about our surroundings be it at home or at work, on the road, in the water or in the fields and forests. IoT encompasses sensors and meters, network connectivity, smart devices and software to interchange the information between machine and devices.

IoT is establishing a presence and providing services in areas such as transport, asset tracking and monitoring, agriculture, security, defense and other fields. One of the pressing forces for the rise of IoT is coming from increasing societal needs. Due to the mounting global challenges that have to be faced, solutions to tackle global warming, feeding the growing population and creating sustainable cities must be developed. All of these tasks and goals require well functioning connectivity with better and faster access to information and data.

Take a look at the numbers — the magnitude of the impact is reflected in the envisaged global growth of the IoT market and number of devices. Even though an online search for an answer to the seemingly simple question “How many IoT devices are there in 2019?” will result in different results from various, highly reputed research organisations.

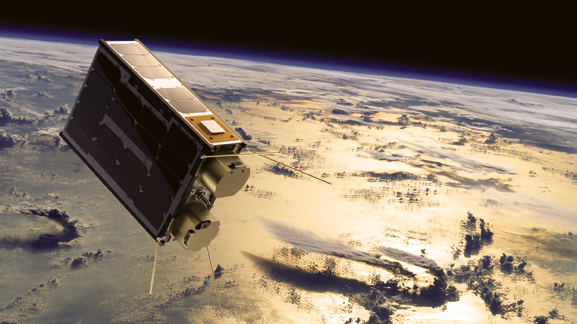

Artistic rendition of a NanoAvionics smallsat on-orbit.

The shared trend throughout all the results shows that rapid growth in IoT adoption rates across all sectors should be expected. In November of 2019, Statista Research Department projected the total installed base of IoT connected devices will amount to $75.44 billion worldwide by 2025, a fivefold increase in ten years.

An IDC report from last year published a lower figure of $41.6 billion connected IoT devices, generating 79.4 zettabytes (ZB) of data by 2025. Northern Sky Research estimates that the SATCOM IoT share of the market will have grown to $5 billion by 2025.

Within these sectors, the BFSI (banking, financial services and insurance) segment holds the largest share in the global market, followed by agriculture. The two are projected to emerge as the fastest-growing, end-user industry segments in terms of CAGR (Compound Annual Growth Rate), with BFSI estimated to reach a CAGR of 25.77 percent and agriculture 12.7 percent. IoT-based applications, such as precision farming, livestock monitoring, smart greenhouse, and fish farm monitoring, are expected to be instrumental in increasing the speed of the agriculture processes.

Further integration of IoT in container tracking could generate up to 26.1 billion euros per year by 2025. An average shipping container is used only 20 percent of the time, due to the global distribution of customers. IoT tracking could increase use rates by 10 to 25 percent, reducing annual costs by 11.3 billion euros per year in 2025. Plus, the global utility IoT industry is expected to grow by double digits each year between now and 2024, to $15 billion by 2024.

However, IoT’s ultimate success will depend on satellite network support that address five challenges: ubiquitous coverage, speed-to-market, low cost, security and reliability. Arguably, the best guarantee to ensure such success is through constellations of smallsats.

Challenge 1 — Ubiquitous Coverage

The continued growth of IoT and achieving the benefits of this technology for everything from precision farming, smart cities to smart transportation and tracking marine wildlife, depend upon ubiquitous coverage. Today, there is no single communications technology that can reach all the possible regions and devices in the world. Nor could it handle the multitude of connections required and the magnitude of data transmitted and received for future IoT applications. Only 80 percent of the Earth’s landmass is covered by terrestrial cellular network for a simple reason — only satellites can cost effectively cover the dead zones.

The leading standard and a large portion of the future growth in the number of IoT devices is expected to come from low-power, wide area networks (LPWAN). The biggest market opportunity for low-power devices connected via satellite networks is asset tracking.

Existing terrestrial networks already serve the majority of IoT/M2M devices via GSM and LPWAN (with standards such as Sigfox, LoRa, and Ingenu) technologies. However, they are limited to the boundaries of densely populated land territories as they require infrastructure such as power grid and internet link to operate base stations.

LPWAN enables communication between devices that are far apart and remote, while only requiring a minimum amount of power. The advantage through using LPWAN via a space-based IoT/M2M infrastructure is to bring hundreds of new network operators to the market. LPWAN allows them to provide worldwide network coverage in densely populated territories as well as remote locations and geographically complex and dangerous areas, such as oceans and deserts.

Artistic rendition of the NanoAvionics GIoT constellation.

Challenge 2 – Speed to Market

In 2015, the total IoT revenue opportunity was $724 billion and is expected to grow to $2.88 trillion by 2025 at a ferocious 32 percent CAGR. More than half of these figures come from application development, systems integration, hosting and data monetization.

Large satellites operating in the IoT sector represented $1.31 billion in 2015 and they are expected to reach $2.38 billion in 2025. Employing LEO IoT infrastructure based on smallsats with inter-satellite links would allow access to the vast opportunity represented by the mainstream IoT/M2M market, with a high market potential uptake.

Given the necessity for satellite based connectivity, the expected market growth and opportunities for downstream businesses based on LEO satellites, there can be little wonder that the race to provide IoT connectivity via smallsat constellations is underway. The range covers old-space heavyweights moving or expanding their infrastructure to low cost smallsats, as well as NewSpace arrivals such as Fleet, Myriota, Lacuna Space, Blink Astro, Hiber, Astrocast, Kepler and NanoAvionics. Their business models are also highly dependent on low-cost, miniaturized LEO satellites.

NanoAvionics is an exception, though, because in contrast to other newcomers, the company is developing a constellation-as-a-service infrastructure. The company won’t provide IoT services directly; instead, NanoAvionics’ Global Internet of Things (GIoT) infrastructure is aimed at IoT/M2M operators who can add their IoT payload to the smallsats to offer satellite based IoT services. The European Space Agency’s (ESA) Advanced Research in Telecommunications Systems (ARTES), who is supporting the project, expects the GIoT system to directly boost existing and emerging IoT/M2M businesses, reducing their time to market at much lower costs.

These companies are targeting different aspects of the IoT market with different business models and different forms of connectivity. The diversity is a continuation of the fragmented IoT/M2M market itself where we have five main segments in the value chain.

1) Networking providers manufacture telecommunication equipment, such as network base stations for terrestrial IoT operators and satellite manufacturers, such as Thales Alenia, Airbus and Boeing, provide satellite buses pre-configured for IoT communication instruments. Estimated market share for this segment is $72.4 billion or 10 percent of the total IoT/M2M market.

2) IoT/M2M device manufacturers build devices for IoT/M2M applications. These can vary from temperature sensors to mechanical disturbance monitoring devices. Estimated market share is $72.4 billion or 10 percent of the total IoT/M2M market.

3) Application providers provide value-added software and services that support IoT/M2M applications. Estimated market share is $289.6 billion or 40 percent of total IoT/M2M market.

4) IoT/M2M service providers offer IoT services that comprise the provisioning of IoT platforms and other IoT related IT-services and solutions. Estimated market share is $144.9 billion or 20 percent of the total IoT/M2M market.

5) IoT/M2M network operators provide electronic communication services based on terrestrial or space networks, which consists wholly or mainly in the transmission of signals on electronic communication networks. They interact with end-users, both private individuals (e.g., car owners) and companies (car fleet operators), and provide technical support. Estimated market share is $144.9 billion or 20 percent of the total IoT/M2M market.

Although the startup companies for satellite-based IoT face competition from incumbent SATCOM operators who have been providing connectivity services for decades, their existing large and expensive constellations were developed long before society was hit by the innovations of IoT and do not match current market needs. The services they provide remain quite costly and are not adapted to, or compliant with, the newest technologies, such as low power, miniaturized IoT/M2M devices.

Not only are these traditional satellite IoT/M2M technologies expensive, the M2M/IoT devices employing such satellites connectivity are also relatively complex and bulky. Compared to the new generations, they require significantly higher amounts of power to sufficiently meet radio communication link parameters. More importantly, traditional communication satellites typically operate in higher orbits (upper part of LEO, GEO, sometimes Medium Earth Orbit (MEO)) that make direct communication with them impossible using the latest low power and miniaturized IoT/M2M devices for mainstream usage.

To reach the required faster speed of real-time data transmission to and from Earth, satellites in LEO have an advantage to those in higher orbits. This is simply a mathematical matter of the distance a signal must travel.

While technically just one satellite has the ability to cover 90 percent of the Earth, their geographical coverage — the amount of surface on Earth one smallsat alone can send data to any time — is limited. Only constellations with a large number of satellites can provide constant coverage and real-time connectivity.

Challenge 3 — Low cost

There are profitable opportunities for smallsat companies that can avoid the huge capex burdens of incumbent satellite network operators. One of the main hurdles for ubiquitous coverage is cost and, while satellite connectivity for remote and difficult to reach areas is less expensive than terrestrial solutions, the operational and deployment costs for sending smallsat constellations into LEO are still significant. The latter is due to a lack of dedicated launchers and the number of satellites required to provide fast data exchange.

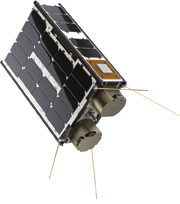

NanoAvionics multi-purpose smallsat bus.

It is safe to assume that the new generation of dedicated launch systems on the horizon will have a significant impact on cost by providing more primary payloads, an increase in price pressure and reaching orbits that would normally be too expensive to consider. The successful development of fully reusable vehicles will also have a measurable impact on lowering costs.

The second major impact on lowering costs will come from advancements in standardization during the production process. As the first Ford car production line standardization helped to significantly lower production costs and reduce lead times, such standardization will also make satellites and satellite components far more reliable as less room is left for faults when building and assembling these craft. Over the next few years, many efforts and steps to set and use more standards will be witnessed. Naturally, constellations are a prime candidate for production lines using the exact same model for each smallsat.

The first generation of NewSpace-type smallsats also lacked critical components to carry out commercial services and could not combine the features of resource powerful traditional satellites with NewSpace approach. As a result, there were no similar infrastructures in operation to meet the technical and economic requirements of the existing IoT/M2M operators.

In contrast, new constellations, such as the NanoAvionics GIoT, will develop a cost efficient, faster, and integrated space based IoT/M2M infrastructure, which matches the requirements of low power devices thus providing operators with low-cost access to space. Other benefits of these new constellations include the synchronization of orbits, a significant higher amount of power available for payloads and solutions to avoid frequency interference.

On the operational side, the network elements will inevitably increase in complexity. One possible and likely solution for the latter is the combination of constellation management with artificial intelligence (AI). At NanoAvionics, the highest level of operations automation is mainly used for day-to-day work, such as mission tasking. The software is being taught to identify critical situations and ways of reaction in order to minimize any negative impact. One of the most important aspects in operations automation is constellation management based on precise orbital mechanics and propulsion system capabilities.

At the moment, people on the ground have to monitor and manage satellites around the clock. In the long term, that is not sustainable. The use of AI would reduce the number of operator hours required to manage satellite constellations by reducing work-load for network monitoring and for root-cause-analysis tasks. Automating these tasks would mean that network incidents can be resolved much faster and leading to higher availability of the satellite services.

Challenge 4 – Reliability

High availability is another prerequisite. As the world is becoming more and more dependent upon IoT within day-to-day lives, the need for the availability of IoT data, as well as the web, mobile apps and physical things that rely on that data, grows immensely. IoT infrastructure is responsible for essential services such as traffic control and life-saving IoT devices that include pacemakers and insulin pumps. This means that, in addition to cyber-attack protection, satellite-based IoT systems must include redundancy to eliminate single points of failure. With a constellation of satellites in LEO, any temporary failure could be bridged by using the other satellites, functioning as a redundancy measure, to pass on the data to another satellite of the same constellation which in turn can send it to ground terminals.

With operators sending thousands of single satellites into LEO and the rise of LEO constellations counting more than 55,000 of planned satellites — SpaceX alone plans to launch 42,000 satellites — the risk of further space debris, either by collision or malfunctioning satellites, is increasing, as well. If all of the announced mega-constellations launched, current tracking technologies would result in more than 67,000 ‘collision alerts’ each year. That’s more than 180 alerts per day that would require a decision to make hundreds of precautionary satellite maneuvers a day, or risk the small chance of a collision. AI could be used to solve these manpower-intensive telemetry changes caused by collision avoidance. The European Space Agency (ESA) is already working to automate the process of collision avoidance using AI because manually avoiding collisions “will become impossible.”

The need became apparent when in September of last year, the ESA determined the safest option to avoid a potential collision with a SpaceX Starlink satellite was firing the thrusters on their Aeolus satellite. This was the first time for ESA that they had to move a satellite to avoid colliding with a mega-constellation.

The use of AI for on-orbit management could also extend the operational life time of smallsats by optimizing the power consumption of thrusters for orbital maneuvers. Although still in the early days for AI, many tests will be conducted to bring the technology to a high level of maturity and mainstream deployment.

However, it’s not just on-orbit where AI could be advantageous — AI could also help to automate test environments that simulate on-orbit situations. AI could perform the tests more quickly and learn to sequence them for more efficiency. At the application level for IoT and M2M communications, sensors installed on the engine and navigation systems could monitor how much fuel is being consumed as well as assist in optimizing navigation and automatically determine the best path for the spacecraft to conserve fuel or shorten the journey.

While LEO congestion itself, pushing operators to higher orbits, will become a factor toward the end of the next decade, the risk of creating further space debris is far more pressing. The ideal approach for sending satellites into orbit should be ‘leave no trace.” This might be difficult to put into action at first; however, the risk of the much dreaded Kessler effect and with the potential of losing life, critical access to orbits should be a huge motivator.

There are two solutions in existence to avoid debris build-up from new smallsats. As a first step, on-orbit service technologies to extend the lifespan of smallsat could be implemented and ultimately control the active de-orbiting of satellites at the end of their mission or lifespan.

The advancement in using less fuel for propulsion systems should already make active de-orbiting a viable option. It’s a simple matter of leaving enough fuel for maneuvering the satellite closer to the Earth atmosphere where it can safely burn up. For satellites with malfunctioning propulsion or complete communications failure, cleanup satellites could be capture the satellites and drag the craft down to burn up in the atmosphere.

Challenge 5 – Security

Additional risk also looms from another side. Cybersecurity is becoming an issue, especially as the industry moves toward IP infrastructure, hybrid networks and cloud-based solutions. F-secure issued a stark warning last year that cyberattacks on IoT devices are now accelerating at an unprecedented rate and had grown 300 percent to more than 2.9 billion events, in 2019. In the past cyber attacks on satellites were unsuccessful but firms already have signaled a dramatic jump in distributed denial of service (DDoS) attack threats, which are attempts to make an online service unavailable by overwhelming that service with traffic from multiple sources. The tremendous number of high-throughput satellites and the time spent on connected devices means the scale of these threats will grow far faster than perhaps anyone anticipates. New strategies are needed for to detect vulnerabilities and breaches across the various networks as well as to predict and proactively protect against potential security threats.

These are certainly considerable challenges and, while IoT isn’t the magic wand that miraculously solves all our problems, the range of existing and potential IoT devices supporting everyone’s lives is going to be enormous and they will all need to be connected. To make those connections possible, it’s obvious that reliance on the ever increasing number of satellite constellations is more than necessary — secure and reliable communications are paramount for communication successes across the globe.

Vytenis Buzas is the CEO and co-founder of NanoAvionics – a nanosatellite bus manufacturer and mission integrator based in Midland (TX), Oxfordshire (UK) and Vilnius (Lithuania).

Prior to founding NanoAvionics, Vytenis initiated and lead the first national satellite mission in Lithuania — LituanicaSAT-1 — and worked with smallsat and subsystem R&D projects under various research institutions, including Vilnius University

in Lithuania.

He was also a scientific researcher at NASA Ames research center where he was involved in projects related to liquid mono-propulsion systems for small spacecrafts as well as station keeping and de-orbit systems for the eventual recovery of payloads.

Vytenis acquired a BSc in Aeronautical Engineering at Vilnius Gediminas Technical University and a MSc. degree at the Kaunas University of Technology in Mechatronics.